Data continues to suggest we aren’t in a recession.

This may be difficult for many to believe.

A recent survey by The Conference Board showed that 41% of respondents think we are already in one.

Even those who don’t believe we’re there yet are worried — 33% of respondents believe we will be in a recession within six months.

The latter group may be correct. Here’s why.

Real Income Data Raises Recession Fears

Last week government economists released data on real personal income, excluding current transfer receipts.

Real income is adjusted for inflation.

By excluding government transfer payments like unemployment insurance, we see the strength of the private sector in the economy.

In July, that measure reached a new all-time high.

This raises recession fears.

While that’s not definitive, it is one of the primary metrics economists use to determine if we are in a recession.

Most data agrees with real income that we are not in one — right now.

But some private sector data indicates we are heading for one.

Private Sector Data Looks Gloomy

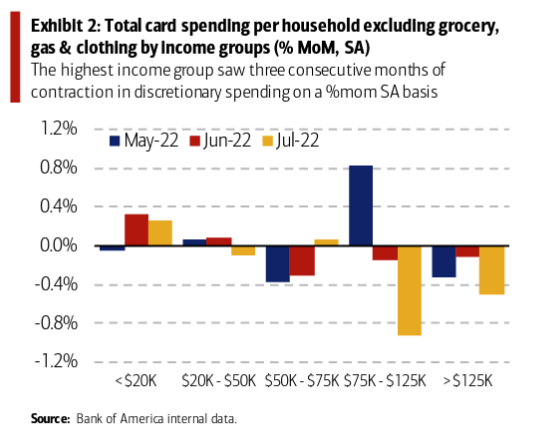

High-income consumers have cut back on their spending.

Source: Bank of America.

Bank of America reported consumers with annual household income greater than $125,000 reduced spending for three consecutive months compared to a year ago.

This data shows total credit and debit card spending per household.

Banks can obtain this information because they provide the tools for spending.

The data excludes spending on groceries, gas and clothing — the Census Bureau defines these as necessary spending.

Spending on these categories is less sensitive to changes in consumers’ financial situations.

On the other side of the spectrum, the increase in spending by lower-income households show they are spending more on necessities and may go into debt to support other needs.

Bottom line: High-income household spending is a key driver of economic growth.

If these families aren’t spending, recession chances are high.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.