In a speech earlier this week, Federal Reserve Chair Jerome Powell was firm in his commitment to fighting inflation, noting the central bank might raise rates more than 0.25% at a future meeting. He added that the Fed could even use rate hikes to restrict the economy if needed.

While Powell’s words are welcome, the Fed’s stance may be too late. An important theory says the Fed is further behind inflation than ever.

Many fields are part art and part science. For example, even if we wish otherwise, medicine is part art and science. Interest rate policy under the Fed seems to be an art, but some economists have attempted to make it a science.

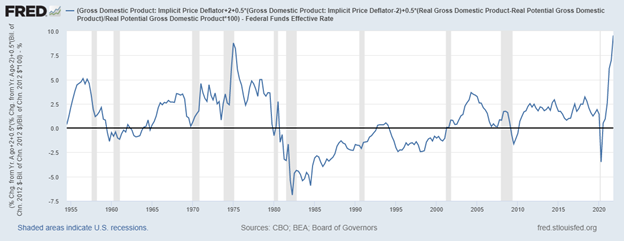

An economist named John Taylor developed the “Taylor rule” in 1993. This rule applies a formula to determine the proper rate based on the current inflation rate, actual GDP and the potential GDP in an optimized economy.

The Taylor rule finds the current federal funds rate should be 9.6%. That’s well above the Fed’s current target rate of 0.25% to 0.5%.

The chart below shows the difference between the Taylor rule and the current federal funds rate. When the difference is below 0, the Fed’s policy is restrictive.

Most of the time, Fed policy is accommodative, but in the last year, the difference jumped to an all-time high.

The Difference Between the Taylor Rule and the Fed Funds Rate

Source: Federal Reserve.

The Fed’s Accommodative Policy Breaks Taylor Rule

This is bad news for the economy.

The Taylor rule’s previous record of 8.8% occurred in 1975 when inflation was above 10%. The Fed got inflation down to 5% by 1977, before it soared to almost 15% in 1980. The chart shows the Fed then got very serious about fighting inflation.

The Taylor rule says the Fed needs to announce about 20 individual 0.5% interest rate hikes to break inflation.

We are likely to see history repeat. The Fed allowed inflation to rise, and the Taylor rule quantifies the Fed’s policy failure. Fighting inflation generally requires raising the federal funds rate to a higher level than inflation.

We’ll get there. But expect some pain along the way.

Click here to join True Options Masters.