As the stock market pulls back, economists ask if price action is a warning of a recession. It’s possible, given the Federal Reserve’s expected policy shift. The Fed has almost always caused a recession when raising rates.

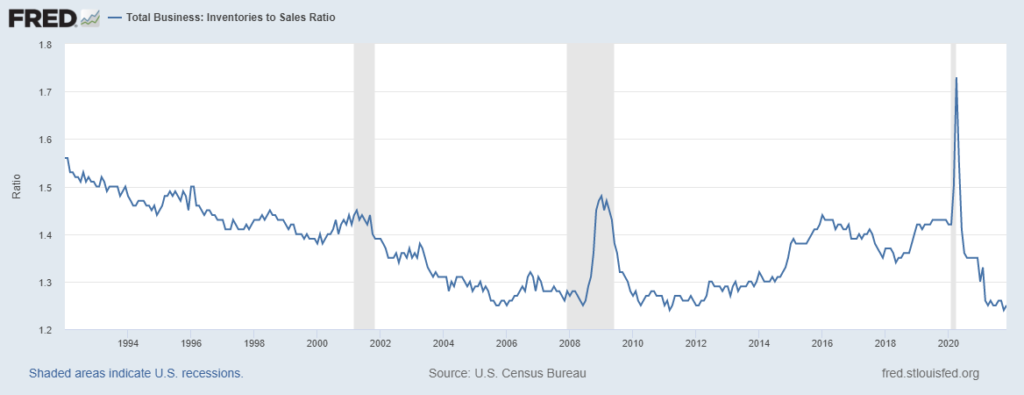

One bullish economic indicator is the inventory-to-sales ratio. Right now, it stands at 1.25, significantly lower than its pre-pandemic level of about 1.4.

Inventory-to-Sales Ratio

Source: Federal Reserve.

This ratio is significant in the current economy. A low ratio means shoppers find empty shelves in parts of their favorite stores. Low inventory also means lost profits for retailers.

Increased Inventory Demand Is Bullish

Manufacturers maintain inventory: Their low inventories are the underlying cause of the empty store shelves.

Supply chain disruptions explain low inventory levels. When the economy shut down, orders were canceled and deliveries were delayed. It takes time to recover from that.

Now, stores, manufacturers and other businesses will consider increasing their inventory in the future.

The inventory-to-sales ratio has generally been in a downtrend since data became available in the 1990s. This makes sense from a business perspective. Inventories are expensive to maintain, and new technologies allowed businesses to manage inventory more aggressively.

The pandemic unleashed a desire for self-sufficiency. For some businesses, that meant bringing production in-house and increasing inventory demands.

Inventories across the country total an estimated $2.2 trillion. Increasing inventory levels by 10% across all industries would increase GDP by almost 1%.

It will take time to rebuild — and then, to expand — inventory levels. Some businesses will have to expand. With expansion comes an increased demand for storage space. Investors can look to this trend to support the economy and the stock market into 2023. The biggest beneficiaries could be trucking companies and warehouse REITs, which will move and store all those supplies.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters