When Elon Musk tweets, investors react — for better or worse.

Eccentric CEOs aren’t anything new, but these random comments (coming in at 280 characters or less) are creating major market waves.

Let’s draw some comparisons to another market mover — Warren Buffett — and see how we can manage our assets to come out ahead.

Check it out in this week’s Investing With Charles.

How @elonmusk Moves Markets

Matt: I want to talk about Twitter Inc. (Nasdaq: TWTR) because Musk recently tweeted that he bought 9.6% of the company, was going to be seated on the board and then he declined.

Then he said he was going to buy it entirely.

Now, it came out that private equity firms like KKR, Apollo Management and Silver Lake have considered the prospect of working with Musk to buy Twitter.

Is it going to happen? We don’t know.

The story seems to change every day.

But I want to talk about how Musk has transformed how investors play the stock market. And Twitter is his outlet.

For example: In August 2018, Musk sent one of his most infamous tweets:

After that tweet released on August 7, Tesla Inc. (Nasdaq: TSLA) shares jumped 11% in about a day and a half. Now, in the following days, the shares went back to normal.

Now we go to May of 2020:

TSLA was split-adjusted at about $156 per share at the time. The shares dropped about 10% over the next couple of trading sessions. And all the losses recovered over about the next three trading days.

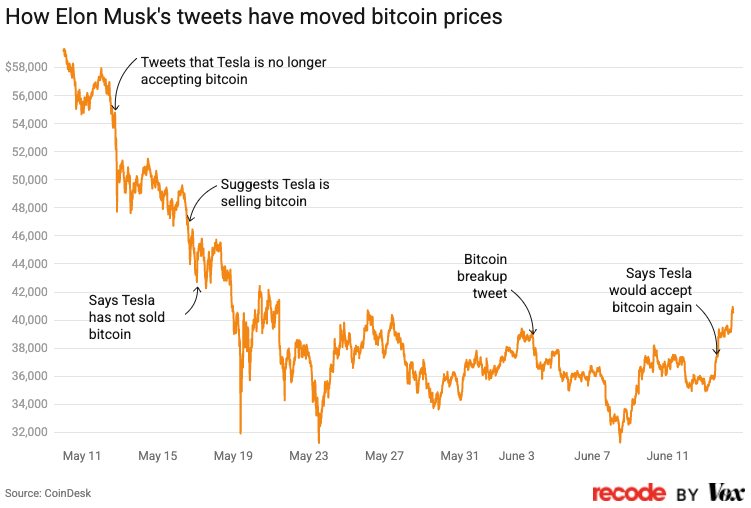

Now I want to also focus on cryptocurrencies. The fine folks at Recode put together a chart here to illustrate how Musk’s tweets have moved bitcoin prices:

This is in 2021. He tweets that Tesla’s no longer accepting bitcoin. Bitcoin value drops. Then he suggests that Tesla is selling bitcoin. It drops even more.

Then he says, “Tesla hasn’t sold bitcoin.” We see a markup. And it continued throughout the first half of 2021. And the same thing happens with Dogecoin — an altcoin that Musk tweets about frequently.

How have we reached this point where Musk’s tweets move the market like this?

Musk Isn’t Acting in Your Best Interest

Charles: There’s a lot to unpack here.

I‘ll start with this: Why do you have rules surrounding what corporate executives can say and not say?

There’s a reason you have blackout periods, reporting periods and windows of time when companies are permitted to release information. Because it turns into this if you don’t, where every random firing brain synapse of Musk could become a market-moving event.

When you’re the head of not one, but multiple major corporations here, you have a responsibility to your shareholders. You have to act in their best interest.

Musk basically behaves like a kid in a candy store with his daddy’s credit card. Just does whatever he wants and just doesn’t care.

I mean, the SEC fines him $20 million for a joke tweet, whatever. That’s pocket change for him. He doesn’t really care. It’s not a big deal.

The problem is it’s a big deal for the people whose assets move.

Even though Musk may not care about $20 million, if you’re a regular investor … if you had money invested in one of the stocks or cryptocurrencies or whatever that he caused to move … that can have a major impact on your life and your financial health.

It’s the reason why we have the SEC and why we have rules.

Eccentric CEO’s Aren’t New — Look at Warren Buffett

Charles: It’s funny. Eccentric CEO behavior is not new by any stretch of the imagination. I mean, Musk is almost a caricature of … I mean, the guy has almost evolved into a James Bond villain.

It’s so ridiculous.

This guy is a caricature of a caricature almost.

But eccentric behavior isn’t new with executives. Warren Buffett famously bought Dairy Queen because he liked the ice cream.

But eccentric behavior isn’t new with executives. Warren Buffett famously bought Dairy Queen because he liked the ice cream.

Now, what did he do at Dairy Queen? Nothing. He put it into the Berkshire Hathaway portfolio of companies. It’s been a long-term holding ever since. He didn’t do any damage to it.

But that really was just: “Ha-ha. This is funny. I’m going to buy this.”

