I am just like millions of Americans.

I have student loan debt.

It’s not as high as some, but it’s higher than what I’m comfortable with.

While student loan repayment is on hold until June 2023, we’ll have to pay the piper again soon.

I know the Biden administration is fighting for student loan forgiveness. But even if the current plan is implemented, it will only put a small dent into what has become a mountain of debt.

The Federal Reserve estimates the value of all outstanding student loans is $1.75 trillion.

In 2006, that number was only $481 billion.

Outstanding student loans in America jumped more than 260% in 16 years!

I’m pleased to say I’ve found a way we can profit from this trend.

Today’s Power Stock is Nelnet Inc. (NYSE: NNI), a $3.7 billion specialty finance company that services a mountain of student loan debt.

Nelnet’s M.O. and Stock Power Ratings

Lincoln, Nebraska-based Nelnet manages more than $420 million in student loans.

The company also develops software for school administrators and offers fiber internet, TV and phone services in Nebraska and Colorado.

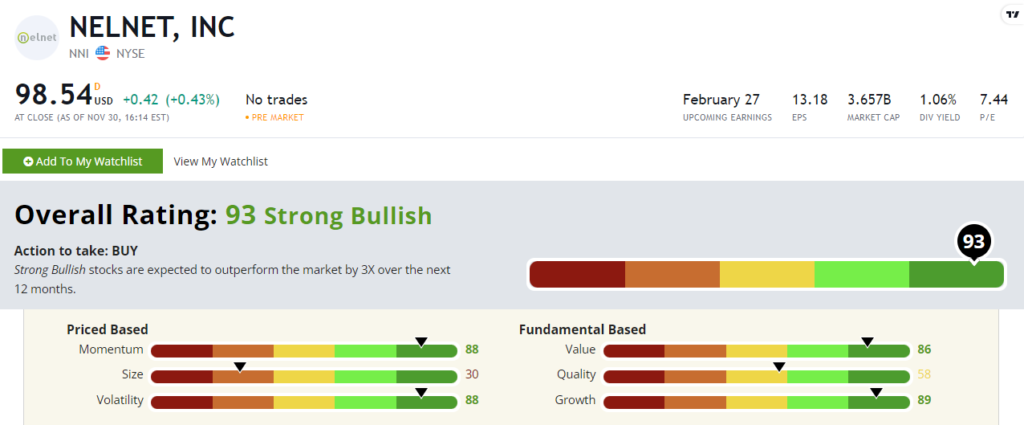

NNI stock scores 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NNI Stock: Outstanding Growth + Solid Momentum

Nelnet recently closed out a great second quarter.

High points include:

- Net income of $104.8 million — a 97.4% year-over-year increase.

- Total sales were $467 million — a 22% increase over the previous quarter.

As you can see, NNI has strong bottom-line growth — scoring an 89 on our growth factor.

It also shines as a value stock … scoring an 85 on that factor.

Its price-to-earnings ratio is half the specialty finance industry average. The company’s price-to-cash flow ratio is 6.35, compared to the industry average of 8.06!

On quality, NNI’s returns on assets, equity and investment are all green, while its peers average negative returns.

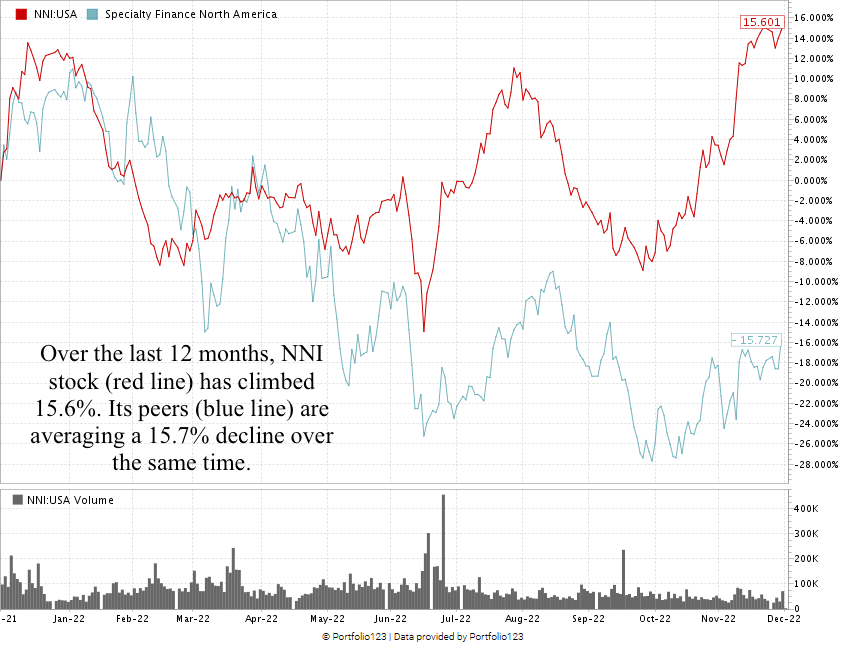

Created in December 2022.

Over the last 12 months, NNI stock has moved 15.6% higher.

Its specialty finance peers averaged a 15.7% decline over the same time.

As I write, NNI stock is trading just 1% off its 52-week high. I’m confident it can hit that and go even higher.

Nelnet stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

The student loan debt crisis has been one of the biggest headlines of the last three years.

COVID and inflation triggered a payment pause, but Americans are going to pay the debt back. Washington’s projected student loan forgiveness plans won’t come close to footing the $1.75 trillion bill.

As a reliable servicer of student loans in the U.S., Nelnet stock is a strong contender for your portfolio.

Stay Tuned: A Meme Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

I’m switching it up a bit on Monday with a stock to avoid. It’s a massive entertainment company that’s been wrapped up in meme stock madness for almost two years. Its CEO also announced her recent exit only three months into the job.

Do you know what company I’m going to kick off with next week? Email me at StockPower@MoneyandMarkets.com with your guess.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets