In this Marijuana Market Update, I focus on cannabis earnings and their relation to cannabis stocks during a market downturn.

Despite Earnings, Markets Are Bearish

It’s been a rough couple of weeks for the stock market.

Major stock indexes have taken a beating:

Factors contributing to the broad sell-off include high inflation, a hawkish Federal Reserve and continued pressures over the war in Ukraine.

And the sell-off has put additional pressure on the cannabis market:

The Money & Markets Cannabis Index shows the decline of the broader cannabis market.

The is an equal-weighted index including all cannabis stocks with a market cap of more than $1 million.

Over the last 12 months, the index value has plummeted 53.6%. The steady decline is frustrating for cannabis investors — especially when you factor in cannabis earnings.

Here’s a look at some of the more recent cannabis earnings reports I’ve found. (This is not a complete list):

Again, this is just a sampling of cannabis earnings — most reporting quarters ending on March 31, 2022.

As you can see, the trend shows cannabis sales are up. The average year-over-year sales increase of the companies listed is 55% — which is very strong for the cannabis industry.

Notably, the sales figures for Jazz Pharmaceuticals are only for cannabis-related sales, not its overall total quarterly sales.

So we see a trend of increased sales across the board for cannabis companies.

However, that has not translated into a better position for the stocks. In the chart, you can also see the price-to-earnings ratio for each company. The “N/A” listed on some of them indicates the company has a negative ratio and thus, is losing money.

IIPR Has Tanked Lower

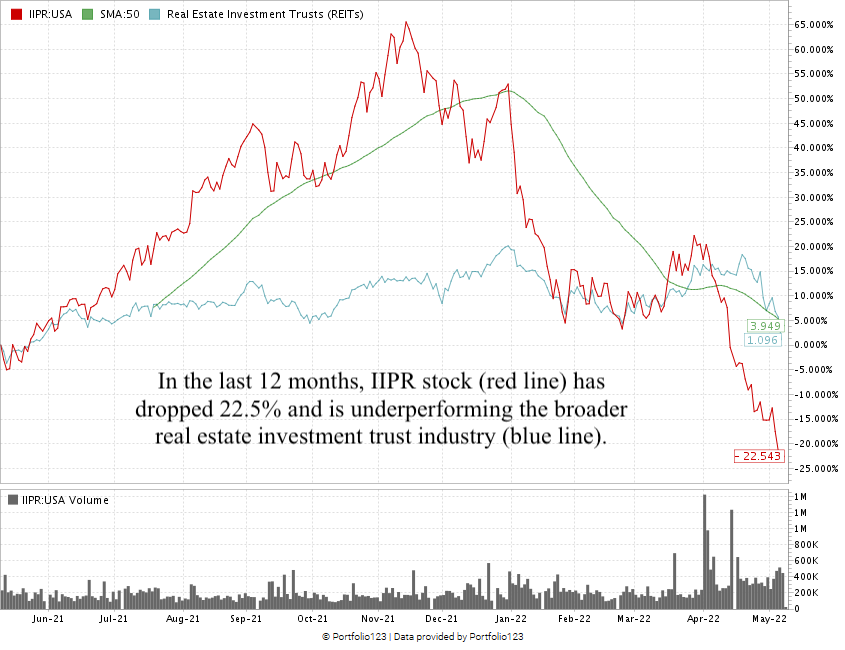

Here is the stock chart for one of my bullish cannabis plays, Innovative Industrial Properties Inc. (NYSE: IIPR). This is a cannabis-related real estate investment trust (REIT) that owns, operates and leases property to cannabis companies looking for retail or growing space.

From May 2021 to November 2021, the stock ran up 45% even when the rest of the cannabis market fell.

However, since reaching that high, the stock has dropped around 22% from where it was a year ago.

But look at the table I showed earlier: IIPR’s year-over-year growth is 50%! That, however, hasn’t translated into a stock price bump.

Let’s use Cronos Group Inc. (Nasdaq: CRON) as another example:

CRON’s Slide Lower

Cronos has a year-over-year sales growth rate of 99% — even more impressive than IIPR — yet the stock is down 54% over the last 12 months.

A bright spot for Cronos is that there is a slight (very slight) uptrend in the stock right now, but not enough to suggest we have hit the bottom of the dip.

The Takeaway

What all of this tells me is that big market investors are less concerned about the sales growth in the cannabis market and more concerned about trading on big headlines … which I’ve mentioned before.

Due to the lack of federal legalization of cannabis, that’s what we have to go on. However, smart investors like you are looking beyond headlines at the growth metrics of these stocks.

That is where your focus should be, along with valuation metrics. Don’t trade on headlines because you don’t make money on headlines. You make money investing companies with good fundamentals, solid value and growth potential.

One more thing: You can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we’ll use in any of our videos. Just send us your questions and feedback.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with Chief Investment Strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes Co-Editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that move the market.

All of these series are on our YouTube channel.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.