It’s been a rough week for tech stocks. The Nasdaq dipped below its 50-day average for the first time since October, and the S&P 500 saw its longest losing streak in a year.

While investors appear to be taking money off the table, commodity-oriented stocks are holding their own. And commodity stocks like the one I have today are some of the best dividend payers right now.

BHP Group Ltd. (NYSE: BHP) is one of the largest and most diversified miners in the world. It’s a major producer of copper, iron ore, nickel, metallurgical coal (used to make steel), potash (used in fertilizer) and even petroleum.

If it’s used in new construction, there‘s a good chance BHP mines it.

I wrote earlier this year about BHP’s rival Vale S.A. (NYSE: VALE), noting that President Joe Biden’s plan to “Build Back Better” meant that we could expect a massive wave of infrastructure spending in the United States. But the story goes far beyond U.S. borders. Every country in the world is dealing with the fallout of the COVID-19 pandemic, and it will likely be years before most countries claw back to pre-COVID-19 levels of output and employment.

Well, infrastructure spending generates jobs and output. It was a big part of President Franklin Delano Roosevelt’s New Deal in the Great Depression, and it will almost certainly be a big part of whatever comes next for virtually every country on the map.

BHP stock exposes our portfolios to these trends while also collecting an attractive 4% dividend. Note that BHP pays its dividend semiannually rather than quarterly and that its dividend tends to fluctuate based on commodity prices. The company pays out about 50% of its profits, so rising commodity prices mean higher payouts.

Let’s see how BHP stacks up using our Green Zone Ratings model.

BHP Group’s Green Zone Rating

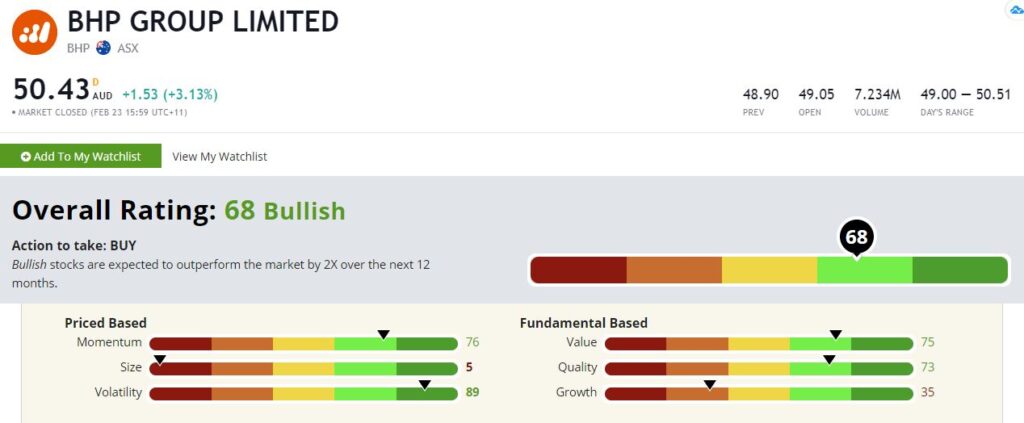

The company sports an overall rating of 68 out of 100, putting it in “Bullish” territory on our scale. Stocks with ratings of 60 or higher are Bullish, and Adam O’Dell’s research has shown that Bullish stocks have historically enjoyed returns that are about twice as high as the S&P 500’s over the following 12 months.

BHP Group’s Green Zone Rating on February 23, 2021.

Let’s dig deeper.

Volatility — Commodity prices are known for volatility. Yet BHP’s shares are remarkably steady. The stock rates at an 89, meaning it is less volatile than all but 11% of the stocks in our universe. That’s noteworthy because, after the run, the broader market has enjoyed, it isn’t hard to imagine higher market volatility ahead.

Momentum — BHP also rates well on momentum at 76. Commodity prices have been rising lately, as I’m clearly not the only person who sees new construction as a trend for the coming years. Rising stock prices tend to beget more rising stock prices, and investors follow what‘s working at that moment.

Value — It’s not super common for a high momentum stock to also rate well on value. But BHP certainly does, sporting a value rating of 75. After years of being mostly ignored by investors, commodity stocks are cheap.

Quality — BHP also rates well in quality with a score of 73. Quality matters in the rough and tumble world of raw materials. Mining projects require enormous capital outlays, and the price of the underlying products can be wildly volatile. A strong balance sheet helps companies survive and thrive during the ups and downs of the commodity cycle.

Growth — BHP doesn’t score super high on growth, coming in at 35. But remember, our metrics are backward-looking, and this has been a difficult decade for commodities companies. So, BHP’s relatively low score here should be taken in context.

Size — BHP is a large company with a market cap of nearly $200 billion. Not surprisingly, it rates low here, with a size score of just 5.

Bottom Line: BHP is definitely a little more aggressive as a dividend play than some of the other stocks I’ve highlighted here. I’m good with that. In BHP, we get a competitive 4% yield with the possibility of strong capital gains if commodity prices continue to trend higher.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.