Stocks rose last week as the Nasdaq Composite Index hit a new all-time record.

Investors are banking on a new round of economic stimulus, including direct payments to households, increased unemployment insurance and aid for state and local governments.

There will be a lot of activity on Wall Street in a compressed time. The market is closed on Monday in observance of Martin Luther King, Jr’s. birthday.

But investors will have plenty to track in the four days the markets are open, including:

- Big IPOs.

- A rash of quarterly earnings.

- New data releases.

Let’s get into this edition of the Money & Markets Week Ahead.

On the IPO Front

There are a few initial public offerings (IPO) on the schedule this week.

Perhaps the biggest one is for a company you likely haven’t heard of.

MYT Netherlands is planning to launch its IPO on Thursday and could see a massive market value.

What is it? MYT Netherlands is a foreign company that is based in Munich, Germany.

It is the parent company of Mytheresa.com, an online shopping platform that launched in 2006. That platform is one of the leading Europe-based luxury fashion retailers.

It offers products from more than 200 of the world’s most recognized luxury brands (think: Burberry, Dolce & Gabbana, Gucci, Prada, Saint Laurent and Valentino).

According to the company, in 2020, its average order was around 600 euros, or $726.

It registered around $579 million in sales for the 12 months ending September 30, 2020.

The company also said that 30% of its sales in fiscal 2020 came from its Top Customer program, an elite group that comprises only 2.6% of its total customer base.

The offering. The company plans to trade on the New York Stock Exchange under the ticker MYTE.

Renaissance Capital reported that MYT Netherlands hopes to raise $266 million with an offering of 15.6 million American Depositary Shares at a price range of $16 to $18.

Using the midpoint of that price range, the company could see a market value of around $1.5 billion.

On a related note, Poshmark, a used clothing marketplace, raised around $277 million off its IPO last week. The company priced at $42 per share which was above its range of between $35 and $39.

Morgan Stanley, J.P. Morgan, Credit Suisse, UBS Investment Bank, Jefferies and Cowen are all bookrunners on the MYT Netherlands IPO.

Deeper Dive: Netflix Earnings

The fourth-quarter 2020 earnings season kicked off on Friday with reports from several large financial institutions.

This week, the earnings season gets into full swing with several large companies reporting.

But instead of looking at the obvious … banks … I want to focus on a different company, one that could line out how the broader market performed during the quarter.

On Tuesday, streaming giant Netflix Inc. (Nasdaq: NFLX) reports its quarterly earnings.

Let’s look at how Netflix has performed and what I expect earnings to show this week.

What is NFLX? The best way to describe Netflix is that it was one of the first (and is one of the biggest) providers of streaming video.

You can watch shows, movies and documentaries from Netflix on several different platforms, including smartphones, tablets, smart televisions and other streaming devices like Roku and Amazon’s Fire Stick.

While it started small, the company has grown to nearly 200 million subscribers around the world.

Netflix Close to 200 Million Subscribers

However, Netflix is facing significant competition from other platforms like Disney+, Hulu, HBOMax and Discovery+.

Last time out. In their last quarterly report, Netflix reported a significant slowdown in the number of subscribers added to the platform.

The company added only 2.2 million paid subscribers in Q3 2020 compared to 6.8 million added in the same quarter the year before.

