Looking for the all-time, best-of-the-best investment returns? Look no further than Renaissance Technologies.

If you put just $5,000 into its Medallion Fund when it was founded in 1988, then never touched it, you’d have $304 million today. That’s what you get when you compound your money at 37% a year … for 35 straight years.

RenTech is the tippy top of the hedge fund world. For the kind of person who is allowed to invest (it’s a short list), it doesn’t get any better.

And its methods for achieving these returns are completely unlike what most hedge funds use.

From the beginning, the Medallion Fund’s managers have relied on mathematical models, quantitative data analysis and high-turnover trading to generate a torrent of consistent, market-trouncing profits. Over time, it has added up to the highest rate of compounding the investment community has ever seen.

But all of Renaissance’s Ph.D. math whizzes pale in comparison to its most powerful moneymaking tool: artificial intelligence.

You probably know AI didn’t first emerge through ChatGPT. That’s just the most recent breakthrough, which puts it in the hands of anyone with an internet connection. The most elite hedge funds have been using a less intuitive, but still powerful form of AI for decades.

The main reason it was reserved for this ultra-wealthy class of investors was its exorbitant cost. Running AI algorithms required a level of computing power you could only expect a firm with $130 billion on its books to afford.

This kept it secured within the hallowed halls of RenTech and firms like it, well out of reach of the everyday investors who could benefit from it just as much … if only they were allowed access.

Now, though, AI is leveling the investment playing field. It’s enabling us to create hedge fund-level trading strategies, with similarly astronomical returns, for a tiny fraction of what hedge funds charge their multimillionaire clients.

And that’s why I’ve spent the last year … and $5 million … leveraging the power of AI and quantitative analysis to do exactly this.

What I’ve created may not be as high-octane as the Medallion Fund, but I believe it’s as close as anyone’s going to get, anytime soon.

Not to mention, it won’t cost you anywhere near the fees RenTech would ask for.

Now, don’t worry. I’m not about to tell you to make a hundred trades a day, scalping pennies in a fraction of a second, like RenTech does.

Instead, I’ve found a way to generate comparable returns to the Medallion Fund … by trading just 10 stocks per month. And it’ll take you maybe 10 minutes to make these simple trades.

Let me show you the Infinite Momentum system, and how it beat the S&P 500 by 300-to-1 over the last 24 years…

Climb the Moneymaking Mountain

Beating the S&P 300-to-1 in 10 minutes a month sounds impossible until you realize one simple fact: There’s always a bull market somewhere.

Regardless of what the broad market is doing, a small number of stocks lurking in a hidden corner of the market are bucking the trend and posting huge gains.

And what I’ve learned is that, to find them, you need to screen for stocks that hold three specific, highly important traits:

- Quality — highly profitable businesses, light on debt and generating tons of cash.

- Value — undervalued relative to their peers and the worth of their underlying business.

- Momentum — stocks that are already going up … and going up fast!

You may recognize those three traits if you frequent Stock Power Daily… They are part of what makes my proprietary Green Zone Power Ratings system tick.

Stocks that carry all three traits are rare. But once you find them, historical analysis proves you can rely on these stocks to carry a portfolio well beyond what any index fund could manage.

Here’s the thing, though…

Even when you do find stocks like these, they typically don’t maintain strong quality, value and momentum for years on end.

That’s why I like to compare this strategy to a “relay race”…

Imagine you have two teams competing in a 26-mile marathon. Team No. 1 consists of just one runner, while Team No. 2 is made up of 26 runners who pass the baton after they run a single mile. Which team do you bet on?

Team No. 2, of course — the relay team. Each runner can run at max speed for just one mile, then hand off the race to the next runner, who can do the same. Meanwhile, the lone runner on Team No. 1 keeps a slow pace … trying to simply make it to the end.

This is essentially how my new strategy works. Each “runner” on the relay team is a portfolio of high-quality, high-value, high-momentum stocks … energized and poised for a sprint over the next “mile” … or in our case, month.

After that month, if my system indicates it’s losing steam, we pass the baton to a “fresh” group of stocks that are ready to pick up the pace.

