How long does it take to move a massive oil tanker, a ship designed to transport huge quantities of oil and gas products?

The short answer: a long time.

Everyone loves to talk about the future of clean energy. Electric vehicles, windfarms and petroleum alternatives dominate public discourse. But, in all of that excitement, we underestimate the amount of time, effort and progress needed to rely 100% on clean energy.

Investors often believe that advancements in clean energy technologies mean the sudden demise of the oil and gas industry. But, like an oil tanker, the movement of the oil and gas sector will be slow and steady. That means there are still plenty of investment opportunities hidden within.

About the Crude Oil and Petroleum Industry

There exists an undeniable global dependence on crude oil and fossil fuels. These products are built into the infrastructure of nations, corporations and methods of transportation. While I believe clean energy is the future, I think it’s going to take a long time to get there.

General Motors’ renewable energy imitative isn’t supposed to reach 100% of its facilities and products until 2040. In its U.S. facilities, its goal is to be 100% renewable by 2030, but that’s still a little less than a decade away.

Oil and gas isn’t going away next year. It’s time to take advantage of this knowledge with my pick this week.

International Seaways Inc. (NYSE: INSW) specializes in transporting crude oil and other petroleum products. Stocks like INSW allow us to gain exposure to the energy sector without buying downtrodden energy stocks.

International Seaways owns 36 vessels that transport crude oil and gas products across the world, and its future is bright.

INSW’s Green Zone Rating

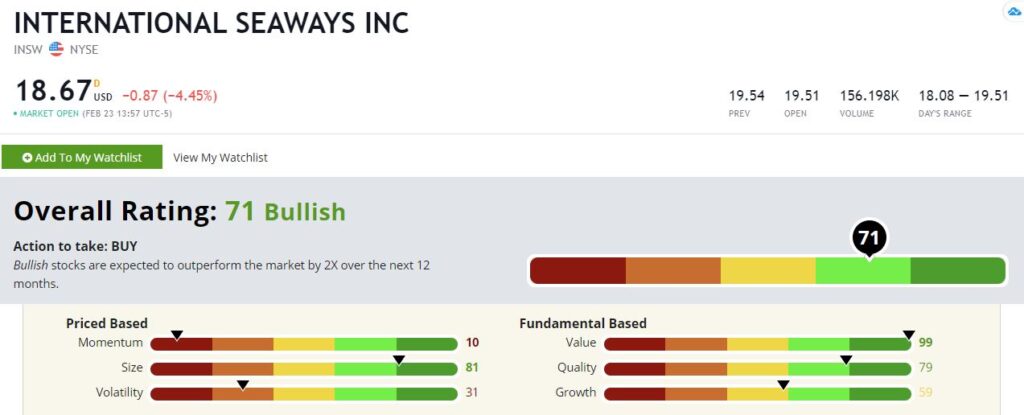

International Seaways stock carries a 71 out of 100 overall Green Zone Rating. That places it firmly in “Bullish” territory in our system, so it is expected to double overall market gains over the next 12 months.

Value — INSW rates a 99 on the value scale, proving its promise in the market. While shares are relatively inexpensive, the company still earns money. Over the past year, it’s seen an operating cash flow of a quarter of a billion dollars and a positive net income.

Quality — INSW rates a 79 on the quality metric. This high score is rooted in the company’s strong presence in the crude oil market. With reliable tankers placed worldwide, the company solidifies itself in the industry for at least the next 20 years.

Size — INSW rates a 81 on size because the company bought nine new ships in 2017. These new ships see about a 25% investment yield and stand to increase the company’s bottom line.

INSW is an overlooked but incredibly valuable stock, and it’s wise to take advantage of it today.

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.