Managing Editor’s Note: Adam just updated his Green Zone Fortunes subscribers on how he’s approaching this bear market as stocks continue to fall. We thought it was something everyone would find valuable, so we’re giving you a little preview of what to expect each week from Adam and Charles Sizemore when you join their premium stock research service. For information on how you can do that, click here. — Chad Stone, managing editor, Money & Markets

We’re still in a bear market after recent rallies petered out.

The S&P 500 is back to 21% off its January highs.

The most optimistic of bullish investors are already calling the bear market over. They expect new highs by early next year, if not sooner.

But the base-case scenario I’ve been planning for is a “longer and lower” march down.

I’m not a pessimist.

I consider myself a cautious optimist … but numbers don’t lie.

A majority of the price trends across global markets are pointing down.

And I know from years of experience that trends tend to persist longer in time and further in price than most people expect.

That’s why I’m leaning toward the “cautious” part of my cautious-optimist mindset right now.

But that doesn’t mean you should give up hope — far from it!

Let’s talk about that…

It Pays to Stick to the Plan

I’ve said before how the natural reaction to falling stock prices is to either panic and sell everything … or to freeze and do nothing.

Both are wrong!

If you’ve followed a prudent, adaptive strategy during the market’s bull years, the best thing you can do during a bear market is … stick to your strategy!

That doesn’t mean you have to stick with all of your positions through thick and thin. By all means, follow your stops … cut what’s not working … and figure out what is. (Charles Sizemore and I strive to make that as easy as possible in Green Zone Fortunes.)

Any adaptive strategy worth its salt adjusts to changing market conditions. It exits positions that are no longer well-matched … and finds new positions that are better poised to take advantage of the new normal.

At Green Zone Fortunes, we add one high-conviction stock to our portfolio every month.

We identify a “Strong Bullish” stock … that’s operating in a market-beating mega trend … and that has an “X-factor” we feel other investors don’t quite appreciate.

When the stocks we add to our portfolio go on to make large gains … we ride those lucrative trends for as long as possible.

And when a stock we add doesn’t pan out … we cut our losses short.

That’s our strategy. And since my proprietary six-factor rating system always has a pulse on the market’s best-rated stocks … we can adapt to what the market is favoring at any given time.

The trick is to stick to the strategy.

That means maintaining the discipline to add new positions each and every month, even when stock prices are falling and it feels scary to do.

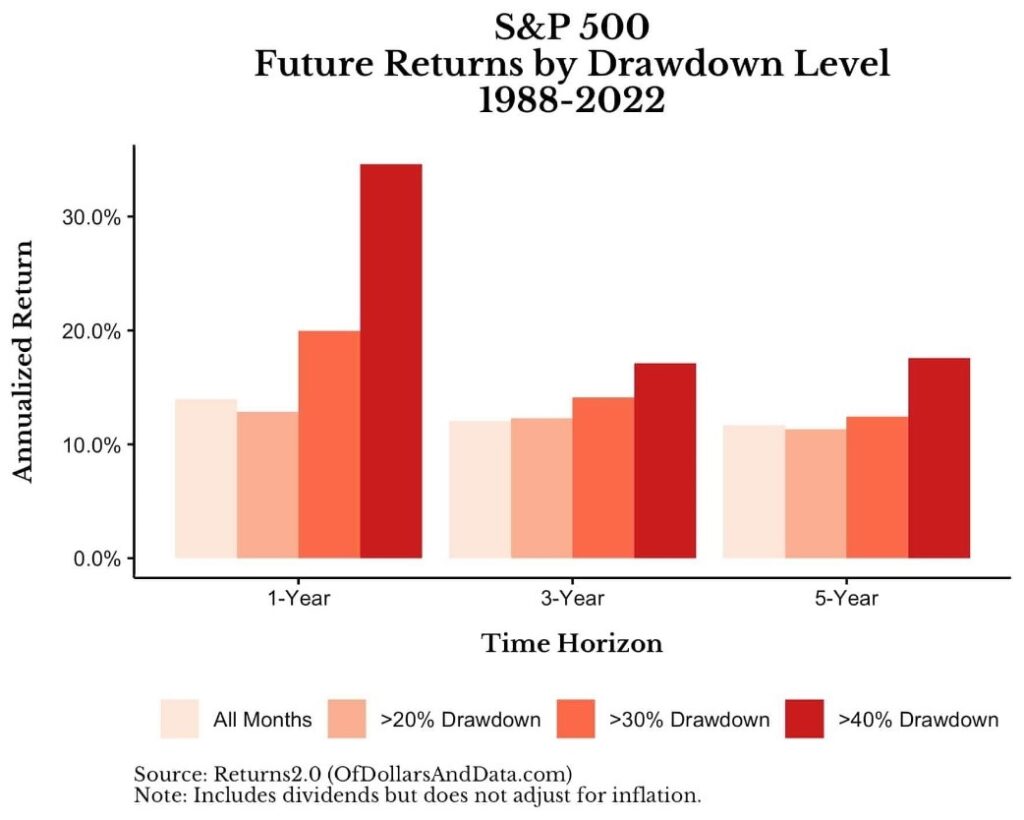

Remember the silver-lining of falling stock prices: higher forward returns.

Have a look…

As I said, I’m planning for this bear market to go “longer and lower.”

The S&P 500 is only 21% off its highs right now. It could hit a 30% drawdown … even 40%.

While that would pressure our open positions, the silver lining is that further drops would create lucrative buying opportunities, too!

As you can see above, historically the S&P 500 has returned about 20% in the year following a 30% drawdown … and about 35% the year following a 40% drawdown.

That’s why I urge you to continue adding capital to the positions we recommend each month. And we won’t stop finding new opportunities.

We’ll never know until after the fact when “the bottom” is in. Sticking to a strategy that adds positions at regular intervals ensures you put capital to work around the bottom, when forward returns are the highest.

If instead you panic and sell everything, or freeze and do nothing … you won’t be in a position — on the mental or economic side — to take advantage of the bull market that will follow this bear.

Now, I know I just talked a lot about how we do things in Green Zone Fortunes, but maybe you haven’t taken the plunge and joined my and Charles’ premium stock research service yet.

We boil our strategy down to find stocks that meet three stringent criteria:

- Strong ratings in our proprietary system.

- An X-factor that other investors are ignoring.

- A powerful market-crushing mega trend.

For more on that third point, click here to watch my “Imperium” presentation and find out how we’re tracking the genomics (aka DNA science) mega trend.

To good profits,

Adam O’Dell

Chief Investment Strategist