Inflation news is unsettling for any American — even more so for those living off their investments.

The topic dominated the financial news last year, and I see no immediate signs that it won’t do the same in 2022.

Just this week, the Bureau of Labor Statistics reported that consumer price inflation ran at 7% over the last 12 months.

Retired folks know that the 2% to 3% they can earn in bonds doesn’t go far when prices are rising at 2-3 times that rate. Even the stock market’s long-term average of around 10% looks meager when you shave off 7% due to inflation.

My colleague and co-editor of Green Zone Fortunes Charles Sizemore believes inflation will fall off a cliff by the middle of this year. He thinks we might even get deflation.

Even if he’s right, that turning point could be at least six months away.

In the meantime, we have trades to make.

And the “inflation trade” still has further to run.

Inflation Helps One Asset

Inflation is bad news for bonds and certain pockets of the stock market, but it’s fantastic for commodities.

While infinite amounts of money can be “printed” with nothing more than keystrokes on a computer, commodities are finite. They are naturally scarce and have to be extracted, which takes time and money.

Ride Rising Prices Higher: DBC Commodity ETF

As a case in point, look at the Invesco DB Commodity Index Tracking Fund (NYSE: DBC), one of the largest and most popular broad-based commodity exchange-traded funds (ETFs). DBC has a market cap of $2.6 billion and trades about 3.5 million shares per day. Liquidity isn’t an issue.

DBC has ripped higher since April 2020, almost doubling off its lows.

And it’s shown no signs of slowing down. Since April 2020, DBC has matched the S&P 500’s returns, and this is during a time when the stock market was on fire.

“Commodities” is a broad term that includes everything from corn to uranium. So the particular mix of commodities held matters.

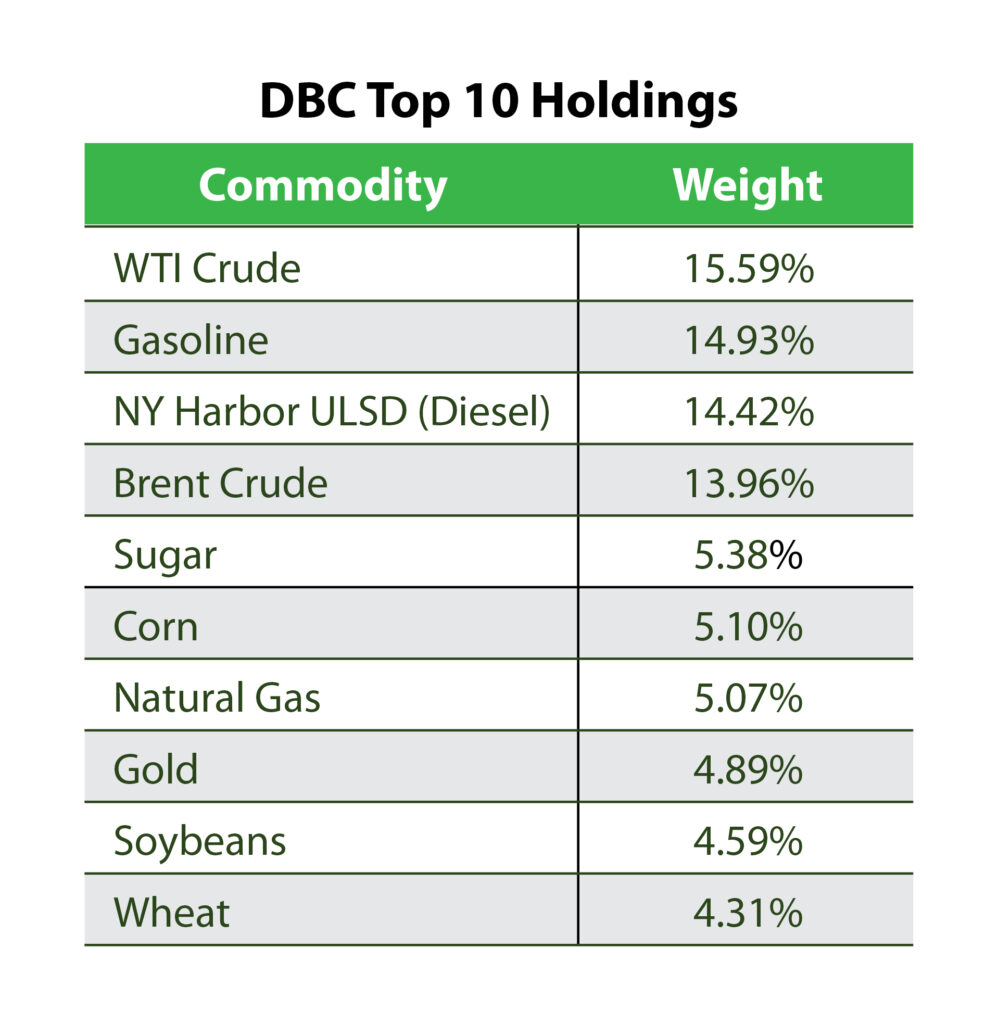

You might notice DBC is betting big on energy right now. Its top four holdings, making up nearly 60% of the total, are all related to energy. Natural gas, in the seventh spot, chips in another 5%.

DBC also has exposure to soft commodities like sugar, corn, wheat and soybeans. But it’s safe to say that as go energy prices, so goes DBC.

That’s not a bad thing at all! I’ve been bullish on energy for months and have recommended stocks in that sector in my premium investing services.

The Future for the Inflation Trade

Energy washed out and reached a point of maximum pessimism during the early months of the pandemic. As you might remember, the price of crude oil went negative for a while. The supply and demand dynamics for energy were so upside down. You literally couldn’t give oil away. You had to pay someone to take it.

Those conditions weren’t sustainable. But they helped create the trading opportunities we see today.

The inflation trade is far from dead. I expect that it still has several months left to run. Buying a broad, energy-heavy ETF like DBC is one solid way to play this trend.

You could also join Green Zone Fortunes for more ways to invest within the energy space.

Our model portfolio has some of my highest-conviction stock recommendations across both “old” energy (my readers are sitting on a top open gain of 69% since March 2021 on one oil and gas producer) and its newer, greener options like battery tech and electric vehicles.

Click here to see how you can gain access to these stock recommendations an research now.

I can’t wait to see you among our Green Zone Fortunes elite!

To good profits,

Adam O’Dell

Chief Investment Strategist