During last weekend’s Total Wealth Symposium in Orlando, one attendee raised his hand to ask a simple question during the first panel discussion…

He explained that he’d sold a lot of his stocks ahead of the bear market in 2022. Now, he was tired of “waiting on the sidelines,” but he was worried he might buy the wrong stocks.

He’s not alone, either.

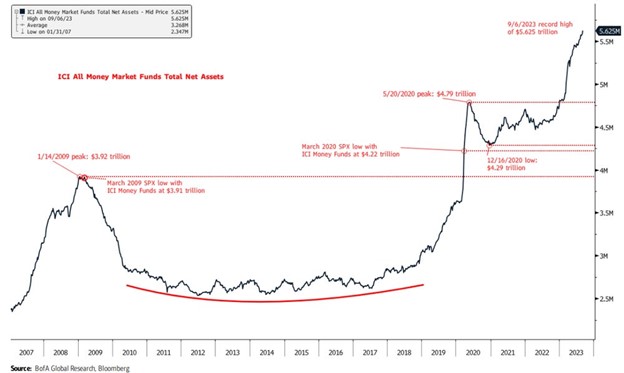

According to Bank of America, investors were keeping a record $6 trillion in cash on the sidelines at the end of 2023.

Record Amount of Investor Cash “Sitting on the Sidelines”

This shouldn’t come as too much of a surprise. After all, 2022 was the worst year on record for Wall Street’s gold-standard 60-40 portfolio.

But when it comes to growing your wealth, time in the market is important. And if you’re just sitting in cash month after month, inflation is slowly eating away at your hard-earned savings.

So the first step is just committing to getting out there and investing — making your hard-earned money work for you.

Once you’ve done that, the rest is easy. All we have to do is find a handful of great stocks that can beat the market.

That’s where Green Zone Power Ratings come in…

Green Zone Stocks Soar Through Bull and Bear Markets

Many of the investors keeping cash on the sidelines right now are worried about a potential repeat of 2022.

They’re afraid that rates might rise once again, which will send their stocks crashing.

But when you buy the right stocks, you can make money in bull markets, sideways markets and even bear markets.

Take, for example, a company called Celsius Holdings Inc. (Nasdaq: CELH) that hit our Green Zone Power Ratings watchlist in July 2020.

This weekly watchlist that I send around to Green Zone Fortunes and Max Profit Alert subscribers scours a universe of over 2,300 securities to highlight the 10 highest-rated stocks according to our proprietary system. These are some of the market’s most promising investments by our measure.

When Celsius first made the watchlist, it was a complete unknown for most investors…

The company produces sugar-free energy drinks targeted at fitness-minded consumers. The drinks are preservative-free, packed with vitamins and contain nearly twice as much caffeine as a can of Red Bull.

By 2020, Celsius had developed a loyal following among consumers (including some of the folks in my office). Yet many investors still had their reservations.

After all, Celsius was trading at $13.38 per share on the day it hit our watchlist that July. That was up from $4.28 at the beginning of the year — so shares had already more than tripled.

And the company’s market cap had also doubled the year before.

If you’re supposed to “buy low and sell high,” then wasn’t it already too late for Celsius?

Not even close…

Celsius Soars 1,144% After Making the Green Zone Watchlist

Since it first made our watchlist, Celsius has soared from $13.38 per share to over $166 before a 3-to-1 split in November 2023. That’s a massive 1,100% gain in just over three years!

I wrote about the company here in Money & Markets Power Daily in October of that year. If you’d bought shares after I published that article, then you’d be up over 650% today.

Our whole team has put my Green Zone Power Ratings system through the wringer over the years. Whether it’s Matt Clark breaking down high-rated stocks, Chad Stone showing you how easy it is to look up stocks on your own, or Mike Carr using the system to create new strategies (more on that below) … we’re always working to show you what my ratings system can do for your portfolio.

Use Systems to Maximize Returns

Ratings systems vary in functionality.

