Children are anxiously awaiting Santa’s return on Christmas. They’re preparing by being extra good.

After all, Santa’s watching…

They seem to forget that Santa was watching all year. By the time December comes, he’s checking his list. And he’s already decided who’s been naughty or nice.

Adults who trade also get excited about Christmas. At least those with money in the stock market do. They begin to anticipate the Santa Claus rally in December.

Some are a bit like children, expecting Santa to deliver gifts that exceed their already high expectations.

But the Santa Claus rally doesn’t mean prices go straight up in December. It means that historically, stock prices show a tendency to move higher in the second half of the final month of the year.

Is that the case again this year?

Profits or Coal for Wall Street?

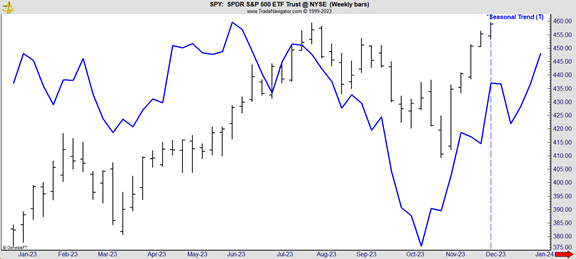

You can see the late-month expectation in the weekly chart of the SPDR S&P 500 ETF (NYSE: SPY) below. The blue line is the seasonal trend, and the dashed line shows where we are now.

December’s Seasonal Trend

The Santa Claus rally tends to start in the third week of the month. The first two weeks tend to be weak. We’re seeing this play out as major indexes trade lower to start December after November’s huge rally.

Over the first two weeks of December, the SPY has moved higher 56% of the time since 1993. Overall, the index has gained 62% of the time in a two-week period.

The track record isn’t screaming “bearish,” but it’s also not overly bullish. Now is an ideal time to act like children awaiting Santa’s arrival and prepare.

Investors should plan for the year-end rally and decide how they will take advantage of the short-term opportunity. That is, if it comes.

Although we get a Santa Claus rally 75% of the time, it’s even more important to be ready if there isn’t one.

You may have heard of the old saying: “If Santa Claus should fail to call, bears may come to Broad and Wall.”

That one is backed by testing. When we don’t get a Santa Claus rally, January has shown a small loss on average. Returns over the next year also tend to be below average.

The Santa Claus rally isn’t really an investment strategy. But it still gives us an idea of what to expect after December. If Santa delivers a lump of coal to Wall Street, we should prepare for turmoil in the upcoming year.

But we’ll be ready for that…

Until next time,

Mike Carr

Chief Market Technician