Semiconductors are small microchips you’ll find in electrical devices.

Many industries use these chips, including the military, clean energy and communications.

But it takes other components to make semiconductors perform at their peak.

Couple a semiconductor with a component called a “photomask,” and you have the technology used in smartphone screens and flat-panel televisions.

The chart above shows the industry revenue of semiconductor manufacturing in the U.S.

In 2020, revenue dropped 10.2% when the COVID-19 pandemic stopped manufacturing across all sectors.

But by 2024, it will jump 20.3% from 2020 to a level it hasn’t reached since 2013.

Today’s Power Stock produces the photomasks that we find in flat-panel displays and semiconductors: Photronics Inc. (Nasdaq: PLAB).

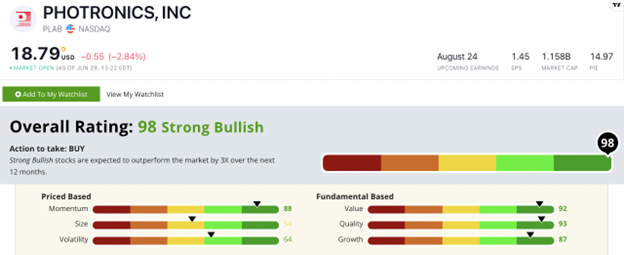

PLAB Stock Power Ratings in July 2022.

Photronics’ photomask products are similar to the ones inside the orange cases below:

Photronics Inc. stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system.

Photronics Inc. stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

PLAB Stock: Phenomenal Fundamentals & Momentum

PLAB released its quarterly numbers, and I was impressed:

- The company reported total revenue of $204.5 million — an increase of 28% over the same quarter a year ago!

- Its income left after taking out expenses, taxes and dividends for preferred shares almost tripled that of the same quarter last year.

PLAB stock scores a 93 on our Stock Power Ratings system’s quality metric.

That’s based on an operating margin of 20%, compared to its peers’ average of just 14.8%. Its gross margin of 41.8% is right in line with the semiconductor equipment industry average.

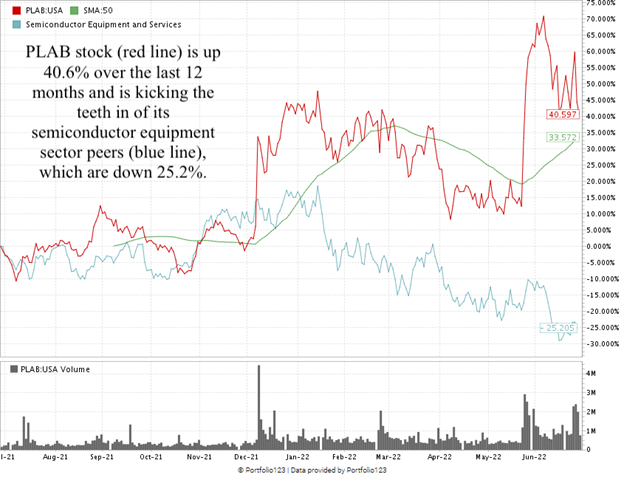

Despite the recent tech sell-off, PLAB stock hit a 52-week high in June:

Over the last 12 months, PLAB jumped 40.6% and hit a new 52-week high during the first week of June. It’s blowing past its semiconductor equipment industry peers, which average down 25.2% over the same 12 months.

Photronics Inc. stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Semiconductor demand is gaining steam again.

The companies that supply components for semiconductors are set to beat chipmakers.

I’m confident you can see why PLAB is a strong investment for your portfolio!

Stay Tuned: Must-Own 5G Tech Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent tech stock to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com.