One of the problems with fundamental investing is that, as a regular investor, you’re always at an informational disadvantage. You get financial statements and earnings releases when they are announced to the general public. Of course, acting on early information is illegal insider trading — the sort of thing that lands you in federal prison. But not all insider trading is illegal.

Company officers regularly buy and sell their own shares from their personal accounts. There are rules — they generally can’t buy or sell near a major announcement — but nothing is stopping the men and women running the companies from trading their own stock as long as they disclose the trades. And here is where it gets fun.

Company insiders tend to be regular sellers of their shares, but you can’t glean a lot from the sale. If a founder or CEO sells a couple million dollars worth of stock, they might be buying a new ski chalet or yacht. Or maybe they’re paying off their ex in an expensive divorce settlement. Or it could just be some good old fashioned diversification. It could literally be anything.

But there is only one reason a company insider would whip out their checkbook to buy shares. They believe, based on their intimate knowledge of the company, that its shares represent a good value.

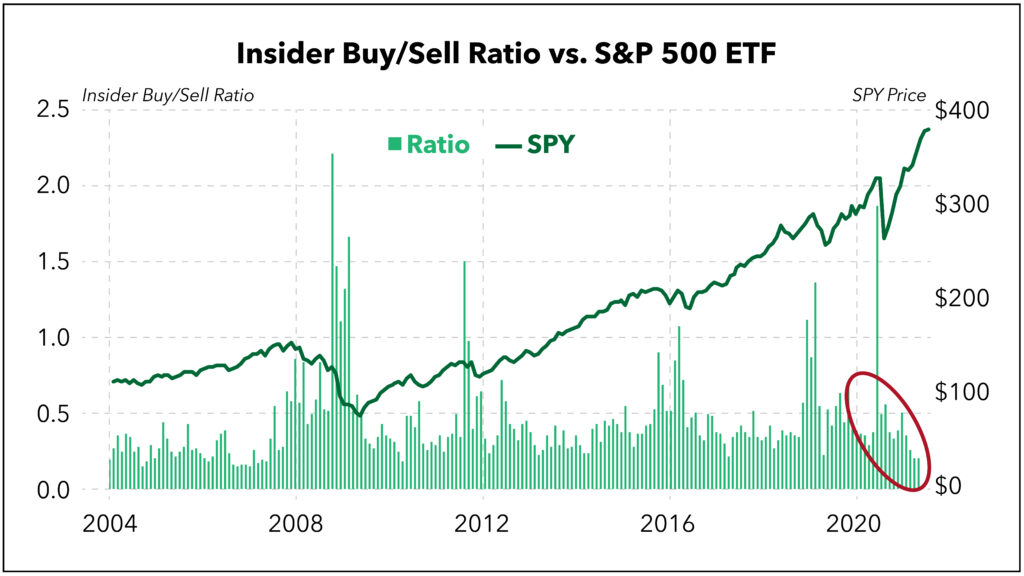

Insiders are relatively good market timers. They don’t always get it right, of course. For example, Kinder Morgan founder Richard Kinder spent millions of dollars buying his company’s stock right before the 2015 energy bust torpedoed it. But, by and large, we see major bursts of insider buying near market bottoms and buying trails off near market tops.

Just for grins, let’s see what the insiders are up to today.

Source: GuruFocus.

Company Insiders Aren’t Buying

The short answer? Not much.

The ratio of insider buys to sells over the past month was a paltry 0.21. That means for every $100 sold by an insider, there was only $21 bought.

While not quite the lowest on record, it’s not far from it. In late 2006 and early 2007, the number dropped to just 0.14. It’s clear that insiders aren’t exactly chomping at the bit to buy company shares right now.

Historically, high insider buying has been a fantastic indication of gains to come. As you can see on the chart, insiders were practically tripping over themselves to snap up shares in late 2008. They went on a buying spree again during the European sovereign debt crisis in 2011 and 2012, during the sideways market of 2015 and 2016, during the near bear market of late 2018 and most recently during the March COVID-19 bear market. In every case, the market went sharply higher shortly thereafter.

The lack of buying does not necessarily mean the market is due for a tumble. There are plenty of stretches where the insider buying was weak even while the market rocketed higher.

But it does suggest that this might not be the best entry point for major new positions. If the people running America’s largest companies aren’t interested in buying their own shares, perhaps there is no real hurry for us to jump in with both feet.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.