If you’re the type of investor who will only consider U.S. stocks … you’re missing out on HALF of the global markets’ best opportunities.

We have home country bias to thank for that. (More on that below.)

These investors do not strongly diversify their portfolios with international market securities, which could become a weakness for their portfolios if their home-country suffers serious economic decline.

Historically speaking, U.S. stocks have outperformed foreign stocks only around half the time.

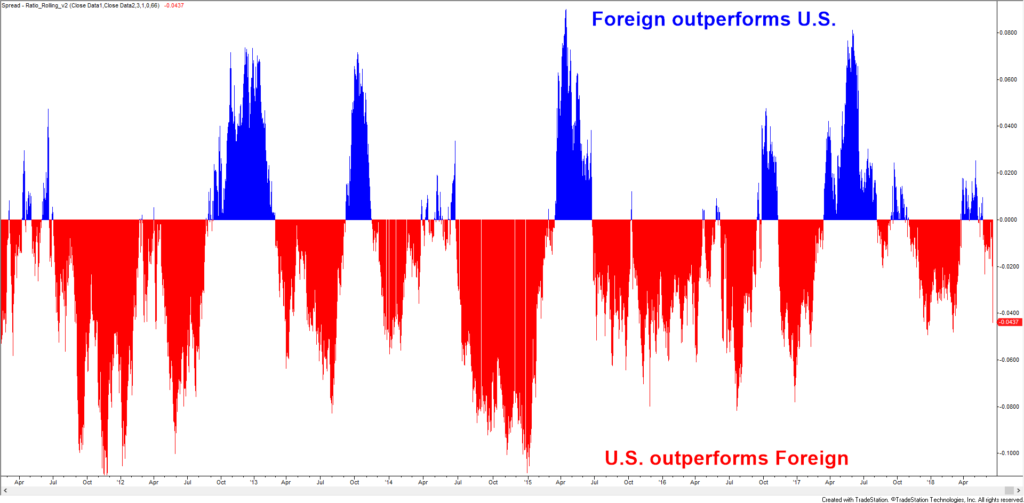

Take a look at this chart I pulled together, which shows the relative performance of U.S. stocks and foreign stocks over the last nine years…

Red: U.S. Stocks Outperform — Blue: Foreign Stocks Outperform

As you can see … sometimes U.S. stocks outperform (red plots), while at other times foreign stocks do better (blue plots).

This means you have to keep an open mind and be willing to make investments in both U.S. and foreign stocks … to be a truly successful investor.

Basically, we should avoid home country bias, which is:

Investors’ natural tendency to be most attracted to investments in domestic markets. Investors tend to focus more on their home markets and the companies that do business within these markets, because they are familiar with them.

These investors do not strongly diversify their portfolios with international market securities, which could become a weakness for their portfolios if their home-country suffers serious economic decline.

And that’s what my new “Overseas Opportunities” feature is all about … highlighting a non-U.S. stock or exchange-traded fund (ETF) that’s worth a look, particularly for investors who may naturally lean too heavily toward U.S. stocks.

Perhaps best of all? There’s no hassle. You don’t have to get approval from your brokerage to trade these funds and stocks.

Many investors don’t realize it, but you can get this exposure with stocks and funds that trade right on the New York Stock Exchange!

Let’s jump right into this month’s Overseas Opportunities highlight…

India: The World’s 5th-Largest Economy

While China gets all the press as the up-and-coming economic powerhouse of the eastern world, India’s economy and markets are nothing to sneeze at.

Estimated to generate roughly $3.2 trillion gross domestic product (GDP) in 2020, India’s economy is the 5th largest in the world.

And it ranks third on purchasing power parity, a measure that adjusts for the price of goods and the value of currency in each country.

What’s more, India’s annual GDP growth rate has averaged 7.4% for the past decade — more than three times the rate of growth in the U.S.

One of the simplest ways to gain exposure to a diversified basket of Indian stocks is buying an ETF, such as the iShares MSCI India ETF (NYSE: INDA).

In both my Cycle 9 Alert and 10X Profits trading services, I track the movements of this ETF on a daily basis as a proxy for how India’s stock market is performing.

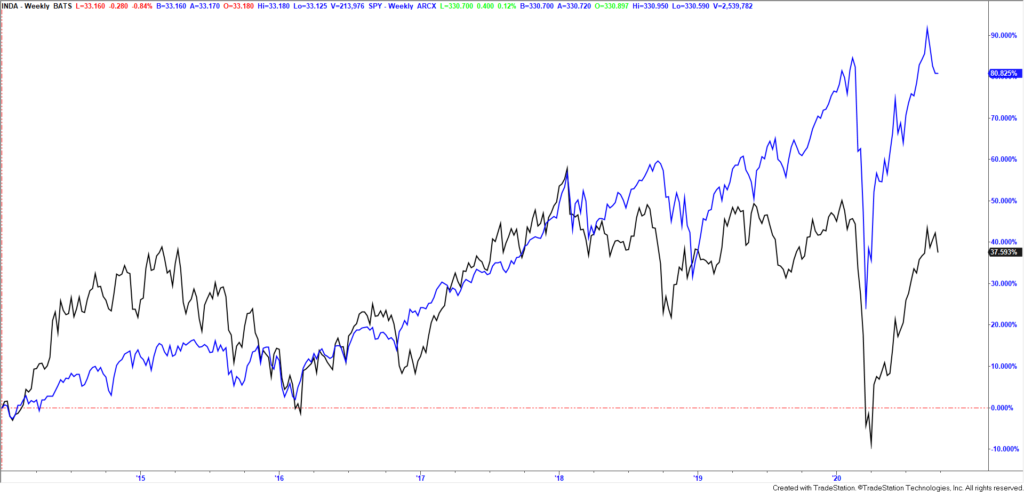

Since 2014, the United States’ S&P 500 (SPY) has certainly outpaced India’s stock market.

Here’s a percentage-performance chart that shows INDA’s roughly 38% return relative to the S&P 500’s 81%:

INDA (Black) Vs. S&P (Blue)

What you’ll see is that India’s stock market performed better than the S&P in 2014 and early 2015.

Then the two markets performed equally in 2016 and 2017.

And then, more recently, U.S. stocks have been on a run of outperformance — in late 2019, prior to the coronavirus crash, and even in the bounce-back since.

Why You Should Buy India ETF

This cyclical pattern of outperformance and underperformance is common of any comparison between U.S. and foreign stock markets. When you see one market outperform the other for quite some time … you can typically expect “mean reversion” of that relationship, with the laggard outperforming the leader, as the two markets reverse roles.

I think that makes India’s stock market worth a close look today.

Indian stocks have underperformed the S&P for the past two years, setting up the potential for a role reversal over the next year or two. And more recently, India’s stocks have begun to show signs of closing that gap.

Over the past three months, INDA is up 12% … more than each of the 15 top global economies I track, and double the S&P 500’s (SPY) 6% return.

As I mentioned, buying shares of the iShares MSCI India ETF (NYSE: INDA) can be a great way to gain diversified exposure to India’s economy.

I definitely recommend you consider adding a slice of India’s stock market to your pie.

To good profits,

Adam O’Dell, CMT

P.S. Looking overseas reveals many investment opportunities. In August, as part of my premium Green Zone Fortunes service, I found a foreign company that is could be poised to be the next Paypal,Visa or Mastercard. The stock lands in the “strong bullish” zone of my algorithm — and it’s set to beat the market by three times in the next year!

Click here to read about this stock, and get more details now!