You may be wondering how the housing market will react to higher mortgage rates.

As the Federal Reserve prepares to raise rates, analysts consider how that will affect different markets. Many analysts take a simple approach to the housing market and declare higher rates will stop the spike we see in home prices.

The logic is simple: Higher rates increase the cost of mortgages. Potential buyers won’t qualify for as much as they can when rates are low. The decrease in mortgage qualification will lead to lower bids from buyers, and that will force prices to stop going up.

Neither supply nor demand factors into that logic. It’s just a thought exercise on what buyers want.

Mortgage Rates Outlook: Demand Rises for One Key Demographic

When we consider supply and demand, the analysis changes dramatically. Supply of homes is low. According to the National Association of Realtors: “At the end of December, the inventory of unsold existing homes fell to an all-time low of 910,000, which is equivalent to 1.8 months of the monthly sales pace, also an all-time low since January 1999.”

Demand is rising. The group of Americans between 18 and 34 is the largest age group in the country. Over 46 million people in this age group are looking to start their own households.

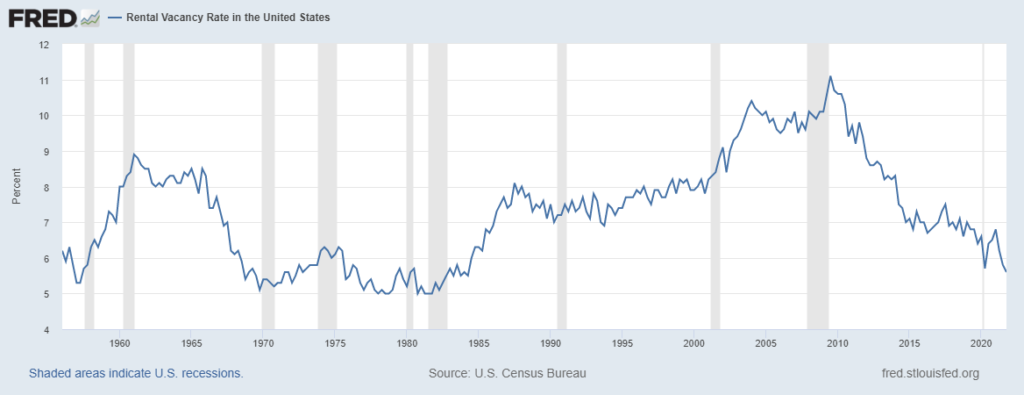

Now, analysts taking the simple approach to forecasting price trends will argue that if mortgages are unaffordable, potential buyers will become renters. Supply affects rental prices as well. The 5.6% vacancy rate of rental properties is a 38-year low.

Rental Vacancy Rate at Historic Lows

Source: Federal Reserve.

If buyers become renters, we should expect rents to increase. Since rental homes are worth more when rents are higher, that puts upward pressure on prices.

Higher interest rates will make mortgages more expensive, and some potential buyers will be priced out of the market. But this will all be bullish for home prices since demand remains high and supply is tight.

Expect supply to grow even tighter as rates rise and construction slows due to higher material costs.

Bottom line: There’s no reason to expect a reversal in this market.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters