Investing in the cannabis sector can be a risky prospect, and if you are looking for reliable market gains — look elsewhere. But if you do your homework you can find major opportunities, positioning yourself well for the future.

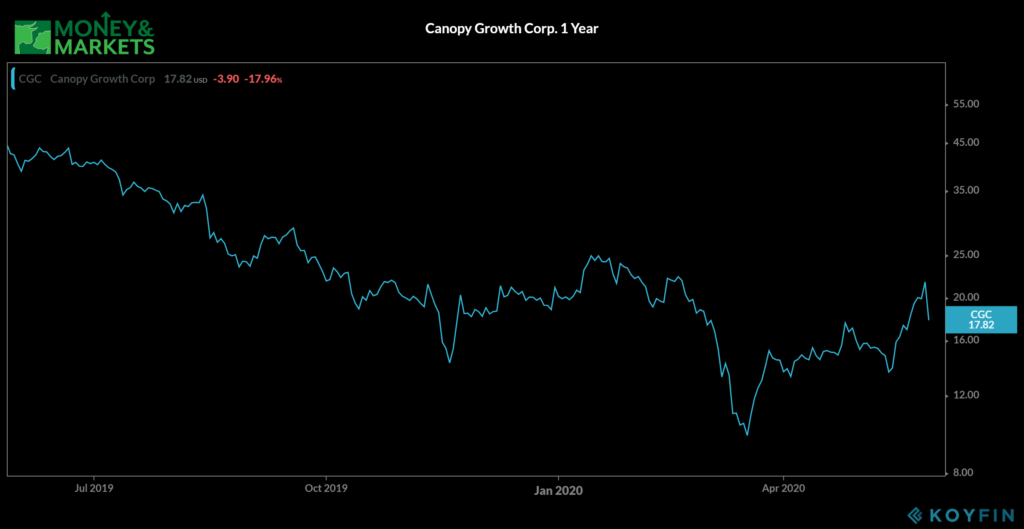

Canadian producer and former cannabis sector darling Canopy Growth Corp. (NYSE: CGC) was the latest victim of a massive sell-off Friday after reporting a 13% fall in revenue in its fiscal fourth quarter to CA$107.9 million. It also posted CA$3.72 losses per share and CA$1.3 billion net losses, while analysts were expecting only CA$0.59 losses per share in Q4, according to The Motley Fool.

During the company’s earnings call, Canopy also alluded to a lack of demand in the last quarter as consumers dealt with the coronavirus lockdown. Recreational sales of cannabis products like softgels, oils and “Cannabis 2.0 products” (edibles and ingestibles that were legalized late last year in Canada) were down 31%.

The news sent shares of Canopy crashing down Friday morning following a big Thursday melt-up. The stock lost over 21% at one point, and was trading down around 19.6% by 3:30 p.m. on the East Coast.

It was the latest blow to the cannabis industry that still has a lot of challenges ahead as more U.S. states and the federal government inch closer and closer to legalization. But does that mean you shouldn’t be investing in the cannabis sector?

Investing in the Cannabis Sector

Banyan Hill Publishing commodities expert Matt Badiali says it is fine to invest in this burgeoning industry, but he stressed in Prosperity Research’s latest Marijuana Market Update podcast that anyone investing “needs to do their homework.”

“Gut feeling? Hope? They’re not good strategies when your in a sector as risky, and as roiled as this one is,” Badiali said.

So what about Canopy Growth? Badiali argues that Canopy’s stock tanking Friday presents the perfect time to get in on the company’s future growth, which is still bright.

“I see the fall in Canopy’s shares as a buying opportunity,” said Badiali, Editor of “We knew the quarter would be poor, due to lock-ins and store closures during the pandemic. The management’s decision to move toward profitability over volume is welcome news.”

Badiali points to a particular shift in the company’s focus as a major positive, per Canopy Growth management on the earnings call:

Canopy Growth will focus on … markets and product categories with the highest and most tangible profit opportunities in the near term. Core markets will be Canada, U.S. and Germany with focus on recreational and medical.

And Badiali is bullish on where the stock is heading in the future.

“I am a firm believer that Canopy will be twice its current price within 12 to 18 months, as the restrictions ease,” he said.

The cannabis sector has faced a lot of headwinds as more states consider legalization, but some legislation on a different front could soon be a boon for the industry as a whole.

The House of Representatives passed another $3 trillion coronavirus stimulus package earlier this month that included a provision for the Secure and Fair Enforcement (SAFE) Banking Act.

If the bill passes, it would provide protections for banks offering services to marijuana businesses in legal states, which has been a major holdup for producers and retailers since legalization started in the U.S.

Of course, the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act likely won’t pass muster on the Senate floor in its current form as some legislators worry the government has already spent too much in the coronavirus fight. But the SAFE Banking Act has now passed the House twice (once in May and by a wide margin back in September 2019), which is a good sign.

Investing in the cannabis sector can be a lucrative venture over the long haul, but doing your homework and knowing what headwinds the industry faces will give you a leg up.

Canopy Growth has been a beacon of strength in the industry as well, and a sell-off like Friday’s provides a nice buying opportunity for long-term investors.

Editor’s note: Be sure to check out Matt Badiali’s weekly Marijuana Markets Update on the Prosperity Research YouTube channel here. Subscribe to the channel to get the latest updates on the cannabis sector and more.