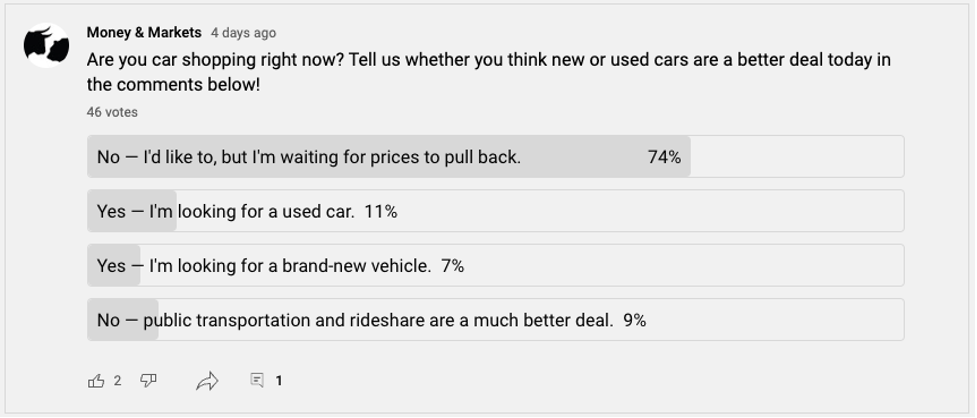

In a recent poll on our YouTube channel, we asked if viewers are car shopping right now:

With new and used car prices on the rise, it’s no surprise that 3 out of 4 folks are waiting for prices to pull back.

That means we have to make sure the cars and trucks we own stay on the road as long as possible.

Part of that mission is using fuel additives to keep our engines purring like kittens:

The chart above shows the value of the global fuel additives market from 2018 to 2028.

In that decade, the market’s value will increase 17.2%!

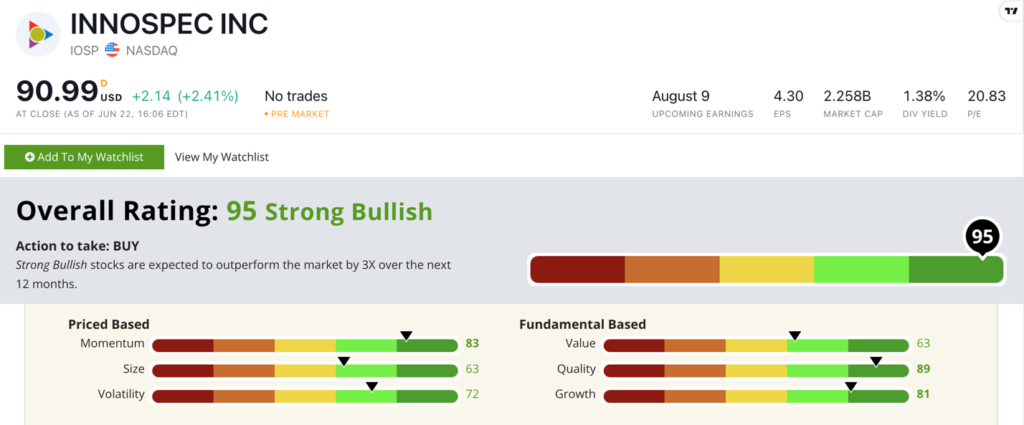

Today’s Power Stock creates fuel additives that we use in cars, trucks, boats and planes: Innospec Inc. (Nasdaq: IOSP).

IOSP Stock Power Ratings in July 2022.

It also makes specialty additives to use with renewable fuels.

Innospec stock scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

IOSP Stock: Top-Notch Growth + Quality

I dove deeper into Innospec, and here’s what I found:

- In 2021, IOSP reported revenue of $1.5 billion — a 24% increase from 2020.

- Its first-quarter 2022 revenue clocked in at $472.4 million, which was a 39% jump from the revenues it reported in the same quarter a year ago.

IOSP’s quality numbers are excellent — in particular when you compare them to similar stocks'.

Its return on investment (ROI) is 10.2%, while the specialty and performance chemical industry average is negative 5.2%.

Innospec’s operating margin is 9%. The industry average, on the other hand, is negative 12.5%.

The company’s growth prospects are also solid. Its one-year earnings-per-share growth rate is 223.4%!

IOSP stock jumped 21% from July 2021 to June 2022, as you can see in the stock chart above. Broader market headwinds pared those gains back, but the stock is still in the green.

It’s up 5.9% for the past 12 months and beats the specialty and performance chemical industry, which is down 6% over the last 12 months.

Innospec stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

With soaring new and used car prices, Americans want the most life out of our vehicles we can get.

Innospec helps in that mission by providing top-of-the-line fuel additives to keep engines purring and cars on the road. It’s an excellent contender for your portfolio.

Bonus: Shareholders earn a 1.4% dividend yield, meaning the company will pay you $1.26 per share, per year to own the stock.

Stay Tuned: Co. With Semiconductor Exposure

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top maker of products crucial to semiconductors.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.