With this unique approach, we don’t need to find long-term stock market winners. We just consistently buy the 10 strongest stocks of today … and ride their rallies one month at a time.

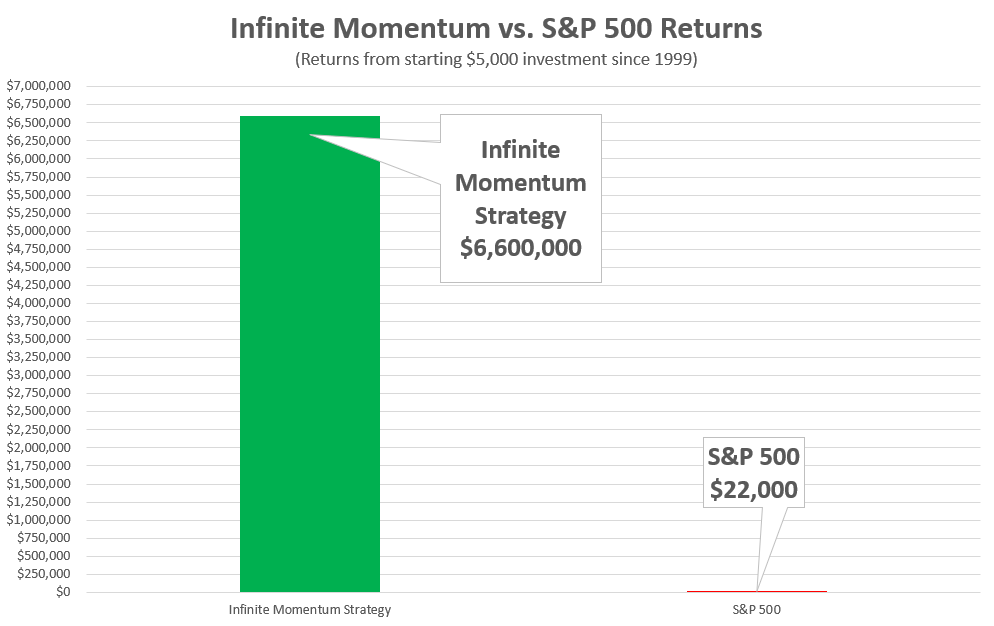

Tracing this strategy back over the last 24 years shows it beats the S&P 500 by 300-to-1.

Putting $5,000 into the strategy back in 1999 would’ve meant profits of over $6.6 million today. By comparison, the S&P 500 barely even charts with its $22,000 total return.

If RenTech sits at the summit of the moneymaking mountain, then the Infinite Momentum strategy gets you 99% of the way to the top.

I’m happy with that if it means I can get this strategy into the hands of anyone willing to use it for the long term and enjoy its potential.

That’s why, in less than a week, I’m doing just that.

Join Me at the Infinite Momentum Summit

I call this strategy “Infinite Momentum” for its ability to leverage AI in a near-limitless fashion to ride a huge, long-term wave of market momentum.

It’s the single greatest investment strategy available to everyday investors I’ve ever seen.

And the first to use AI in a way that doesn’t involve day trading, options, futures, forex or any other kind of leverage.

When I first set out to create this strategy, my mission was to build something easy to use, but every bit as profitable as strategies with 100X the complexity.

Generating returns that rival the all-time greatest hedge fund, with a tiny fraction of the work and cost, shows me that I’ve completed this mission.

The next step is the one I’ve been waiting months for… To share it with you.

That’s why I’d like to invite you to join me at the official launch of this new strategy on September 19, at 1 p.m. Eastern time, at the Infinite Momentum Summit.

There, I’ll join my co-host John Wilkinson to demonstrate the full power of this strategy. During the free event, you’ll get all the details on how it works, including some of the major trends it’s predicted in the past. I’ll also show you how I used the power of AI to take the strategy to another level.

And most importantly, I’ll show you how you can access the first 10 trades as soon as you join, which will begin your journey to the top of the moneymaking mountain.

I urge you to put your name down right here so you can ensure your access to the event.

See you Tuesday,

Adam O’Dell

Chief Investment Strategist, Money & Markets