Editor’s Note: During our upcoming live event on September 23, Adam O’Dell will reveal something truly extraordinary. You’ll get the details on a strategy that has beat the market by 51 times … while producing top-performing wins of 440% in two days. To reserve a VIP spot at this groundbreaking live event, click here.

While running for president in 2007, then-candidate Rudy Giuliani was stumped by a question that had stumped President George H. W. Bush in 1992.

When asked about the price of milk and bread, Giuliani answered: “A gallon of milk is probably about $1.50, a loaf of bread about $1.25, $1.30.” Fact-checkers quickly pointed out that milk cost at least $3 at that time and bread was more than $2.

Analysts long used this question to highlight how out of touch politicians are. Failing to know the price of basic grocery items seems to imply that they are elitist. In recent months, it’s become clear at least some Federal Reserve officials are out of touch.

If you’ve walked the aisles of a grocery store recently, you know prices are rising. The same is true at the hardware store or almost any other store. The Fed’s insistence that inflation is transitory and therefore not a problem probably seems out of touch to anyone who has pushed a shopping cart recently.

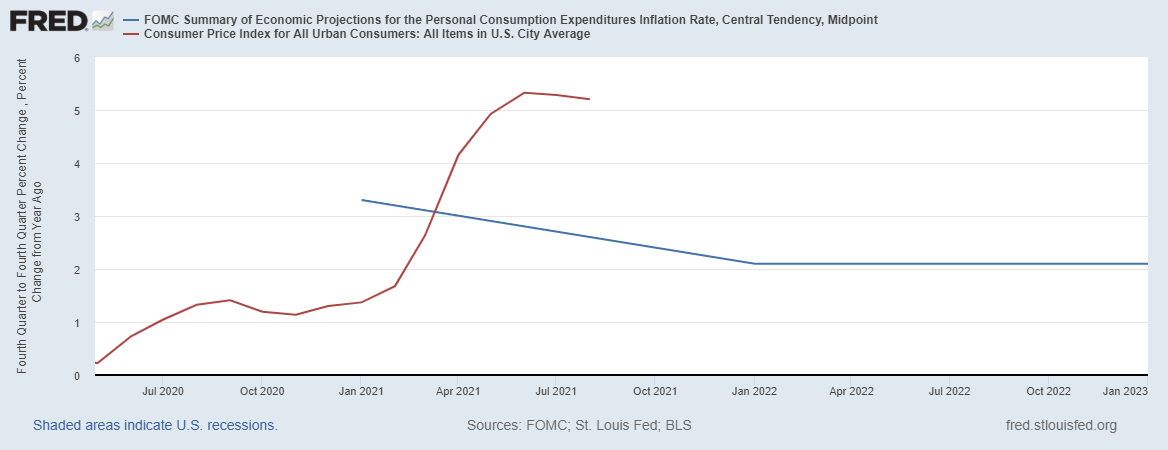

Of course, we need data to confirm that opinion. The Fed’s estimates of inflation provide that data. The chart below shows the Fed’s inflation forecast (the blue line) and actual inflation (the red line).

The Fed’s Inflation Outlook Is Out of Touch

Source: Federal Reserve.

The Fed Isn’t Looking at the Right Numbers

The Fed publishes an official inflation forecast every quarter. While the Consumer Price Index is above 5%, the Fed had expected it to be under 3%. The Fed’s preferred inflation measure, the rate of change in the Personal Consumption index, is above 4%.

The Fed’s preferred measure understates prices that consumers must pay. It measures what they pay, and consumers have limited incomes, so they substitute cheaper items when prices rise.

Consumers can’t avoid the pain of buying a gallon of milk or a loaf of bread. Economists at the Fed can ignore that pain by focusing on different indicators or by insisting that inflation is transitory.

In the real world, we know that even if inflation is transitory, the higher prices we pay at the store are here to stay.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking. Follow him on Twitter @MichaelCarrGuru.