Federal Reserve officials continue to tell us that inflation isn’t going to last. Prices are higher because of the unique circumstances associated with the pandemic. In a few months, those price pressures will fade, and we will be back to normal.

It’s a good story. But consumers aren’t buying it.

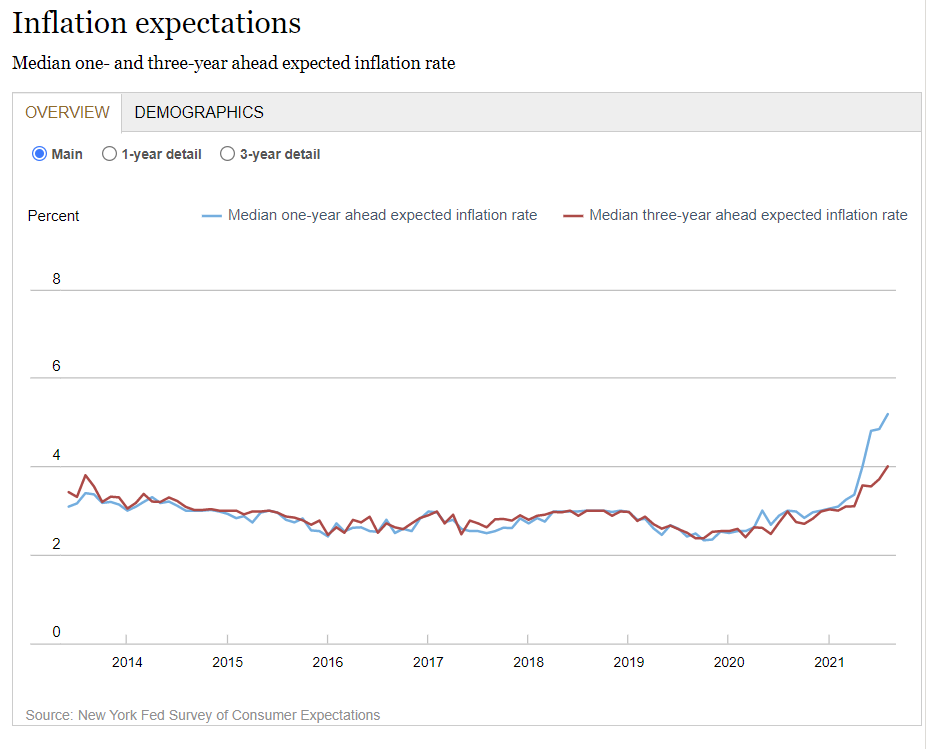

According to the latest data from the Federal Reserve Bank of New York’s Survey of Consumer Expectations, the median year-ahead inflation expectations of consumers jumped above 5% in August. This measure increased to 5.2% from 4.8% in July — the eighth consecutive monthly increase and a new high in the data.

The red line in the chart shows inflation expectations for the next three years. At 4%, that value is also at an all-time high.

Inflation Expectations Are High Across Demographics

Not surprisingly, given their experience in the 1970s, older consumers are more concerned about inflation. Those over 59 expect inflation of 6% in the next year and inflation averaging 4.9% over the next three years.

Consumers with less education are also concerned about inflation. Their expectations match the fears of older Americans.

That also makes sense. Those with college degrees are often in higher-paying jobs and own their own homes. Their mortgages insulate them from rent increases which are becoming more common.

The more highly educated households also generally spend less of their income on daily necessities in percentage terms. They see the impact of inflation later than those without a college degree, and those without a degree comprise most Americans.

Older Americans also spend more than average on housing expenses. They also face higher medical expenses, and medical expenses consistently grow faster than core inflation measures.

Inflation expectations are high for most consumers, and this could become a source of future inflation. Consumers worried about inflation may spend quickly before higher prices reduce their purchasing power. Increased demand could spark even more inflation, and the Fed seems unprepared for that possibility.

P.S. Live on September 23, Adam O’Dell will reveal the details of a simple two-day trade we believe is the fastest way to grow money ever devised. It’s a big claim. Can we prove it? Find out on September 23 by signing up for the event here.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.