As I wrote yesterday, consumer staples stocks haven’t been getting a lot of love from investors. In a world in which AI makes the real world look like science fiction, “boring” consumer necessities like razor blades, soap or packaged food just doesn’t seem all that interesting.

But what does my system say?

Whenever I see an entire sector essentially left for dead, I get interested. Investors – even the pros – often throw out the baby with the bathwater. This creates opportunities for those of us willing to stay disciplined and follow the data.

So, with all of that as an introduction, let’s do a proper X-ray of the consumer staples sector to see if there are any overlooked gems. As I’ve repeatedly said over the past several months, I expect the Mag 7 trade to break down in 2026. That trend is long in the tooth and long since over-owned. To make money in this market, we’ll need to find opportunities elsewhere.

One thing is immediately clear…

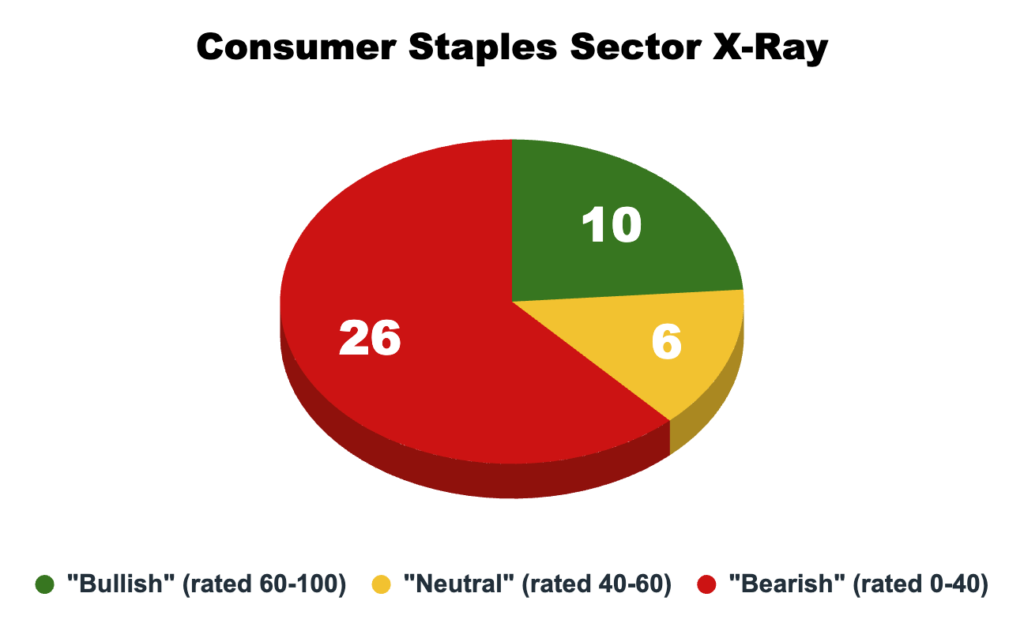

Investors aren’t entirely crazy to write off consumer staples. My Green Zone Power Ratings system rates 26 out of the 42 stocks in the sector as “Bearish” with another six as “Neutral.” Only 10 rate as “Bullish.”

We’ll focus our attention on the “Bullish” rated stocks, of course. Our goal here is to find hidden gems that Wall Street has overlooked.

Where Do Staples Pick Up Points?

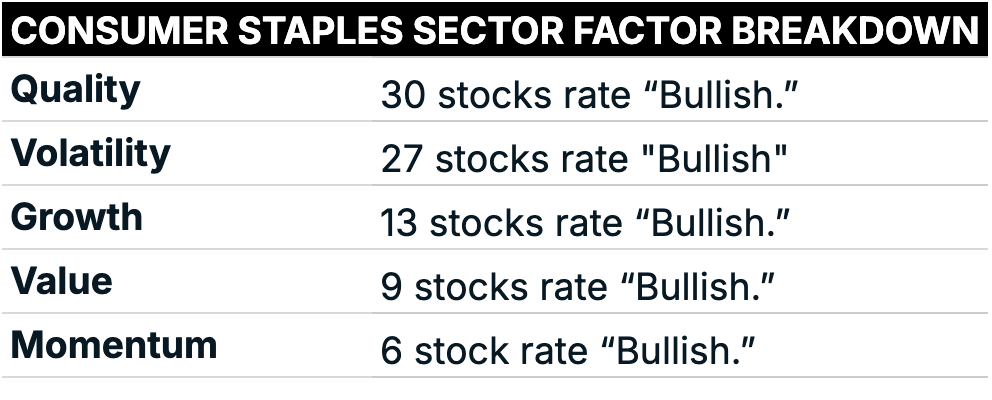

My Green Zone Power Ratings system is a composite of six individual factors – growth, value, quality, momentum, volatility and size – each of which has several component subfactors. Let’s see where consumer staples score well, picking up points.

Given the sluggish performance of the sector, it’s not particularly surprising that only six consumer staples rate as “Bullish” on momentum, meaning they have a factor score of 60 or higher. The momentum factor is a measure of how a stock is performing today, against its market peers, and staples have been lagging.

The strongest factors by a country mile are quality and volatility. 30 consumer staples stocks rate as “Bullish” on quality and another 27 on volatility.

This makes intuitive sense. Successful consumer companies build strong brands, which build customer loyalty and allow them to charge premium prices. Those premium prices lead to industry-leading profit margins.

No one in their right mind will tell you that McDonald’s makes the world’s best hamburger. But as any first-year MBA student will tell you, the company has a world-class brand that none of its competitors can match. The golden arches are knocking around the world.

Given the “boring” nature of the consumer staples sector, it’s also natural that the sector would tend to score well on volatility. (A high volatility score means that the stock exhibits low volatility, meaning the stock doesn’t fluctuate much.) The business of selling basic necessities is stable. Good economy or bad, you still need to make your weekly grocery run.

High Quality Consumer Staples With Strong Growth

I want to focus on quality today. But I don’t want to settle on slow-growth dinosaurs. So, I compiled a list of “Bullish” rated stocks that also specifically rate as bullish on quality and growth. We’re looking for quality companies with strong brands that are growing at a healthy clip.

You’ll see a few familiar names here. Off-price retailers Ross Stores (ROST) and TJX Companies (TJX), the owner of the TJ Maxx, Marshalls and HomeGoods retail chains, have popped up in What My System Says Today various times over the past few months.

Despite the boom in the AI economy, a lot of Americans are really struggling right now. Off-price retailers like Ross or TJ Maxx can be a financial lifeline.

I’m not surprised to see Altria Group (MO), the owner of Philip Morris and other tobacco brands, and chocolatier Hershey (HSY) make the list. Both are prototypical high-quality consumer stocks with world-class brands.

I’d also add that both are recession-proof stocks. When times get hard, people tend to smoke more or splurge on comfort food like a chocolate bar. So, if the economy hits a rough patch in 2026, either or both of these stocks would be a good defensive addition to the portfolio.

To good profits,

Adam O’Dell

Editor, What My System Says Today