In this Marijuana Market Update, I respond to a viewer asking about Innovative Industrial Properties Inc. (NYSE: IIPR).

I mentioned this cannabis real estate investment trust (REIT) last week, but now it might be in hot water as it deals with a class action lawsuit filed by some of its shareholders.

Viewer Question on IIPR

Henry emailed me recently to discuss Innovative Industrial Properties:

I read your article regarding IIPR stock. It is very interesting!

I’m impressed with IIPR’s high growth rate and projected future growth trajectory, both on the earnings and revenue sides, plus the 5% dividend. So, I’m still holding the stock.

However, I feel it is hard to understand why it dropped so much compared to other industrial REITs, such as the benchmark ETF (INDS), in which IIPR is one of the top holdings. INDS only dropped ~25% from its top in November 2021, while IIPR dropped ~53% in the same period.

Henry wasn’t done with his research. He emailed me the following day after finding an article about shareholder litigation against IIPR, suggesting that could be the reason for IIPR’s deeper drop.

These are all great observations, Henry. I want to get into IIPR a bit more and give you my take on the stock’s recent pressure.

Now, let’s look at IIPR, a Maryland-based REIT specializing in sale and lease-backs of property to cannabis operators.

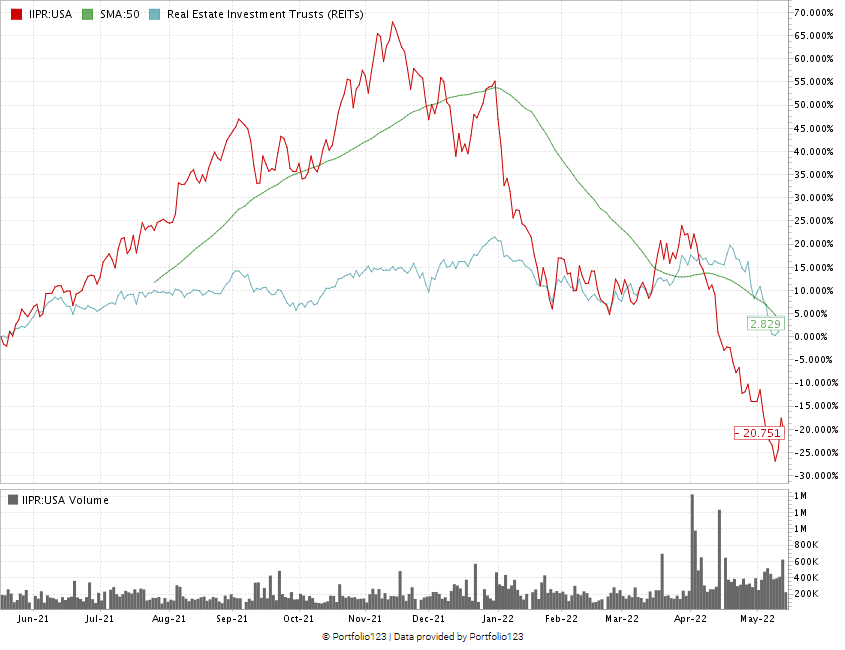

IIPR’s Stock Dropped Over the Last Year

IIPR has dropped around 20% in the last 12 months, compared to the broader REIT sector, which is up around 3% over the same time. The stock is down more than 50% from its November 2021 high.

But when you overlay the REIT index with IIPR stock, there’s strong parallel movement between the two.

IIPR bounced up in November 2021, along with the index, followed by a drop. The only real difference is that IIPR traded sideways from late January 2022 to April 2022, while the broader index continued to fall.

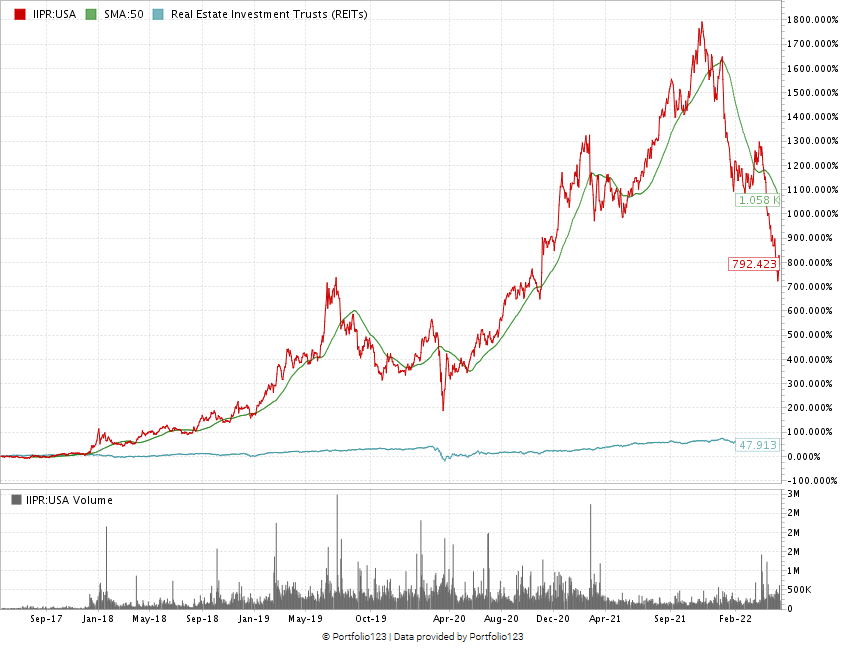

Despite Drops, IIPR Is Up Over 5 Years

Since 2017, IIPR is up around 790%, compared to its REIT peers which are only up 47%.

Will Shareholder Litigation Tank IIPR?

The suit Henry mentioned contends that IIPR is more of a cannabis lender than an actual REIT and that the value of properties owned by IIPR is much lower than it has implied.

It also suggests that IIPR’s top customers are in more financial trouble than shareholders have been led to believe. Those customers may not be able to make lease payments in the future.

I don’t have a huge concern over this lawsuit.

First, suits like this are common and often dismissed.

And the suggestion that IIPR is more of a bank and less of a REIT doesn’t pass the sniff test.

Remember: REITs must generate 75% of their revenue from real estate. As IIPR conducts sale and lease-back transactions with cannabis operators, the lawsuit’s claim doesn’t hold much water.

As to the claim of financial challenges for some of its tenants: In its most recent quarterly report released on May 4, IIPR reported a 50% increase in total revenue over the prior quarter. It reported revenues of $64.5 million in the first quarter of 2022 — so its current financial performance is strong.

It also indicated year-over-year growth in net income and even its dividend payout.

Looking ahead at potential revenue growth shows a strong upward trajectory for IIPR.

The company reported total revenues of $14.8 million in 2018, which is expected to rise to $436.1 million by 2024.

That indicates a compound annual growth rate of 45.6% — which is uber strong!

The Takeaway: I’m not too concerned about this lawsuit. I see it as more an inconvenience for shareholders than an actual reflection of IIPR or its stock performance.

Broader cannabis market headwinds are the more likely cause for IIPR’s downturn.

I’m still bullish on the prospects for IIPR. But if you are considering buying the stock, I would wait for an uptrend to buy high and sell higher. I’m not sure we've hit a bottom for this stock or the broader cannabis industry yet.

Thank you, Henry, for your email exchange. I appreciate the insight.

One more thing: You, like Henry, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with Chief Investment Strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes Co-Editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.