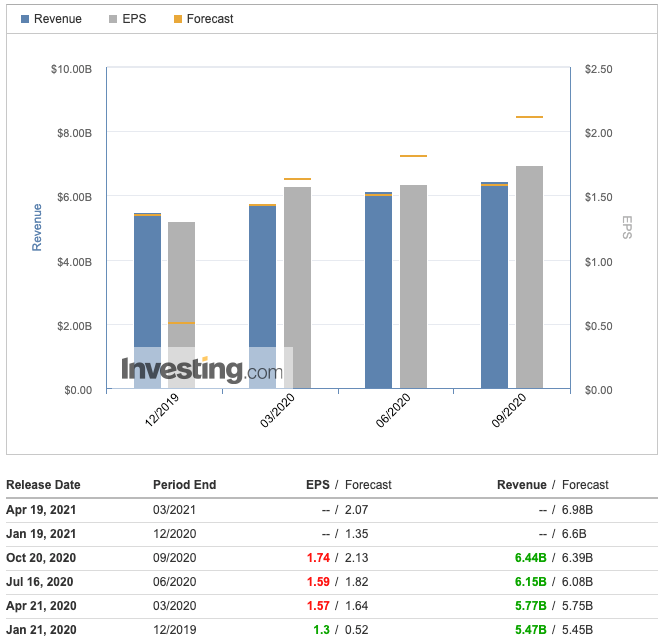

It beat Wall Street expectations for sales by bringing in $6.44 billion — above the $6.39 billion forecast.

However, for the third straight quarter, Netflix lagged expectations for earnings per share. It reported $1.74 per share in earnings, while Wall Street projected $2.13 per share.

NFLX Beats Wall Street Expectations

Despite that, the company remains in the black — thanks in part to the uptick in subscriptions due to the COVID-19 lockdowns in 2020.

What to expect this time. Wall Street analysts are a little snake-bit when it comes to earnings for Netflix.

The company has reported earnings per share lower than expectations in each of the last three quarters.

So, analysts are projecting earnings per share of $1.35 on $6.6 billion. I think that’s a good expectation.

However, over time, the streaming wars will take a bigger toll on Netflix, especially as some of the more popular content it was streaming (like Marvel movies and TV shows like The Office) have moved to different platforms.

Netflix is putting a lot of stock into original content, which isn’t a bad thing, but there could be some rough waters ahead for this streaming giant.

Money & Markets Week Ahead: Data Dump

The U.S. market is closed on Monday due to the Martin Luther King Jr. holiday, so the data dump won’t kick off until Tuesday.

Thursday marks our first big data point of the week.

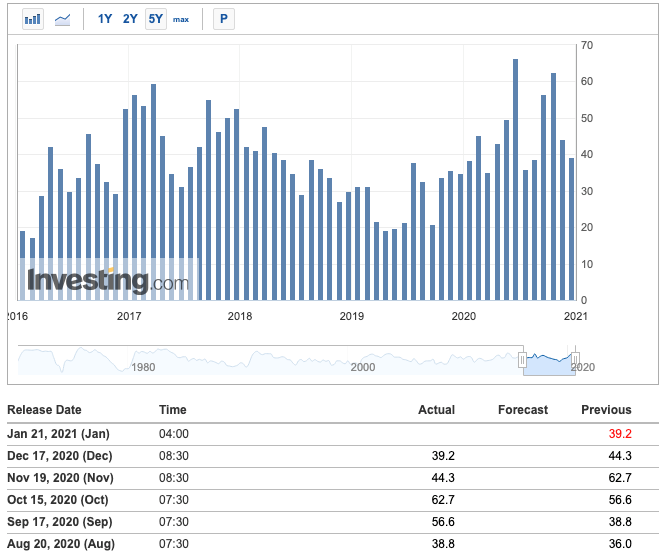

That’s when the Federal Reserve Bank of Philadelphia will release its Business Outlook Survey for the month of January.

The survey covers the general business conditions in the region covering Philadelphia, New Jersey and Delaware.

The December index reading indicated the third straight month of lower expectations. The index read 39.2 — which still means expansion — but it’s nearly half the 62.7 reading in October.

