Federal Reserve Chair Jerome Powell has been busy the past two weeks. He presided over a meeting where the Fed raised interest rates for the first time since 2018. Then he gave a series of speeches reinforcing the message that the Fed is fighting inflation. The only things missing were the “Whip Inflation Now” buttons that President Ford popularized.

Source: Wikimedia.

It’s Hard to Manage Inflation Expectations

Powell knows speeches are an important part of his job. He is trying to manage expectations.

Consumers are worried about inflation. And they should be. Consumers have faced high prices for months. Their pain is going to last for some time.

Finally Powell admitted it will take time to get inflation under control. In a recent speech, he said: “I believe that these policy actions and those to come will help bring inflation down near two percent over the next three years.”

As consumers, we know inflation has been a problem for more than a year. It’s going to continue to be a problem until after the next presidential election in the best case.

Inflation could be even worse than Powell believes. If consumers expect high inflation to last for years, they’ll change their behavior. They’ll buy more consumer staples to avoid price hikes. This will increase demand when supply chains are already under pressure. The result will be more inflation as producers struggle to meet demand.

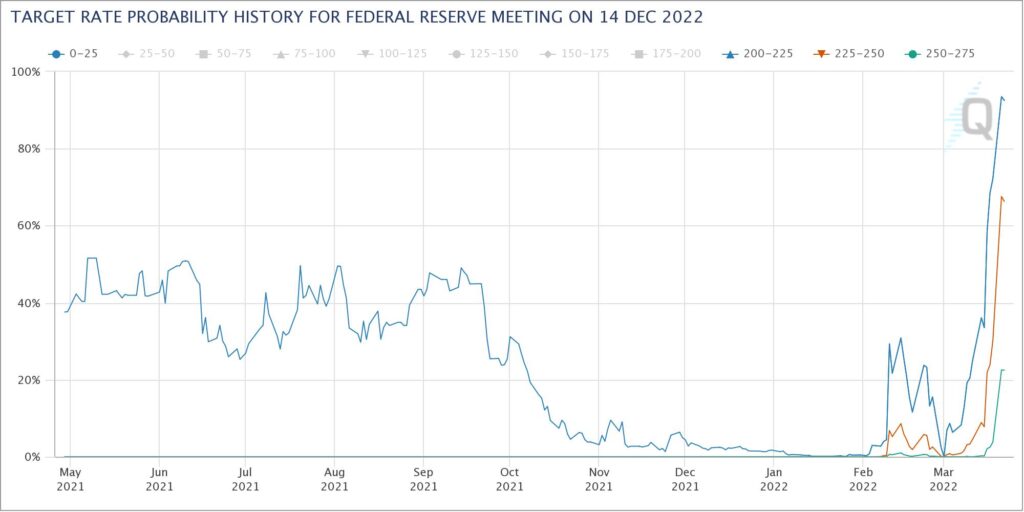

Investors’ inflation expectations are also rapidly changing. The chart below shows what futures traders expect interest rates to be at the end of the year. Six months ago, there was about a 40% chance rates would be near zero. Now, looking at the blue line in the chart, a vast majority of traders expect the Fed to raise rates to the 2% to 2.25% level by year’s end.

Traders Are Planning for More Rate Hikes

Bottom line: The Fed will struggle to get inflation under control. It’s a long battle that politics will affect — inflation will be a crucial topic in the two upcoming elections. If the Fed falters, the economy could plunge into 1970s-style stagflation.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.