It’s official.

A dreaded recession signal flashed across our screen, when the 10-year Treasury yield dipped ever so slightly lower than the 2-year yield.

This is known as an “inverted yield curve.” The bond market is pricing in trouble ahead, which is manifested by higher bond prices and lower yields.

Now, I would take any information coming out of the bond market with a major grain of salt.

After two years of extraordinary COVID-related stimulus, the bond market is too distorted to give definitive signals. All the same, it’s ominous when the Federal Reserve stops buying bonds, as it did last month.

Yet long-term bond prices continue rising. Given that inflation is at 40-year highs, the labor market is overheating and the Fed is now in tightening mode, recession can’t be ruled out.

I suppose we’ll find out soon enough.

In the meantime, we have portfolios to run. And if a recession is in the cards, few stocks are better equipped to ride one out than triple-net retail REIT National Retail Properties Inc. (NYSE: NNN).

Why National Retail Is a Top REIT

National Retail is a landlord that owns a sprawling portfolio of over 3,000 properties spread across 48 states. Its portfolio is concentrated in high-traffic, mostly Amazon-proof retail properties such as convenience stores, gas stations and pharmacies.

National Retail could be the most boring stock on the entire New York Stock Exchange. It’s a two-horse race alongside Realty Income Corp. (NYSE: O).

But that’s my point.

If a recession is just down the road, boring is beautiful. And at current prices, National Retail’s 4.6% dividend yield almost doubles the 10-year Treasury yield!

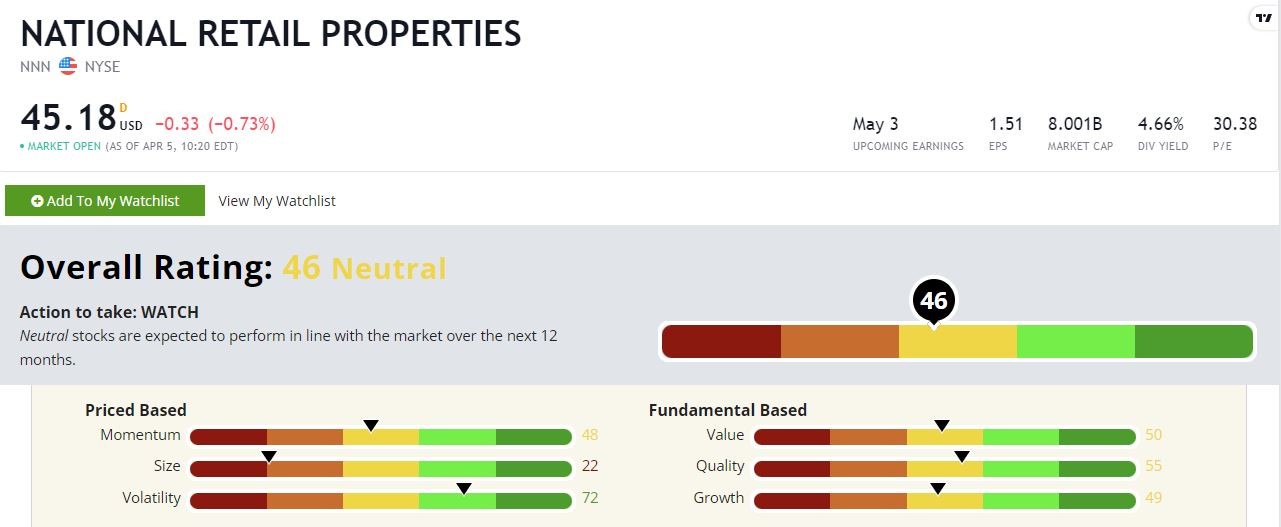

National Retail’s Power Stock Rating

National Retail doesn’t rate particularly well on our Power Stock Ratings system. It’s in the middle of the pack with a composite rating of 46.

But again, we’re looking for recession protection. That’s where this REIT shines. Let’s take a look.

Volatility — National Retail scores highest on our volatility factor with a rating of 72. The higher the rating here, the lower the volatility… And its volatility has been higher than normal over the past two years as its tenants dealt with COVID restrictions.

If a recession is on the way, holding a few low-volatility stalwarts like NNN makes sense.

Quality — REITs get bashed on our quality score because profitability and balance sheet strength are the primary drivers of our metric. REITs tend to have depressed GAAP earnings (the common set of standards used by companies and their accounting departments) and high debt levels. Despite this, National Retail rates a respectable 55. It rates in the top half of all stocks based on quality despite carrying the REIT handicap!

For comparison, STORE Capital Corp. (NYSE: STOR), another triple-net retail REIT that I talked about in a recent Investing With Charles video scores a 51 on our quality score.

Value — National Retail rates in the middle of the pack based on value as well at 50. As with quality, REITs lose points on value because typical earnings-based metrics like the price-to-earnings ratio can make the stock look more expensive than it is. But that doesn’t tell the whole story. If NNN’s real competition is bonds, its 4.6% yield is mouth-wateringly cheap.

Growth — This low-drama REIT‘s growth is also in line with the market average with a value factor rating of 49. Remember, the company owns convenience stores and gas stations. It’s not trying to be a high-growth dynamo. It’s supposed to be an uncomplicated dividend workhorse, and it delivers on that count. Rating in the middle of the pack on growth is impressive when you think about the core of its business.

Momentum — Rising bond yields earlier this year took some of the wind out of National Retail’s sails. This stock tends to rise in value when bond prices are rising (and bond yields are falling). Still, it managed to maintain a momentum rating of 48. And if the economy goes south, you can expect that number to rise.

Size —National Retail isn’t small by REIT standards. It sports a market cap (outstanding shares times the current share price) of $8 billion and a size factor rating of 22.

Bottom line: National Retail looks like an average stock on paper. But it rates highly where we need it to in order to provide value as a recession hedge. And it pays a competitive yield to boot.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.