Philadelphia Business Outlook Dropped Again in December

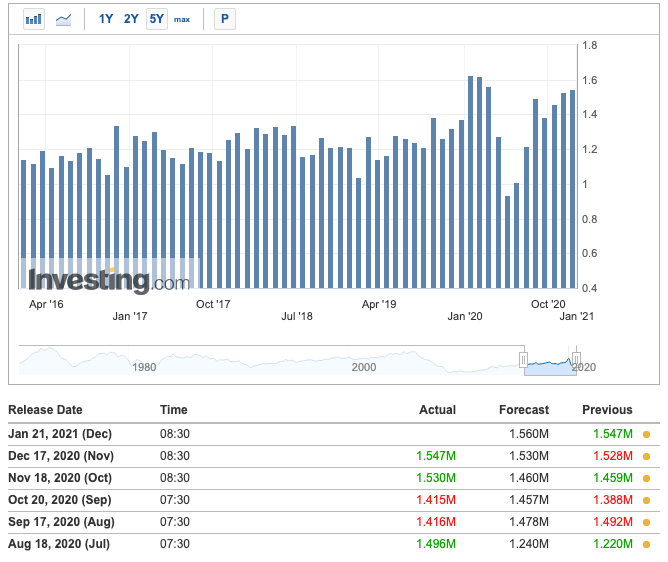

The U.S. Census Bureau will also release its new housing starts for the month of December.

This report tracks the number of new construction that began in the month and is a leading indicator of strength in the housing market.

If housing starts beat expectations or come in higher than the previous month, it is an indicator that the U.S. housing market is strong.

Higher readings also indicate a bullish position for the U.S. dollar.

In November, there were 1.54 million new housing starts — above the forecast of 1.53 million. It marked the second month of increases.

Housing Construction Starts Rise in October and November 2020

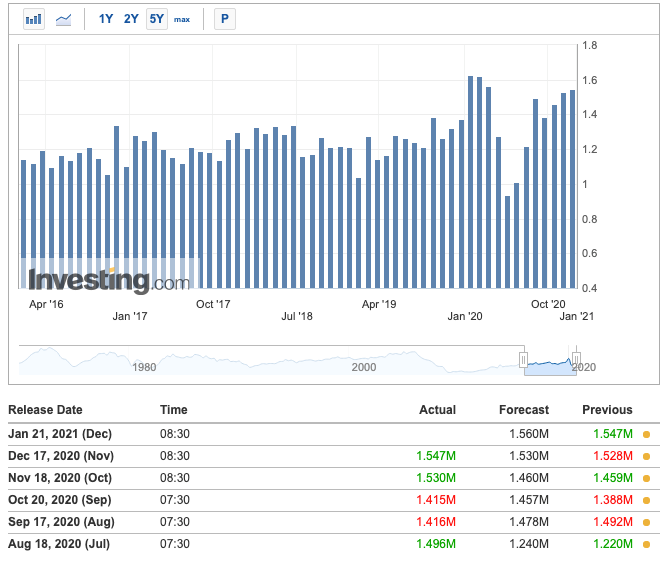

To round out the short week, the National Association of Realtors will unveil their existing home sales figures for December.

The existing home sales report is a key component to gauging the strength of the U.S. housing market as well as the overall economic strength of the country.

If the index beats expectations, it’s a positive reflection on the U.S. dollar, while falling short of expectations is negative.

Existing Home Sales Drop in November

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

Bridgford Foods Corp. (Nasdaq: BRID)

Q.E.P. Co, Inc. (OTC: QEPC)

Tuesday

Bank of America Corp. (NYSE: BAC)

Netflix Inc. (Nasdaq: NFLX)

Halliburton Co. (NYSE: HAL)

Wednesday

UnitedHealth Group Inc. (NYSE: UNH)

Proctor & Gamble Co. (NYSE: PG)

Morgan Stanley (NYSE: MS)

U.S. Bancorp (NYSE: USB)

Kinder Morgan Inc. (NYSE: KMI)

United Airlines Holdings Inc. (Nasdaq: UAL)

Thursday

Intel Corp. (Nasdaq: INTC)

International Business Machines Corp. (NYSE: IBM)

Banc of California Inc. (NYSE: BANC)

Friday

NextEra Energy Inc. (NYSE: NEE)

Honeywell International Inc. (NYSE: HON)

Ally Financial Inc. (NYSE: ALLY)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.