The financial press loves acronyms. FOMO (fear of missing out) is one you see a lot. TINA (there is no alternative) is another one that’s been around for a while.

And there are the FAANGs (Facebook, Apple, Amazon, Netflix and Google). Or the less common FAAMGs, which swaps out Microsoft for Netflix.

One of my all-time favorites is still ABUSE (anything but U.S. equities!) This was common in the mid-2000s, around the same time the BRIC (Brazil, Russia, India and China) exchange-traded funds were a popular investment.

The idea of ABUSE was that investors were eager to invest. They just weren’t keen on U.S. stocks.

With stock prices where they are today, I’m starting to feel the ABUSE. I still plow as much as possible into my 401(k) plan and have a core of long-term buy-and-hold stock positions.

But my exposure to stocks is the lowest it’s been in years. I’m keeping a little more cash on hand than usual. And I’m putting a lot more of my nest egg into alternatives.

With all of that said, let’s take a look at the portfolio of a notorious ABUSEr, Harvard University.

How Harvard Invests With ABUSE

Harvard’s gargantuan $40 billion endowment fund is famous for keeping most of its assets outside of the stock market.

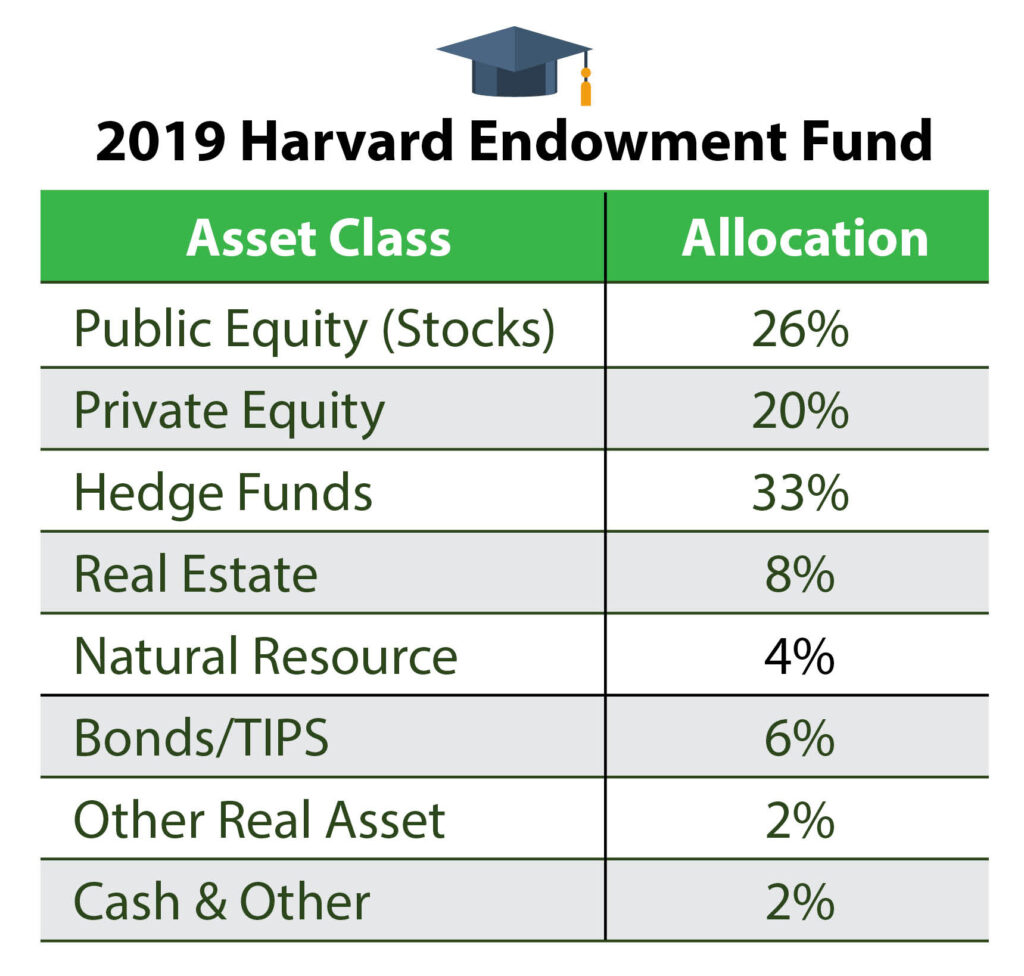

The endowment will publish its annual report soon (its fiscal year ended June 30), so the asset allocation I have is from 2019. It’s possible the portfolio is a little different today, but this should get us close.

Two things jump off the page:

- To start, the endowment has almost nothing in bonds. Traditional bonds and Treasury inflation-protected securities (TIPS) make up just 6% of the total. That’s exceptionally low for an institutional investor like Harvard.

- Stocks make up just 26% of the portfolio.

Private equity and hedge funds make up a combined 53%. These private vehicles are unavailable to ordinary investors. And real estate and natural resources comprise 8% and 4%, respectively.

Create Your Own ABUSE Portfolio

Now, you shouldn’t run out and try to copy what Harvard is doing. Unless you’re a multimillionaire, it’s not possible. Ordinary investors don’t have access to hedge funds, for example.

But you could get close.

Rather than invest in a hedge fund, you could dedicate that portion of your portfolio to active trading strategies, such as those Money & Markets Chief Investment Strategist Adam O’Dell covers in his Cycle 9 Alert.

Rather than buying into a private equity fund, you could buy shares of Blackstone (NYSE: BX), KKR (NYSE: KKR) or any of the other publicly-traded managers of private equity funds.

Real estate is easy enough. Virtually anyone can buy a rental property or two. And with mortgage rates where they are today, it’s never been cheaper to finance.

And you can get broad exposure to natural resources with commodity funds such as the Invesco Optimum Yield Diversified Commodity Strategy ETF (NYSE: PDBC) or the SPDR Gold Shares (NYSE: GLD).

If you’re getting uneasy with U.S. stock valuations, Harvard has proven that having a little ABUSE in your portfolio is a viable long-term strategy.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.