It’s been a challenging year for investors.

Major market averages plunged in January. Tech stock indexes fell 15% or more from their recent highs, with many individual stocks in the sector falling much more. The best-performing index could be the S&P 500, which dropped just over 12%. January’s losses in the S&P 500 are a bad omen for bears, based on a popular indicator.

But widely followed indicators aren’t usually important ones to watch. In January, many investors missed that consumers became less worried about inflation. If you follow the news, you know the media still worries about inflation, but consumers seem to be taking higher prices in stride.

Inflation expectations are more important than current inflation. If consumers expect higher inflation in the future, inflation will likely rise because consumers could delay purchases hoping prices come down someday. Workers are less likely to change jobs if they are worried about higher prices threatening the viability of their company. Businesses invest less because they spend more on operating costs and have less to set aside for future expansion. These factors reduce economic growth.

Inflation Expectations Aren’t a Concern for Consumers

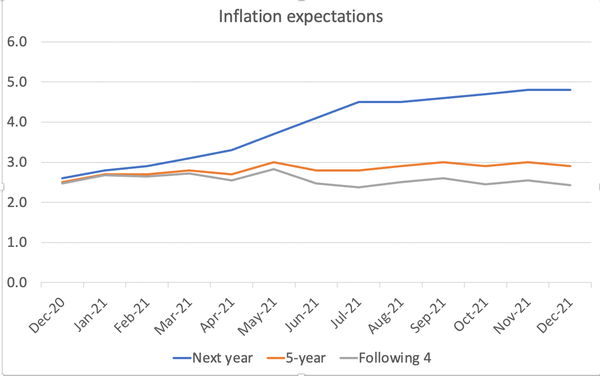

For now, that’s not a concern. The chart below shows inflation expectations from the Michigan Surveys of Consumers.

Source: The New York Times.

Right now, consumers expect prices to rise about 4.8% in the next year. And they expect inflation of 2.9% over the next five years. This means expectations fall to about 2.6% after the current surge.

After inflation soared in the late 1970s, in February 1980, one-year expected inflation was 10%, while five-year expected inflation was 9.7%. This brought the economy to a standstill.

We face different conditions now, but headlines continue to highlight concerns about inflation. If inflation falls later this year, that will boost consumer confidence and stock prices.

Given current inflation expectations, the recent sell-off in stocks looks like a buying opportunity.

Click here to join True Options Masters.