Most people view Buffett as this elder statesman. He’s the wise oracle of Omaha.

He wasn’t always that way.

When he was a younger man, Buffett bought Berkshire Hathaway because he was annoyed with management.

He had a gig going where he would buy shares before management would buy them back as a tender.

Management would call him and say: “Hey, we’d like to buy your shares, Mr. Buffett. We will pay you whatever, $0.05, $0.10, whatever the price was, over the current market.”

Great. Buffett would make the deal, make a little profit and move on to the next one.

Well, the phone call came one quarter, and the CEO said: “Hey, I’ll buy it for whatever, $0.10 above the current price.”

Buffett agreed, but when the offer came in the mail, it was less than what was promised over the phone.

Buffett took that as a personal insult and decided to buy Berkshire Hathaway so that he could have the pleasure of firing the CEO.

Now, I live for the day when I would be able to wield that kind of power. I would like to think I would wield it responsibly.

I think we all know better. I would be no better than Buffett or Musk or anybody else. I’d probably be worse.

But that’s what happens sometimes. You get personal egos and personalities that impact real world decisions here.

If you’re an investor in any of these companies … any of these assets that Musk regularly tweets about … that’s a big deal.

You have to be aware of the risk involved.

A negative or positive tweet could have a major impact on that asset’s price.

If you’re buying anything that’s the subject of a social media or tweet war here, you’re taking risk. Those risks could work out, but they might not.

Is Musk the New Warren Buffett?

Matt: You draw an interesting comparison.

Warren Buffett’s not on Twitter. He does a few conferences here and there, where he talks about his strategy and things like that.

But, by and large, the only time you find out what Berkshire Hathaway is doing as a company is when its quarterly reports are filed. You can see how ownership stakes have changed in its companies.

Traders will then respond in kind.

We’re seeing that with Musk, only on Twitter. Are you seeing some parallels between the two? Where investors are now almost looking for that next oracle, if you will, to follow and mirror investments after.

Charles: Yeah. Back in the day, if you had spies on the ground, you were observing Buffett’s moves. If you could get in front of Buffett’s next big announcement, you could make money.

If you were sniffing around, you could see that, oh, Buffett’s been having lunch with that CEO or Buffett’s been snooping around that company… Buying some shares in anticipation that Berkshire Hathaway was going to buy it was a pretty smart move. You’re getting ahead of what could be a big deal.

The problem with trying to do something like that now is it’s hard to get in front of the next random brain synapse of Musk. He’s really sporadic.

I think everybody’s had a friend or a boss or somebody in their life like that before, where you’re just trying to keep up. You think: “OK. We’re on board. Yep. This is what we’re doing. Wait, what? It just changed?”

It’s really hard to make money like that.

So yes, if you think you can divine the next tweet of Musk and get in front of it, by all means, do it.

Good night. You’ll make a fortune.

Look at what his tweets have done to the prices, particularly of cryptocurrencies. He can move the market. He’s a one-man market-moving machine here.

But it’s a risky game because you don’t really know what that next random brain synapse is going to be.

He’s impulsive. He’s quirky. He moves on to the next thing. He may very well board a rocket ship and move to Mars tomorrow. Would that actually surprise you?

Matt No. Not even a little.

Charles: His Mars colony is in motion. He’s built his Iron Man spacesuit and he is en route to Mars as we speak. Kidding, of course. But that’s just another Tuesday for Musk.

Trying to guess what his next tweet’s going to be is really a tough deal.

How to Handle Musk’s Market Movements

Matt: None of this is to suggest that Tesla is bad, or that SpaceX is bad or that even Musk himself is bad.

But when he tweets or speaks, people listen.

Right or wrong, it’s not for us to say.

As an investor, you are free to follow and do whatever you like. But buyer beware, simply because, as Charles pointed out, we don’t know where his mind is going from one day to the next.

Bottom line: Follow your rules.

And if you don’t have your own set of rules — we’ve got you covered with Green Zone Fortunes.

Chief Investment Strategist Adam O’Dell and I give you our highest-conviction stock recommendations every month. And we’ll let you know the best times to buy and sell because we’ve established our own set of rules so you can make the most with your hard-earned money.

Click here to watch Adam’s “Infinite Energy” presentation, and learn how you can join us in Green Zone Fortunes today!

Do You Think Elon Musk Knowingly Manipulates Markets?

Elon Musk is no stranger to SEC investigations.

But he still tweets … and the market still reacts.

Do you think he knows the power behind his own words?

Let us know by sending an email to Feedback@MoneyandMarkets.com.

We’d love to feature some of your responses in a future video! We’ll send a Money & Markets hat to anyone whose response we use. (Please include a valid mailing address so we can ship it to you. We won’t use your information for any other purpose.)

Email Feedback@MoneyandMarkets.com now!

Where to Find Us

Coming up this week, Matt will have more on The Bull & The Bear podcast, so stay tuned.  Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss Matt’s weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.