It’s now a joke among analysts.

As inflation rose in 2021, Federal Reserve Chair Jerome Powell insisted the price pressures were transitory.

In his defense, supply chains weren’t functioning normally when the economy reopened.

With inflation now at painful levels, traders think Powell may be right.

Why Traders Changed Their Minds

Traders buying and selling with real money take risks in pursuit of real rewards.

Because they need to limit risks, market prices can provide accurate economic forecasts.

Inflation plays an important role in many markets. Bond prices should rise if it falls. Commodity prices should increase if it rises.

Traders make an implicated forecast for inflation as they buy and sell.

Inflation expectations can be backed out of market prices.

The 5y5y to Measure Inflation

One measure of inflation expectations is the 5-year, 5-year forward inflation expectations rate, known as the 5y5y.

The 5y5y is found by assuming you buy a bond that matures five years from today.

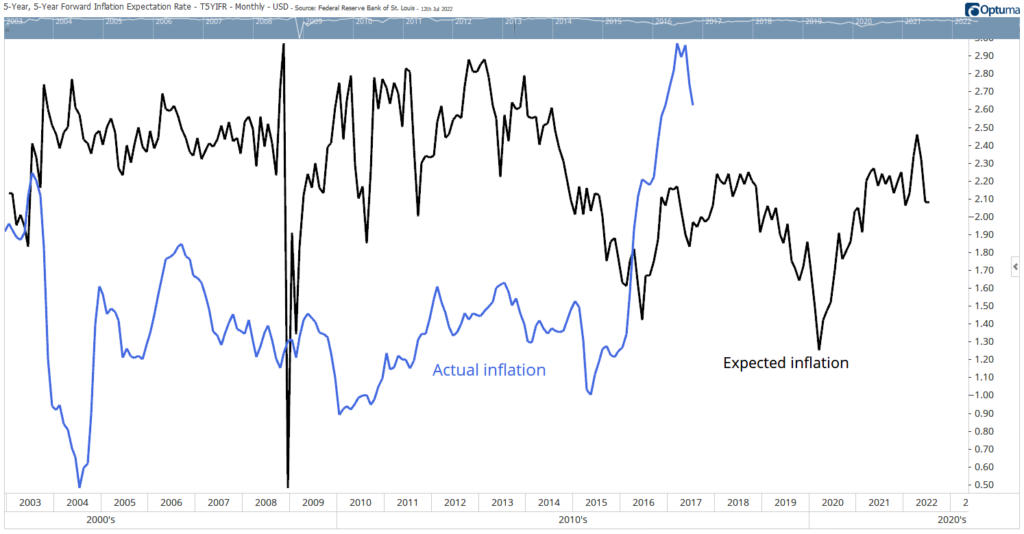

The chart below shows the 5y5y as the black line. The blue line is the actual inflation rate measured by the consumer price index (CPI). The CPI is shifted back by five years to match the market’s forecasting.

2003 to 2022 CPI & the 5y5y

Minor Setback of the 5y5y

There are some big misses.

The magnitude of inflation can be much greater or lower than expected.

But overall, the 5y5y has a reputable forecasting record.

It’s at least as good as the Fed’s economists.

Inflation should be stable by the end of the year and drop after that.

The steep dip in the forecast is consistent with an extended recession over the next year or more.

Market prices tend to be more reliable than economists’ guesses.

Traders in bond markets tell us inflation will decline soon.

Bottom line: This is good news and may be the only good news about inflation we’ll see this month.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.