Editor’s Note: Time is running out to secure your spot to Adam’s game-changing live event on Thursday at 4 p.m. Eastern time … But you can still click here to reserve a VIP spot for the Perfect Trading Window live event. He’ll reveal all the details, including the best way to play this once-in-a-lifetime market anomaly.

After last week’s disappointing GDP report, analysts watched closely on Friday when the Bureau of Economic Analysis released its monthly report on income and spending. Once again, the news was mostly disappointing.

There was some good news in the report. Consumer spending rose 0.6% in September, in line with forecasts of economists surveyed by The Wall Street Journal.

But that spending came from savings. Personal income fell 1% in September. That was worse than expected. Economists were looking for a 0.4% decline.

There was also bad news about inflation. BEA’s Personal Income and Outlays report, the formal name of the news release, includes the Personal Consumption Expenditures (PCE) index of inflation. That’s the Federal Reserve’s preferred inflation gauge and the measure the Fed insists should average 2%.

In September, PCE inflation jumped 4.4%. That was higher than the 4.2% increase reported in August. Once again, inflation by any measure is a problem that consumers can’t avoid.

Personal Income Hasn’t Overcome Unemployment

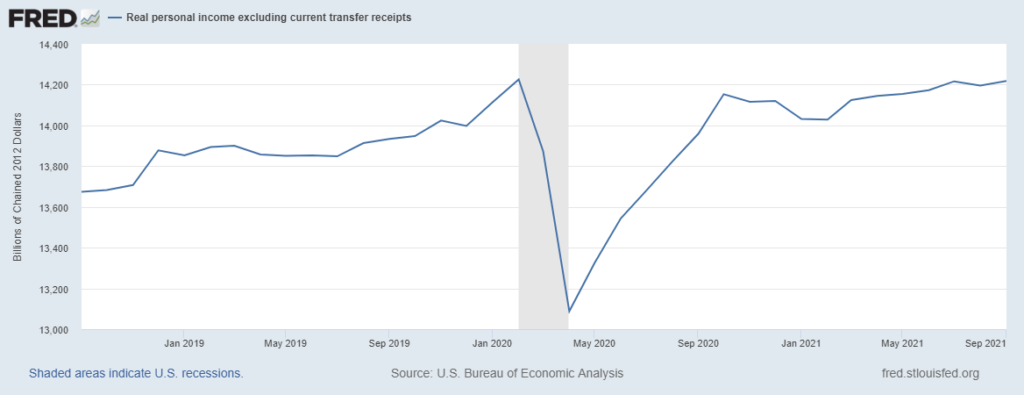

The worst news in the report could be the trend in personal income. Ignoring the impact of government payments for unemployment and other benefits, income remains below its pre-pandemic high.

Personal Income Slow to Recover from the Pandemic

Source: Federal Reserve.

Since unemployment continues to be above its pre-pandemic levels, those with jobs earn more than they did a year ago, on average. But their gains aren’t enough to overcome the drag of the millions of workers who left the labor force.

This is a problem for the economy. MarketWatch noted that economists are “counting on continued consumer spending to power the economy. Consumers bolstered their savings during the pandemic, but this financial cushion is being eroded in part by higher inflation.”

The data says the slowdown in GDP in the third quarter is likely to get worse unless employers hire soon. That makes the upcoming unemployment report the most important information investors need this week.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.