When the House of Representatives voted to impeach President Trump, many analysts thought, “here we go again.” They are thinking this is like Trump’s first impeachment.

But this time is different. The first impeachment was a partisan affair. In this case, there is bipartisan support for the idea that Trump violated the norms of his office. That’s more like the impeachment of President Richard Nixon.

Nixon faced bipartisan pressure to leave office and did resign days after the House voted in favor of impeachment.

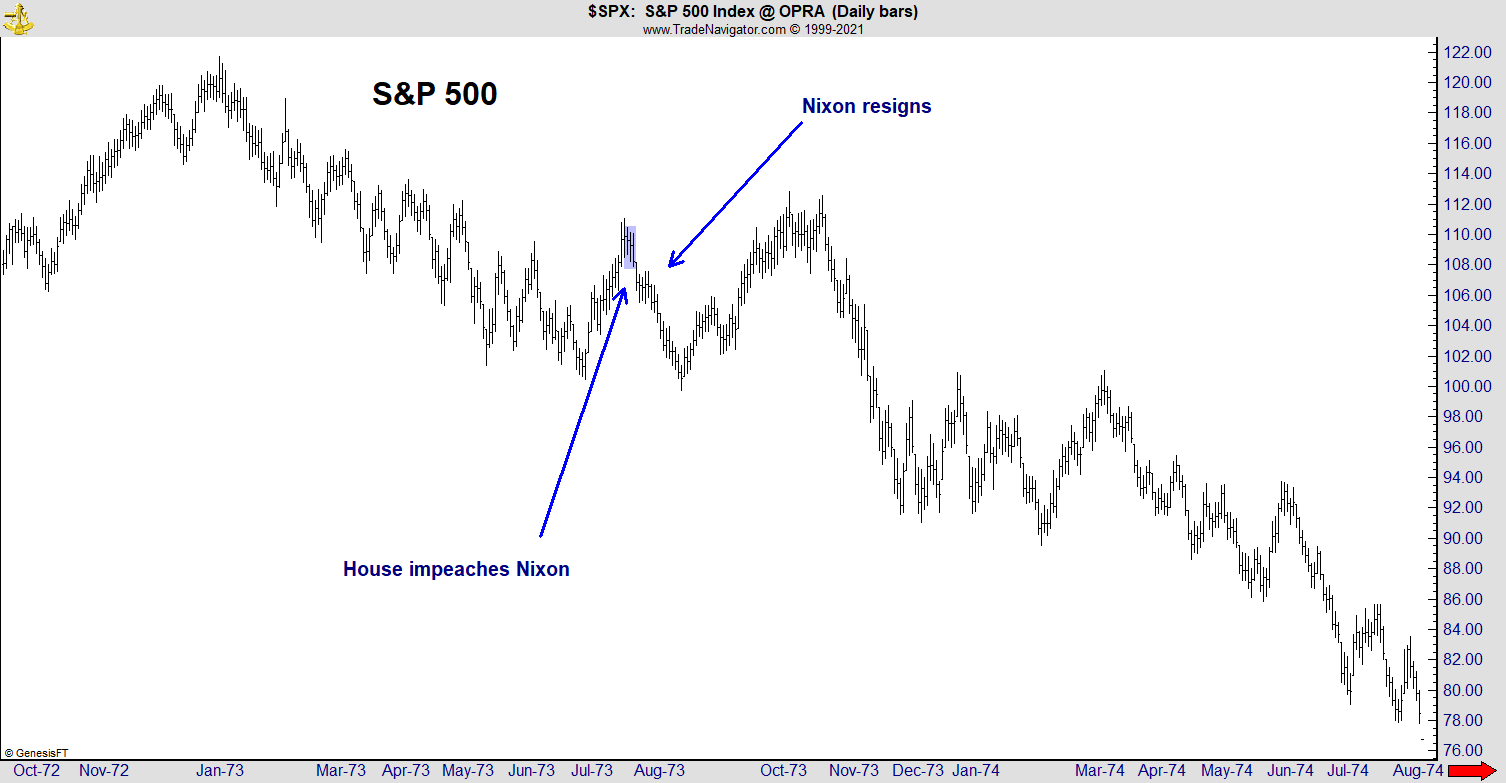

His resignation didn’t end the controversy in Washington. The country remained torn until the next election in 1974. The stock market reflected the turmoil, as the chart below shows.

S&P 500 Index After Nixon’s Impeachment

Source: Trade Navigator.

Impeachment May Pose a Risk for Investors

Stocks rallied briefly on the impeachment. It was a time of relief and hope, as President Gerald Ford noted in his inauguration:

My fellow Americans, our long national nightmare is over.

Our Constitution works; our great Republic is a government of laws and not of men. Here the people rule. But there is a higher Power, by whatever name we honor Him, who ordains not only righteousness but love, not only justice but mercy.

As we bind up the internal wounds of Watergate, more painful and more poisonous than those of foreign wars, let us restore the golden rule to our political process and let brotherly love purge our hearts of suspicion and of hate.

Ford’s words did not heal the wounds. The economy was in trouble, and it remained troubled. Partisanship created a national divide, and the nightmare persisted until one party won decisive control of Washington.

With President Jimmy Carter in the White House, the economic slump deepened. Stocks eventually bottomed, in 1982 and the longest bull market in history began.

Looking ahead, it’s probable President Joe Biden will invoke sentiments similar to Ford’s at his upcoming inauguration. It’s also likely that words won’t be enough.

The economy is in trouble. Partisan turmoil will persist for some time. And investors must consider that as a risk.

Ending on an optimistic note, Carter’s brief term led to a longing for a return to traditional values, and the greatest bull market in history followed his electoral loss.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.