When it comes to dividends, 5% is a decent yield. It’s high enough to get your attention, but it doesn’t seem unsustainable.

All the same, there’s one popular household name yielding 5% you should avoid: Big Blue itself, International Business Machines Corp. (NYSE: IBM).

I wrote a bearish piece on IBM a little over a year ago, and since then shares are down about 10%.

That might not sound all that bad given market conditions in 2022.

But many of the stocks that are down this year will recover and hit new highs in the future. I don’t know that I can say the same for IBM.

Going back to IBM’s 5% yield… I don’t think its dividend is in immediate danger of being cut, but I question its sustainability over time. At the very least, I don’t think there’s a lot of room for growth.

Here’s why.

Cloud Business Is Way Behind

A healthy and growing dividend requires a healthy and growing business to support it. And IBM’s business has been in decline for over a decade now.

The company’s sales hit an all-time high in 2011 before falling every year for the remainder of the decade and bottoming out in 2020. Over the last 12 months, IBM has reported about $59 billion in sales. It was boasting similar sales numbers in the late 1980s!

IBM was the world leader in enterprise computing. And then the cloud, the technology that allows companies to deliver computing services over the internet, was implemented.

Amazon.com and Microsoft quickly jumped into the lead within that space. Now, IBM is a distant also-ran, fighting and clawing to hold on to its market share. And its biggest competition is two of the largest and most cash-rich companies in the world.

You tell me. Is this a stock you’d want to depend on to fund your retirement? How long do you think IBM will be able to continue to pay and raise its dividend without meaningful revenue growth?

Hold or Trade? IBM’s Stock Power Ratings Explained

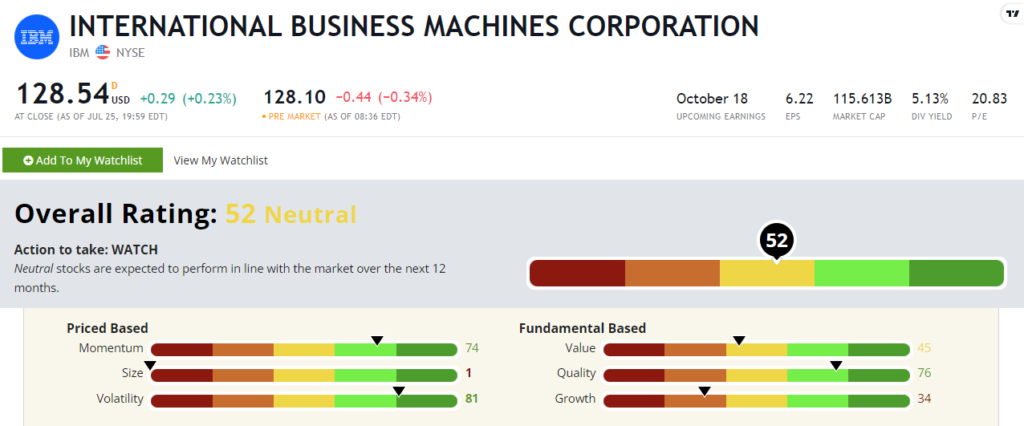

Looking at IBM through the lens of our Stock Power Ratings system, we see a company very much muddled in the middle, earning a “Neutral” 52.

IBM stock rates an abysmal 8 out of 100 on our growth factor. Given how badly the company’s operations have performed over the past decade, I’m surprised it rates even that high.

To its credit, IBM boasts a solid volatility rating at 91. And since low-volatility stocks have performed well relative to their peers in 2022, it also rates a “Strong Bullish” 86 on momentum. This year, IBM has held up much better than its enterprise rivals Microsoft Corp. (Nasdaq: MSFT) and Amazon.com Inc. (Nasdaq: AMZN).

This is the stock market. Even junky stocks can have their day in the sun and be great short-term holdings. Consider last year’s mania in meme stocks like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings (NYSE: AMC).

But when you are considering a new position for a long-term dividend portfolio, business fundamentals matter. You need companies with growth to sustain a dividend. And on that count, IBM falls woefully short.

Bottom line: Trade IBM if you want. But leave it out of your long-term dividend portfolio.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.