The Wall Street pullback that marred the final three months of 2018 has market bulls confident that the crash is mimicking the selloff that bottomed in early 2016 before growing to record highs.

Per MarketWatch:

“If you think what was plaguing the market at that time, you had a strong dollar that was choking off not only U.S. earnings but also the global economy. Oil was plunging…You had a Fed that was ending quantitative easing and they were projected to do four rate hikes in 2016, and then lastly you had very weak Chinese economic data,” said Jeffrey Schulze, investment strategist at ClearBridge Investments, which manages $148 billion.

The start of 2016 was the worst-ever beginning of a new year on Wall Street. The Fed signaled a pause — which the market would love at present — resulting in a weakened dollar, and oil fell below $30 a barrel.

Stocks rebounded, finishing the quarter in the black for the year, with the S&P 500 posting a sizable 9.5 percent gain for the year.

Bears contend there are important differences in the underlying fundamentals, but Schulze and other bulls have argued that history, while not repeating, could rhyme.

Crude appears to have found a footing as output cuts by the Organization of the Petroleum Exporting Countries and its allies take effect; Federal Reserve Chairman Jerome Powell offered up some remarks in a public appearance on Friday that appeared to mollify bulls; the dollar is taking a pause after its 2018 rally; and China likely has further stimulus to deliver on top of the dozens of easing moves it implemented last year.

Something that wasn’t in the mix in 2016 — tariffs and U.S.-China trade tensions — are likely to remain in the headlines as negotiations between Beijing and Washington continue, Schulze argued. That could serve to rattle investors, but he expects the fallout to remain manageable for the economy and most companies.

But perhaps most important, Schulze contends that as was the case about three years ago, the current market downturn is unlikely to be accompanied by a recession.

ClearBridge breaks big market selloffs into “crashes” and “pullbacks.” Crashes occur when stocks see a drawdown of 20% or more that lasts longer than a year. Pullbacks are selloffs of 15% or more that last less than a year. A look back at market performance shows crashes have been 2.5 times more likely to coincide with recessions.

Put another way, that means five of the past six market crashes, as defined by the firm, have been tied to a recession, Schulze said. That means the key question for investors is whether the current market downturn will also be accompanied by a recession.

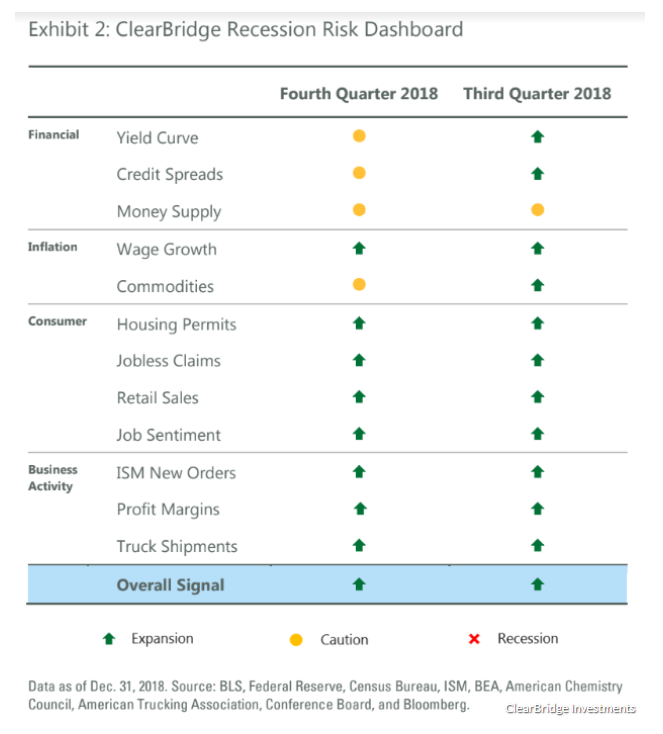

ClearBridge is confident the economy will avoid the “R” word, with Schulze citing the dashboard below in a note:

While all three components (yield curve, credit spreads and money supply) of the financial markets section of the dashboard flipped to yellow from green in the fourth quarter, the consumer and business sections remain green, he noted.

Meanwhile, price-to-earnings multiples have suffered amid the recent volatility, with strong earnings and a negative return combining to leave 2018 with the third biggest annual fall in P/Es over the past four decades, Schulze noted, exceeded only by 2000 and 2002. The fall left the P/Es, a popular measure of valuing stocks, near five-year lows. In particular, the pressure has been concentrated in cyclical sectors, which might be poised for the biggest positive surprises if growth holds up.

The valuation picture is similar to the situation in 1984 and 1994, when the S&P 500 saw subpar gains of 1.4% and 1.5%, respectively, amid a P/E contraction despite strong quarterly results and a solid economy. Schulze said stocks performed strongly the following years, with the S&P 500 logging a 26.3% gain in 1985 and a 34.1% return in 1995.