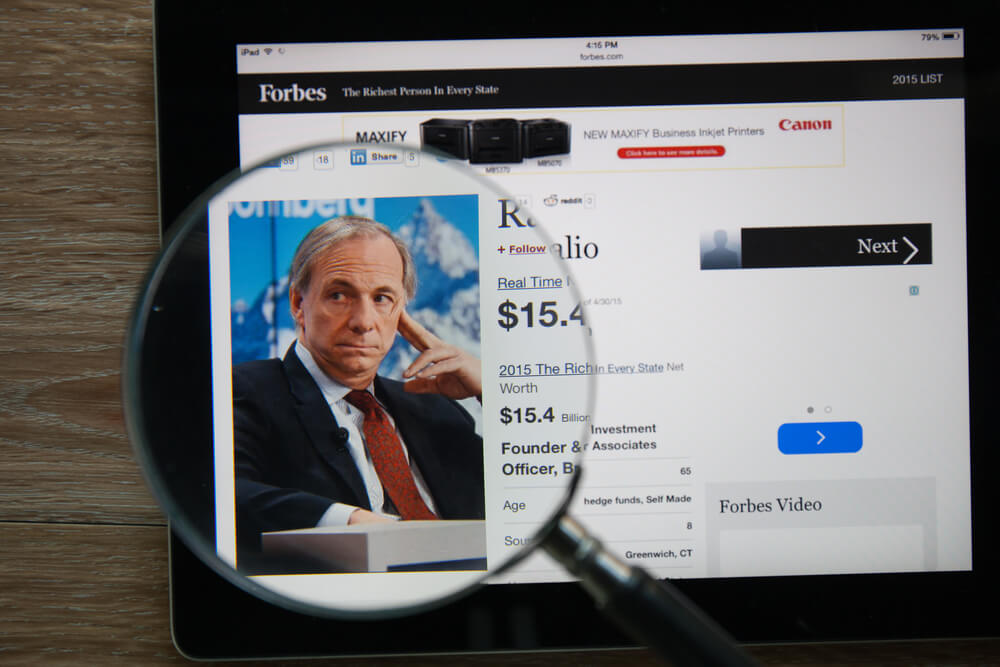

Billionaire Bridgewater founder Ray Dalio’s Pure Alpha Strategy fund dusted its competition in 2018, racking up gains of nearly 15 percent for customers.

“To me, the key is to not have any systematic biases by structuring your portfolios and your incomes so that they hedge each other and are in balance.”

For comparison’s sake, the S&P 500 lost 4.4 percent and the average hedge fund lost 6.7 percent, so winning — and winning that big — is another feather in Dalio’s cap.

So what can you learn from Bridgewater?

Per MarketWatch:

Dalio didn’t get into the details of his outperformance, but he did share this “one important thought” in a LinkedIn post on Monday:

‘If you are worried when the stock market goes down and happy when it goes up, it probably indicates that your portfolio is unbalanced. If your income is also tied to how the economy does, you are doubly at risk because your portfolio can go down when your income is worst, which is scary.’

He explained that most people and companies find themselves in that unenviable position and often turn up the risk by borrowing more and more money, which only exacerbates the problem.

“That’s what makes the financial rollercoaster ups and downs so big and dramatic,” Dalio said. “To me, the key is to not have any systematic biases by structuring your portfolios and your incomes so that they hedge each other and are in balance. Achieving good balance is the most important thing.”

Westport, Conn.-based Bridgewater — with $160 billion in assets — reigns as the world’s biggest hedge fund. The Pure Alpha fund has been a steady outperformer, having returned double digits, on average, over its 28-year history.