Markets tend to move ahead of global events.

There’s no explanation for how this happens.

It can’t be insider trading because many of the events are unpredictable.

In hindsight, we understand the market’s warnings.

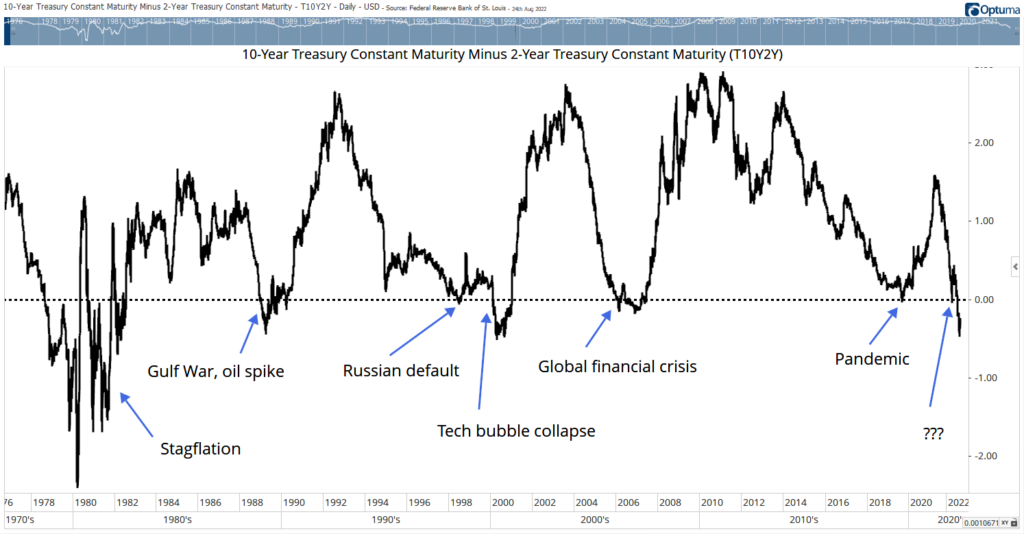

A reliable indicator of an upcoming global crisis is the spread between 10-year and 2-year Treasury notes.

Inverted Yield Curve and the 10/2 Spread

The spread between notes is the difference between their yields.

In this case, the 2-year yield gets subtracted from the 10-year.

The 10-year’s yield should be higher than the 2-year’s.

That’s because inflation will erode the buying power of the note’s principal for an additional eight years.

There’s also more risk over 10 years than two.

Sometimes the yield on the 10-year dips below the yield on the 2-year.

When this happens, the spread is negative.

Analysts call this an inverted yield curve, since the yield curve is the difference between various interest rates.

The chart below shows that the 10/2 spread has inverted.

It also highlights previous times this happened.

Inverted Yield Curves of the Past

To say bad news followed previous inversions is an understatement.

What the Curve Predicted in History

Catastrophes have followed inverted yield curves many times in the past.

These inversions all happened before traders understood what was happening.

The 10/2 inverted in September 2019, five months before talk of a pandemic dominated the headlines.

The indicator warned of trouble one year before the bear market in stocks associated with the global financial crisis of the mid-2000s.

Now, we know there are potential black swans on the horizon.

The war in Ukraine is unpredictable.

Events in the Taiwan Strait could lead to an accidental crisis or a deliberate provocation.

Europe faces a long, cold winter with limited fuel supplies.

Refugee crises threaten the southern borders of Europe and the U.S.

Bottom line: Those are known hot spots.

Countless unknowns are lurking.

The 10/2 spread tells us one may turn into a headline soon.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.