Sentiment indicators measure how investors feel about stocks. They are important because investors, as a group, often have the wrong feeling about the stock market. They become greedy as a bull market is nearing an end … or become fearful as a bull market is beginning.

One of the most useful sentiment indicators is a survey conducted by the American Association of Individual Investors (AAII).

Every week since 1987, AAII asks investors just one question — are you bullish, bearish or neutral about the next six months? The results provide useful insights into the current market environment.

Over the long run, investors tend to be more bullish than bearish. Thirty-eight percent of individuals are bullish in a typical week, while less than 31% are bearish. Almost a third are neutral.

Over the past month, we’ve seen a swing to a bearish extreme. The April 13 reading showed just 15.8% bulls. Bears stood at 48.4%.

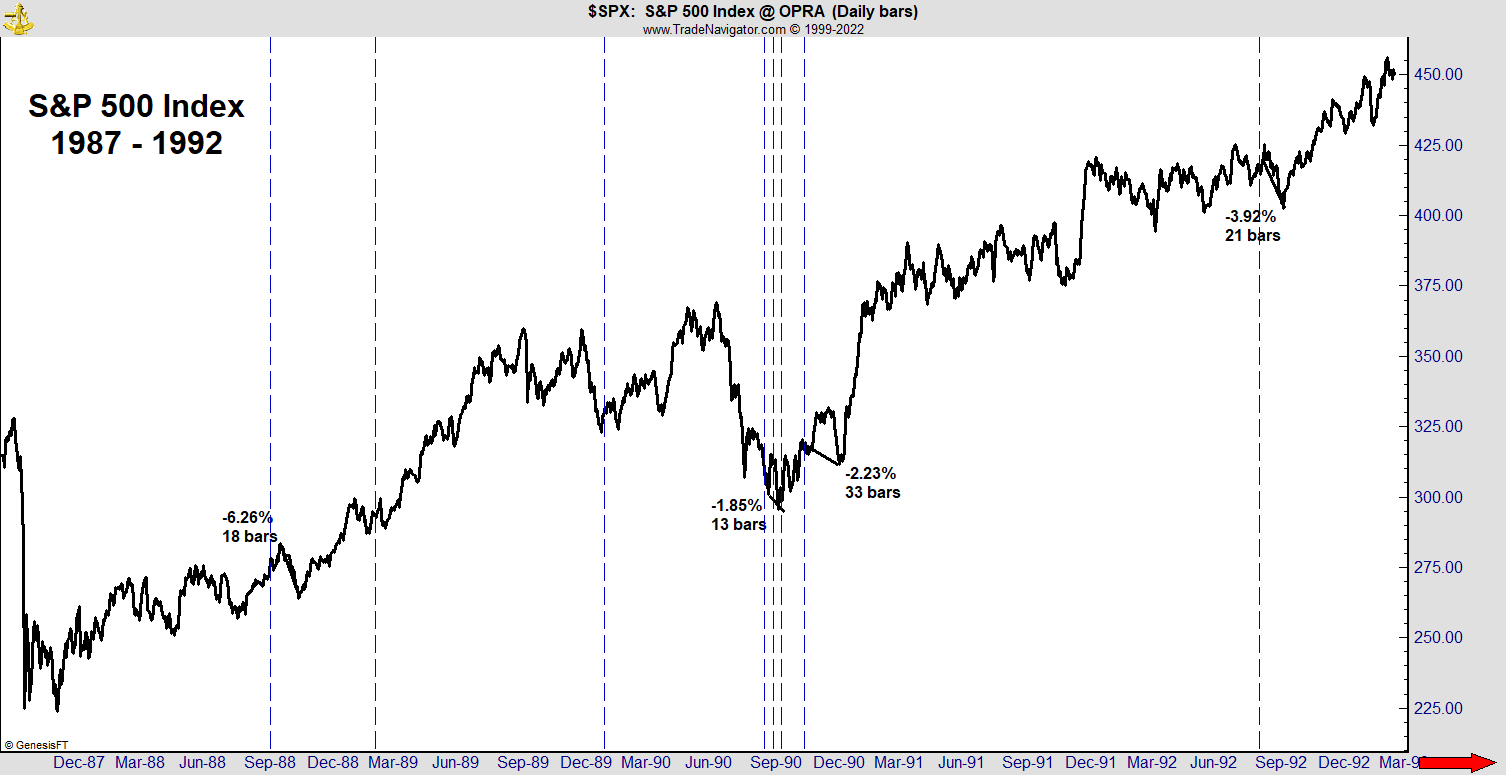

The survey has been completed 1,811 times since its inception, and it just showed the ninth-lowest bullish reading. Blue lines in the chart below mark the previous eight readings, which all happened at least 30 years ago.

Investors Were This Bearish … 30 Years Ago

Investors Are Often Wrong About Stocks

The low readings were all between October 1988 and September 1992. That was a bull market, with the S&P 500 rising 53%. The steepest decline in that time was a 20% decline that began when Saddam Hussein invaded Kuwait in 1990. Four of the readings came as the U.S. prepared for the first Gulf War.

Previous lows in bullishness were buying opportunities. There was a 6.2% pullback after extreme bearishness in 1988. Other readings were near lows or before modest declines.

The most similar precedent is February 1990. Bears made up 48% of that survey, and bulls sat at 15%. The S&P 500 was about 10% below its high, and prices were retracing the first rally after a correction. All of those conditions are close to what we see today.

Low sentiment marked a bottom in price. This is a bullish parallel for the current market.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.