Here at Money & Markets, we’re skeptical of the circulating idea that the AI boom is already “dead.”

There’s still a lot of money being thrown into AI infrastructure – as in hundreds and hundreds of billions of dollars – and we’re still in the early stages of implementation. We’ve barely scratched the surface of what AI can do… and how it will transform the economy.

But it does appear that investors are looking past the so-called “Mag 7” trade and rotating into pockets of the market that have been mostly neglected this year, such as materials and industrials.

This makes sense…

The Mag 7 collectively make up more than 34% of the S&P 500, meaning that virtually every investor the world over (or at least anyone holding an S&P 500 index fund or ETF) already has massive outsized exposure to them. At the risk of sounding cliché, “everyone” is already in the stocks. There’s no new money sitting on the sidelines to buy them.

Meanwhile, Wall Street has been growing uneasy with the bubbly valuations in tech and with the gargantuan sums of money they’ve pledged to spend on AI infrastructure… with no guarantee of return on that investment.

Nowhere is this sentiment clearer than in the performance of leading enterprise software firm Oracle (ORCL). While not a member of the Mag 7, Oracle became the new “it” stock back in September when it announced it was partnering with ChatGPT creator OpenAI. The shares exploded higher by 40%… an absolutely massive move when you consider the stock’s market cap was over $650 billion before that leap higher.

Only now, the stock has given back all of those gains and more over the past three months. Investors see a lot of risk in the company’s AI investments, funded by debt, including a likely $38 billion debt package (still being negotiated) that will be one of the largest AI-linked debt financings ever.

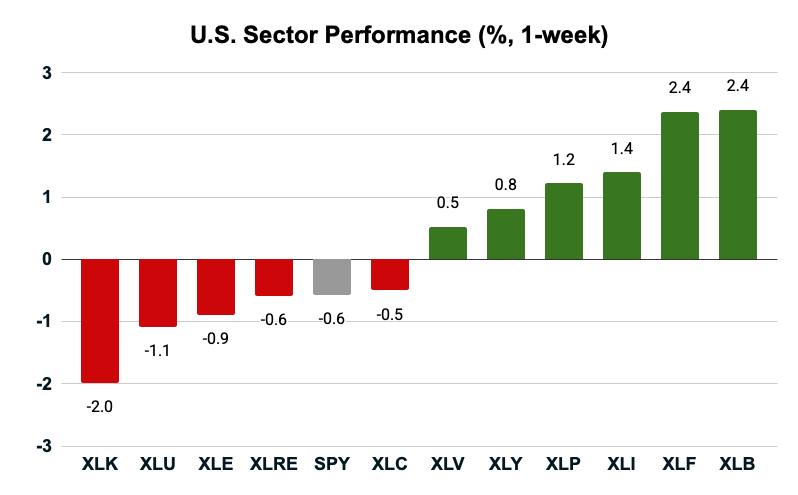

With that as the general sentiment backdropping the tech sector right now, consider that the State Street Technology Select Sector ETF (XLK) was the worst-performing sector ETF last week, down 2%.

Meanwhile, the State Street Materials Select Sector ETF (XLB) was up a very strong 2.4%, ever so slightly beating the State Street Financial Select Sector ETF (XLF).

Investors are clearly still bullish and looking to take risks… they’re just not seeing the value in tech.

Key Insights:

- Investors are hungry for risk and rotating into cyclical sectors.

- Materials were the strongest performer.

- Investors have grown skeptical of the tech trade.

Materials Pushing Higher

I mentioned that materials stocks have been mostly neglected this year. Well, it hasn’t been neglected by everyone. I’m proud to say that the sector has been regularly popping up on my Green Zone Power Ratings system for months now … and that I’ve been profitably trading the sector for most of 2025.

I recommended a speculative gold miner back in April in Green Zone Fortunes, and we’re already up 83%. I followed that up in late August with a second gold miner, and we’re up about 16%. If you’d like to know more about Green Zone Fortunes and how you can get access to my recommendations and my ratings system, just click here.

And it wasn’t just Green Zone Fortunes… I’ve been actively trading mining stocks in my premium Infinite Momentum service as well. I’ve profitably closed 10 out of 11 mining positions this year. And I have two open positions currently, up 113% and 16%.

So, what’s looking good in the sector today?

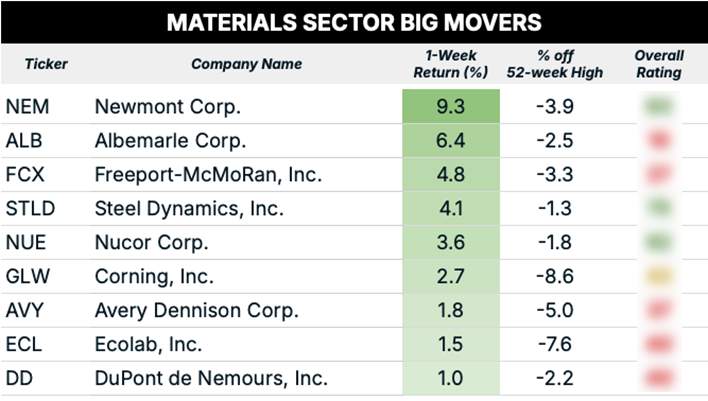

I screened for the biggest winners of the week that are now trading within 10% of their 52-week highs. We’re looking for strong stocks in a strong sector that are trending higher.

Goldminer Newmont Corp (NEM) made the top of the list, up 9.3% last week. And while I can’t give you precise details out of respect to my paid subscribers, I can tell you Newmont is a stock we’ve already made handsome profits on this year. Newmont rates a “Strong Bullish” on my Green Zone Power Ratings System, so I expect its winning streak to continue.

Outside of the mining space, steelmakers Steel Dynamics (STLD) and Nucor Corp (NEU) also boast “Bullish” ratings.

Value in Tech?

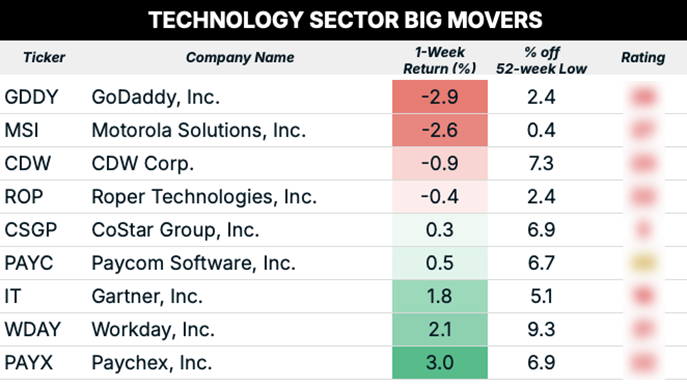

I screened the tech sector for the biggest losers of the week that were within 10% of their 52-week lows. The idea is to find beaten-down stocks that have bottomed out and may be poised to rally.

Well, an interesting byproduct of tech’s strong performance this year is that some of the tech stocks that really got beaten up last week are still well above their 52-week lows. Returning to Oracle as an example, the stock was down 13% last week, yet it’s still over 50% above its 52-week low.

Of the stocks that are within 10% of their 52-week lows, none look investable based on my Green Zone Power Ratings system. One of the nine rated as “Neutral” while the rest were “Bearish.”

The takeaway here is clear. It’s still far too early to go “bottom fishing” in tech.

There are exceptions, of course, and there are certainly “Bullish” rated tech stocks. But we need to be hyper-selective and stick to the best in class.

The team and I are currently putting together a workshop on just how to do that in 2026 … you’ll get an invite as soon as it’s officially inked on our calendar.

For now, all I can say is that I’m pretty sure a set-it-and-forget-it approach to investing in the technology sector is going to lead to a world of hurt in 2026. I’m convinced many folks are lazily sliding into what I believe will be an “obliteration” of the Mag 7 group this coming year … and I’m hell-bent on giving you the information you need to not sleepwalk into that landmine.

Of course, my workshop will end with 100%-actionable steps for you to take to position yourself to beat the market and the Mag 7 in 2026 … just as my simple 12-trading-day system did this year.

More on all this soon … stay tuned!

To good profits,

Adam O’Dell

Editor, What My System Says Today