My wife is a retail store manager for a large corporation.

Now that we’re in the midst of the holiday shopping season, she tells me sales are important, but something else is just as key: customer service.

The problem is that hosting in-house customer service teams is expensive.

That’s why companies choose to have a third-party handle their customer relations using a strategy called business process outsourcing (BPO).

It’s a rapidly expanding market:

Precedence Research forecasts the size of the BPO market will hit $576.9 billion by 2030. That’s almost double where it stands today!

Today’s Power Stock is a leader in the BPO space: IBEX Ltd. (Nasdaq: IBEX).

IBEX is a $469.7 million company that has created a complete customer experience platform for third-party customer service providers.

Its platform is used across several industries:

- Banking and financial.

- Health and wellness.

- Retail and e-commerce.

- Travel and hospitality.

The platform helps customers with everything from payment to delivery and more … seamlessly.

IBEX stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

IBEX Stock: Strong Fundamentals + Great Momentum

IBEX had an outstanding first quarter of fiscal 2023 and is lining up for another solid year:

- Quarterly revenue was $127.9 million — a 17.8% jump from the same quarter a year ago.

- Revenue from its business process outsourcing clients rose 44.3% from last year!

You can see its growth (it scores an 84 on that factor), but IBEX is also a solid value stock.

Its price-to-sales ratio is less than half the industry average of 2.

The company’s price-to-cash flow ratio is significantly lower than the broader professional services industry.

This tells us this customer service stock is a bargain compared to its peers.

It earns a 78 on our value factor.

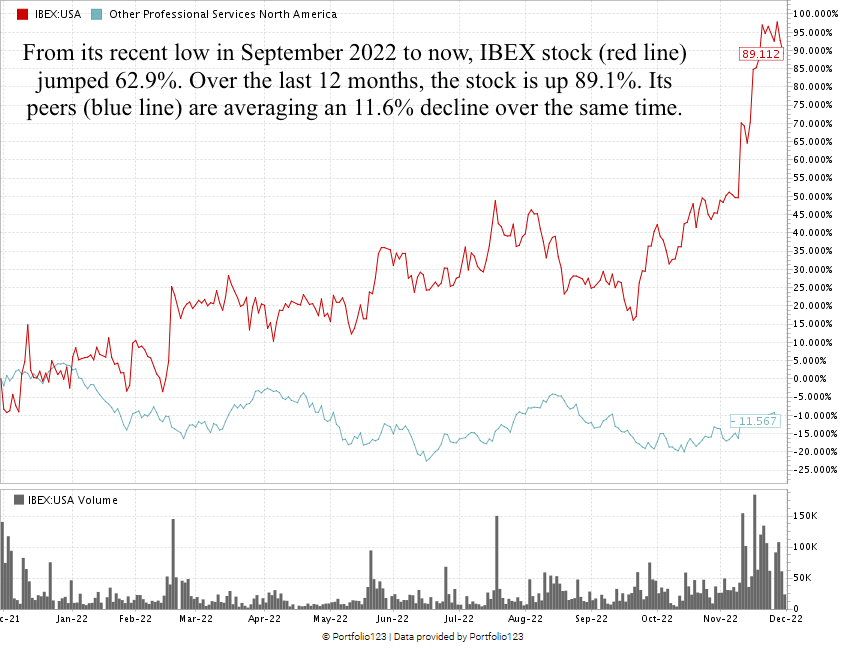

Over the last 12 months, IBEX has risen 68%. Its industry peers are averaging a 12.8% decline over the same time.

Its recent performance is what stands out to me. Check out the chart below:

Created in November 2022.

From its recent low in September to now, the stock has increased 62.9%.

IBEX is showing the “maximum momentum” we love to see in stocks.

IBEX stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re "Strong Bullish" on this customer service stock and expect it to beat the broader market by at least three times in the next 12 months.

More companies are outsourcing traditional business operations, such as customer service.

IBEX is growing into a leader that provides an excellent experience to its third-part customers.

You can see why IBEX stock is a smart addition to your portfolio.

Stay Tuned: High-Growth Co. Tackles Mountains of Student Loan Debt

Stay tuned for the next issue, where I’ll share all the details on a company that services millions of dollars in student loan debt as outstanding balances balloon.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets