Much has been in the news the past week about the Federal Reserve drawing the ire President Donald Trump over its steadily rising interest rate that is spooking investors into a massive selloff that’s seen the stock market take a dive.

“My biggest threat is the Fed because the Fed is raising rates too fast. You look at the latest inflation numbers, they’re very low.”

“My biggest threat is the Fed because the Fed is raising rates too fast,” Trump said on Fox Business TV. “You look at the latest inflation numbers, they’re very low.”

To his credit, Federal Reserve Chair Jerome Powell hasn’t given much in the way of an objection. Alan Greenspan, who worked for the Fed for 19 years under four different presidents, said they all criticized his work and that you have to put blinders and ear muffs on, and keep forging ahead because the Fed is supposed to run free from political influence.

Powell has said the Fed’s goal is to normalize monetary policy in an “extraordinary” economy by sticking to its strategy of gradual interest rate hikes. He’s also said the central bank must watch for signs of a recession while keeping inflation low.

But the inflation argument doesn’t exactly work, according to a recent article in Bloomberg, if the Fed follows through with its plans to raise the interest rate again in December and three more times in 2019, as has been reported. By 2020, most policymakers expect the rate to be above their estimate of the long-term neutral level that neither restrains nor spurs growth.

Per Bloomberg:

“Powell’s task has been made much more complicated by what Trump has said,” said economist Joseph Carson. He argues the Fed needs to raise rates to rein in buoyant asset markets and reduce the risk of destabilizing financial imbalances. That consideration was cited by a number of officials at their meeting last month, according to minutes of the gathering released Wednesday.

The thrust, if not the method, of Trump’s criticism has some support, part of it from unexpected quarters.

Inflation Isn’t the Problem — Yet

Trump is right that inflation isn’t a problem, for now at least. Minus volatile foods and energy costs, the personal consumption expenditures price index is up 2 percent from August 2017 to August 2018, well within the Fed’s target rate for inflation.

“You can believe that the Fed is raising rates too quickly, as I do, and also believe that weighing in the way Trump has is very, very bad,” liberal economist and Nobel Prize winner Paul Krugman said on Twitter on Oct. 12.

Consumers and companies are so convinced that the central bank won’t let inflation get out of control that they act in ways that turn that belief into reality. And Powell wants to keep it that way.

The result though is that inflation may no longer be the best indicator of whether the economy is overheating, Powell said in an Aug. 24 speech.

The Powell Doctrine

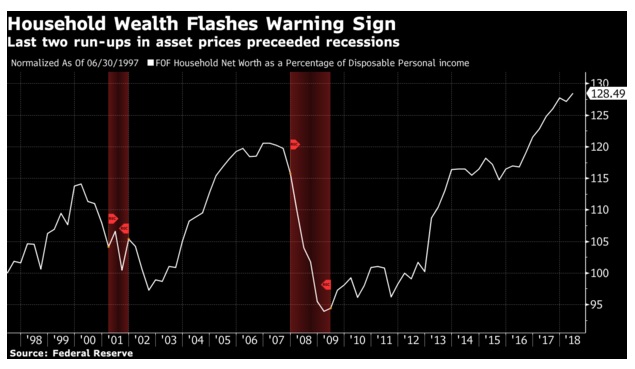

“In the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation,” Powell said. “Thus, risk management suggests looking beyond inflation for signs of excesses.”

But in the face of presidential criticism, it’s difficult to justify tightening credit to counter imbalances when inflation is tame.

The Fed doesn’t have a mandate to prevent an unsustainable surge in prices of shares — such as occurred before the 2001 recession — or of homes -— as happened before the devastating downturn of 2007-09.

Even if the Fed could predict bubbles before they form, steps to head them off would likely be politically unpopular, something Greenspan himself can attest to after he warned of “irrational exuberance” in the markets in 1996.

Even more politically toxic: Contending that higher interest rates are needed because joblessness is too low and has to rise. That’s an argument that Powell — who’s said “there’s a lot to like about low unemployment” — is certain never to make.

Asset Bubbles

The big question the Fed faces is whether or not it should tighten credit more now, or wait until the bubble has burst to then clean up the mess. Powell, it appears, is more inclined to the raise rates now and head the bubble off before it happens, a policy approach former Fed board member Jeremy Stein agrees with.

“Monetary policy should pay attention to indicators of financial market stability or excess,” Stein, now at Harvard University, said in an email. That’s especially true in the U.S. where “the macro-prudential regulatory arsenal is pretty non-existent.”

Powell has downplayed current risks to financial stability and said in July “I wouldn’t use the bubble word.” Even with recent volatility, the S&P 500 hasn’t actually changed much since then, even though Trump blames the big drops of the past week on the Fed.

Stein says it isn’t easy to incorporate financial stability risks in policy, and even more difficult to explain their role.

“If they are to influence monetary policy, it will have to be in a more judgmental, discretionary fashion, and one that may be harder to communicate,” he said. That may also result at times in “a bit more hawkish” approach to policy.

Powell’s senior special adviser Jon Faust foreshadowed the difficulties the Federal Open Market Committee might face when he wrote and article last December.

“Despite a new openness to the idea of asset-market excesses in some parts of the economics profession, the profession is nowhere close to agreeing on a new dogma,” he co-wrote with economist Bob Barbera. “The FOMC will have to create and communicate a new consensus on this contentious and unsettled topic.”

And they’ll have to do that faced with a self-professed “low interest-rate” president who’s quick on the Twitter trigger.