But they’re all meant to help you do one thing: Buy good assets and avoid bad ones.

Based on decades of backtesting and research, we developed our Green Zone Power Ratings system to run on six key factors.

Three are technical (aka they are related to a stock’s price and trading activity):

- Momentum — Strongly uptrending stocks earn higher momentum ratings. We prefer to buy stocks that are already trending higher and at a faster rate than the overall market. This approach can increase our odds of success and decrease risk.

- Size — Smaller companies earn higher size ratings. We prefer to buy smaller companies for the extra “juice” that typically comes with them.

- Volatility — Less volatile stocks earn higher volatility ratings. We prefer low-volatility stocks because they’re proven to generate superior risk-adjusted returns over the long run — with less heartburn.

The other three factors are fundamental. These analyze the strength of the underlying company, including its balance sheet, profit margins and cash flows, as well as its growth trajectory:

- Value — Less expensive (aka “cheap”) stocks earn higher value ratings. We prefer to buy great companies at good prices because the price we pay changes how much we get from future returns. Overpaying for a stock is a costly mistake.

- Quality — High-quality companies earn higher quality ratings. We prefer to buy high-quality companies, of course! To determine quality, the model considers a company’s returns, profit margins, cash flows, debt ratios and operational efficiency, among other things.

- Growth — High-growth companies earn higher growth ratings. All things equal, we prefer to buy companies that are growing both revenues and earnings at faster rates than the market and economy.

We then combine our findings from both technical and fundamental analysis to provide an overall rating from 0 to 100. This score gives us a remarkably balanced view of the strength of the company, the behavior of its stock, and, thus, the likely returns ahead for investors.

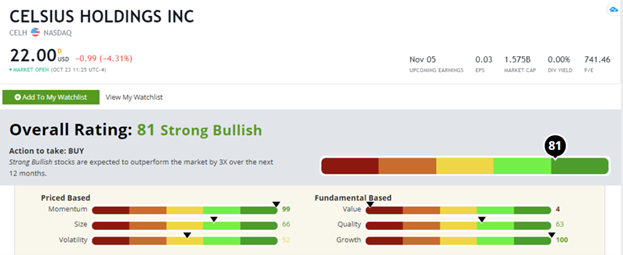

Here’s what Celsius’ rating looked like when I wrote about it in 2020 before soaring for 650% gains:

CELH’s Green Zone Power Ratings in July 2020.

As you can see, its fundamentals weren’t the best (with a Value rating of just 4 out of 100 … it was “expensive”). But with a Momentum rating of 99 and Growth at 100, we were still “Strong Bullish” on the stock, expecting it to crush the market by 3X from there. It’s safe to say CELH did just that!

The Secret to “Worry-Free” Investing

By incorporating factors like Momentum, the Green Zone Power Ratings system helps to filter out the kinds of “behavioral aspects” that consistently cost investors a fortune.

These behaviors include Anchoring, Herding, and Loss Aversion (see the graphic below for the complete list), and they’re hardwired into the human psyche. They’re fundamental to the way we see the world and make decisions. We’re all guilty of falling into these traps from time to time.

These same behaviors can ultimately lead to the mispricing of stocks across the market.

Individual stocks can become dramatically underpriced or overpriced for extended periods of time before snapping back to reality.

But when we put our biases aside and look at the market through a holistic, data-driven system like Green Zone Power Ratings, the opportunities become apparent.

I mentioned it above, but our Chief Market Technician, Mike Carr, has unlocked a new way to use my system. That’s why I wanted to get back to basics today…

By knowing how each piece of this simple system works, you’re going to have a leg up. And I think it’s safe to say Mike has created his own advantage within my own system.

He’s been on fire with his recommendations since launching Apex Alert in October 2023. He’s locked in three positive stock trades after holding for a maximum of 37 days — and his two open positions are also trading in the green.

If you want to see how Mike does it, click here.

To good profits,

Adam O’Dell

Chief Investment Strategist