For decades, corporate IT departments had an unofficial motto: “No one ever got fired for buying IBM.”

Buying products from the biggest, established brand meant you avoided drama. It didn’t matter if the equipment was good or not. That was never the point. Since “everyone” used IBM, you wouldn’t look bad if the equipment ended up bombing. But if you took a chance on an unknown brand that ended up not working out… well, you just became the fall guy.

Now, IBM (NYSE: IBM) finds itself on the wrong side of that maxim. Amazon reinvented corporate IT when it launched its cloud service, Amazon Web Services (AWS). Rather than maintain server infrastructure and a staff of socially awkward technicians with pocket protectors to watch over them, an enterprise client can now outsource all of this workload to Amazon, Microsoft or a handful of other cloud players.

IBM was late to the cloud and all but missed the party. It’s telling that, a few years ago, Oracle founder Larry Ellison made the offhand comment that he “never sees” IBM anymore when he’s bidding for new business.

IBM missed the boat on the single biggest trend in enterprise computing in 20 years, but its stock is still a favorite among many dividend investors. With a yield of 4.5%, it’s one of the higher-yielding companies in the S&P 500.

So, what’s the story here? Could it be that IBM is cheap enough to warrant buying as a long-term dividend payer? I’m not so sure … and a couple of factors are huge red flags for this old tech stock.

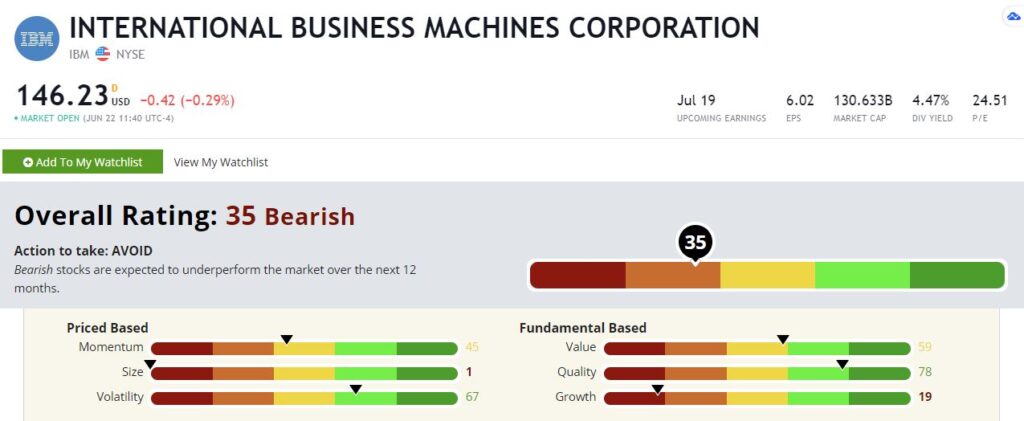

Our Green Zone Ratings system paints a clearer picture.

The IBM Dividend Might Be in Trouble

IBM rates a 35 out of 100 overall, making it “Bearish” in our system and a stock we’re better off avoiding. Bearish stocks are expected to underperform the market over the following 12 months.

IBM’s Green Zone Rating on June 22, 2021.

Let’s do a deeper dive.

Quality — IBM rates well on our quality factor at 78. Part of this is due to the stock’s high return on equity, which has rated above 98 over the past five years. But even this is a mixed bag, as the high return on equity is in part due to the company’s high debt levels. (All else equal, high leverage will juice return on equity and certain other profitability metrics, which is why it’s important to take debt into consideration when evaluating quality.)

Volatility — IBM also rates in the top third based on volatility at 67. We like low-volatility stocks. But low volatility by itself isn’t a reason to buy something. We tend to view the volatility factor are more of a filter of what not to buy. A low-rated stock here will be a headache in most cases.

Value — From here, IBM’s factor ratings start to drop off. IBM rates a rather uninspiring 59 on value. That’s not “bad,” per se. It’s middle of the pack. But it suggests IBM isn’t cheap enough to buy as a pure value stock. And the price we pay impacts future returns. Overpaying can be costly.

Momentum — IBM also isn’t much of a momentum stock. It rates a 45 out of 100, putting it in the bottom half. The past year favored tech stocks, but IBM didn’t fit the profile of some of its high-momentum peers. It’s old tech and yesterday’s news.

Growth — But if you need a reason to avoid Big Blue, consider the growth factor. IBM rates a 19 here, and I’m surprised it doesn’t rate lower. This is a company that had a 22-quarter streak of declining revenues that ended in 2018 … only to start a new 10-quarter streak that was only broken this past March. IBM’s business has been in nearly continuous decline for the better part of a decade. How safe do you think the dividend is going to be if that continues much longer?

Size — IBM rates a 1 on size. Despite all of its problems, it’s still one of the largest companies in the world. This isn’t an undiscovered small-cap gem.

Bottom line: IBM rates flat-out awfully, and the numbers look worse the deeper you dig. With its high debt load and declining revenues, there’s no telling how long that 4.5% IBM dividend will last.

If you’re looking for a solid dividend payer to anchor your income portfolio… keep looking!

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.