Here at Money and Markets, we talk a lot about infrastructure stocks. For the federal government, infrastructure projects are historical face-lifts for the national economy.

During the Great Depression, President Franklin D. Roosevelt implemented the New Deal, a series of programs and projects aimed at stabilizing the economy and providing jobs to Americans.

Under the New Deal of 1933, the Public Works Administration spent about $4 billion on construction of public infrastructure like schools, courthouses, city halls, public-health facilities, roads, bridges and subways.

Not far from my home in Dallas, Texas, there’s a man-made lake. From bath houses to pumping stations, construction projects dot the lake’s perimeter.

These structures are direct results of New Deal initiatives and are constant reminders of its lasting impacts on this nation’s economy.

Today, we don’t have the wherewithal as a nation to implement a New-Deal-level infrastructure initiative, but we do need it. Last year, the COVID-19 pandemic triggered a recession, and unemployment rates hit record highs.

We’ve started to recover in 2021. But it’s not enough.

I think we’re going to travel back in time and take some inspiration from the New Deal. And that means an influx of infrastructure projects: roads, buildings, dams and, most significantly, homes.

Buy This Infrastructure Stock Now

For my latest pick on The Bull & The Bear podcast week, I chose a company that sells a fundamental construction material: limestone.

United States Lime & Minerals Inc. (Nasdaq: USLM) produces lime and limestone products. Limestone is used in road work and other building projects like roofing.

If construction occurs, lime will be present at the site.

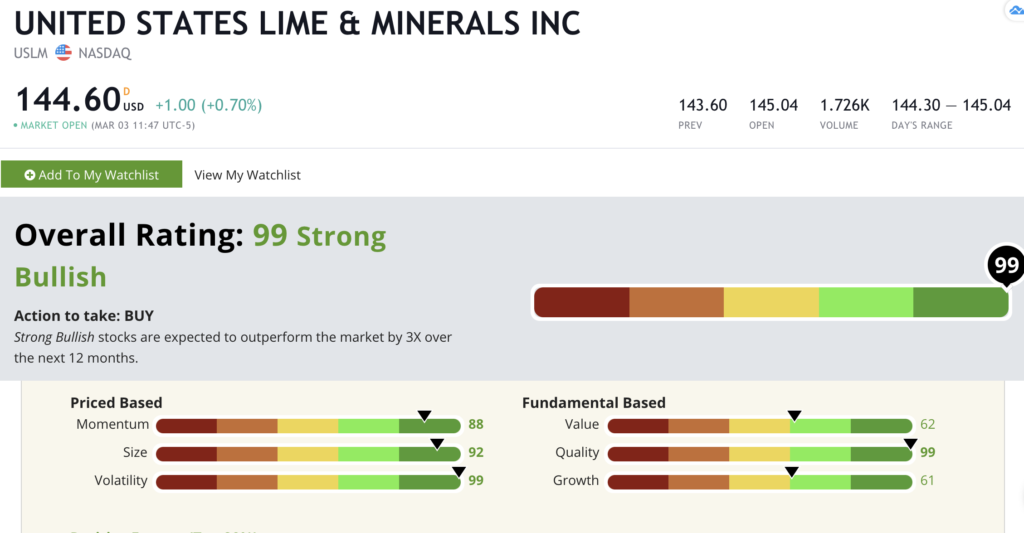

U.S. Lime & Minerals rates a 99 overall in our Green Zone Ratings system. We are “Strong Bullish” on this infrastructure stock. In fact, USLM is in the top 1% of all the stocks we rate.

United States Lime & Minerals Inc.’s Green Zone Rating on March 3, 2021.

Quality — USLM rates highest on quality with a 99 because of its strong profitability. This company’s balance sheet is an infrastructure-sector anomaly: U.S. Lime & Minerals has no debt and good asset turnover.

Volatility — At a 99 for volatility, USLM is a surprising infrastructure stock. USLM has a historical precedent of stable, steady upward growth. After May 2020 lows, USLM’s stock price shot up like a rocket, based on expectations of infrastructure spending. This is the right kind of volatility.

Size — USLM rates a 92 on size. It’s not a huge company, but it’s also not the smallest we’ve seen, which is why it’s important to take advantage of USLM today. Because USLM is a thinly-traded stock, meaning it can’t be sold without a significant price change, proceed with care and precision.

Bottom line: ULSM shows promise, but I recommend caution and precision when pursuing this infrastructure stock. I like small caps, and I think there’s great opportunity here. Basic materials are seeing an uptick in the future. Follow the future of infrastructure by taking advantage with USLM now.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.