When people talk about a “new normal,” they mean it. The COVID-19 pandemic has changed the world forever, and that includes the way that we shop. Once you get used to buying online, you don’t go back to the store. Hence, Amazon.

But, today, I want to look beyond those obvious names and turn to the people who are supporting the online monoliths we rely on for our doorstep shopping experience.

I make 90% of my purchases online.

From phone chargers to baby clothes, each purchase is different and convenient, yet the cardboard packaging remains the same. I want to talk about these boring old cardboard boxes today.

As my stock pick of the week for The Bull & The Bear podcast, I chose International Paper Co. (NYSE: IP). I wrote about this stock earlier this year, but I want to come back to it because I believe in its strength and promise. I think we’re going to see a huge reevaluation of this stock on Wall Street.

Not to mention IP stock comes with a healthy dividend that currently yields 4.1%, so it’s a great pick for any income portfolio.

I want to clarify: International Paper Co. is not your “run of the mill” copy paper manufacturer. The bulk of its products are shipping materials and — you guessed it — cardboard boxes.

The best part about International Paper Co. is its future. The company just announced in December that it’s going to spin-off the packaging section of its business. It refuses to let the dying paper industry weigh it down. Put simply, the most profitable part of this business is going to expand.

Where International Paper Co. (NYSE: IP) Stock Gets Fun

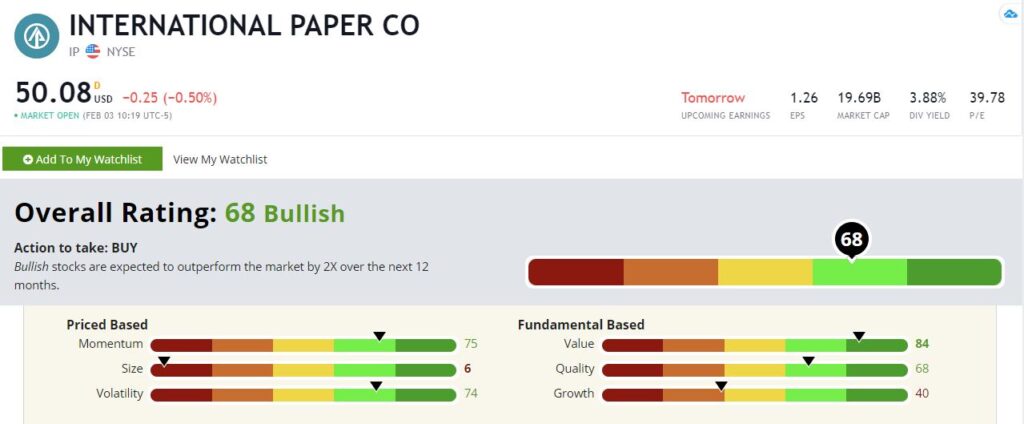

International Paper’s overall score of 68 puts IP stock in “Bullish” territory of our system. Bullish stocks (rated 61-80) are expected to enjoy returns of around double the S&P 500’s return over the following 12 months, based on our research.

International Paper Co.’s Green Zone Rating on February 3, 2021.

Let’s dig a little deeper to see what is driving that score.

Value — IP stock rates highest on value, scoring an 84. This means that the stock is cheaper than all but 16% of the stocks in our universe, and that isn’t a surprise. The raging bull market of recent years has focused on tech and growth names. Old economy stocks like International Paper aren’t in high demand. But with a juicy 4.1% dividend, I don’t expect IP to stay unloved for long.

Momentum — And in fact, it seems that investors are already flocking to the stock. IP scores a very respectable 75 based on momentum. The stock has been trending higher since March 2020 and shows little sign of slowing down.

Quality — We focus primarily on debt management and profitability in our quality metric. IP stock scores well here at 68. And following the spin-off of its paper division, I believe the quality score will move higher as the company shed’s slower-growing product lines.

Volatility — Low-volatility stocks tend to outperform high-volatility stocks over time. So, a higher score on this metric means that the stock is less volatile. International Paper’s volatility rating has actually increased seven points to 74 since I last wrote about it; it’s even less prone to bring price swings now.

Growth — If IP has a weakness, it would be growth. The stock rates at a 40 here, putting it in the bottom half of stocks we rate. But IP’s growth prospects should improve once it sells its paper division.

Size — IP loses points on size, scoring just a 6. All else equal, smaller stocks tend to outperform larger ones. And given that International Paper is a $20 billion company, we won’t see a small-cap bounce here.

Bottom line: With International Paper stock, you have a solid dividend payer in the process of streamlining its business to focus on the most profitable lines. It also happens to be on the right side of one of the greatest trends of our

And that reminds me … I still need to go and pick up a few Amazon boxes off my porch.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.