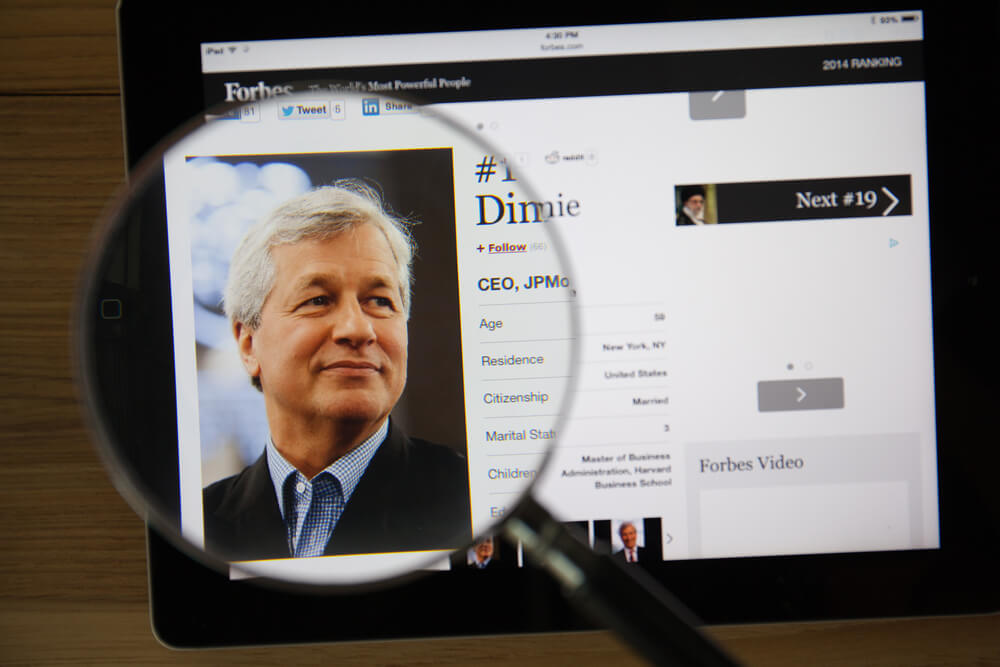

There’s been a lot of talk of recessions lately, and while JPMorgan & Chase CEO Jamie Dimon thinks one will hit the U.S. economy, he doesn’t see it happening anytime soon.

Dimon, while leading the Business Roundtable Wednesday, said “there will be a recession again. My own gut tells me it’s not imminent.”

Regarding Wednesday’s move by the Federal Reserve to once again cut its key interest rate by 25 basis points, Dimon doesn’t think the reduction will be able to fend off the impact of trade relations between the U.S. and China, or its other partners, according to CNBC.

Dimon argues the Fed’s independence is of chief importance, as well, which is an opinion shared by many of the CEOs that were also in attendance at the Business Roundtable. He spoke highly of Fed Chair Jerome Powell who has been the target of countless attacks from President Donald Trump, mostly on Twitter, lambasting the chair for not doing enough to stimulate the economy.

“We all believe that the Fed needs to be independent. It’s not a surprise that any American president wants lower rates,” Dimon said. “Jay Powell is a quality human being. He’s quite bright and quite knowledgeable … . Most Fed chairs have had a little bit of struggle early on with communication.”

Dimon is optimistic about the state of the U.S. economy, echoing a statement he made back in April.

“If you look at the American economy, the consumer is in good shape, balance sheets are in good shape, people are going back to the workforce, companies have plenty of capital,” Dimon said at the time.

“It could go on for years,” he added regarding the U.S. economic expansion that is now in its eleventh year. “There’s no law that says it has to stop.”

And as far as the trade war between the U.S. and China? Dimon is skeptical of a deal happening before the end of the year, but he has spoken to Trump about the impact it’s having on businesses.