It’s amazing what we can do with a smartphone today.

Yes, there’s texting, reading news and checking our Facebook page. But there’s so much more.

I can control my thermostat, turn off my lights and lock my doors … all from a single device. And I don’t even have to be home to do it!

This smart home technology is becoming all the rage as we strive to become more connected.

And the market for smart home technology is growing at a rapid pace.

As you can see from the chart below, research firm Statista projects that revenue from smart home products will increase 131.1% from 2020 to 2025.

Today’s Power Stock started by creating quality, inexpensive headphones, but has grown into a smart home powerhouse. I’m talking about Jabil Inc. (NYSE: JBL).

JBL manufactures an entire smart home product experience. This includes:

- Smart locks, cameras and thermostats.

- Voice assistant devices.

- Home security.

- Smart home control panels.

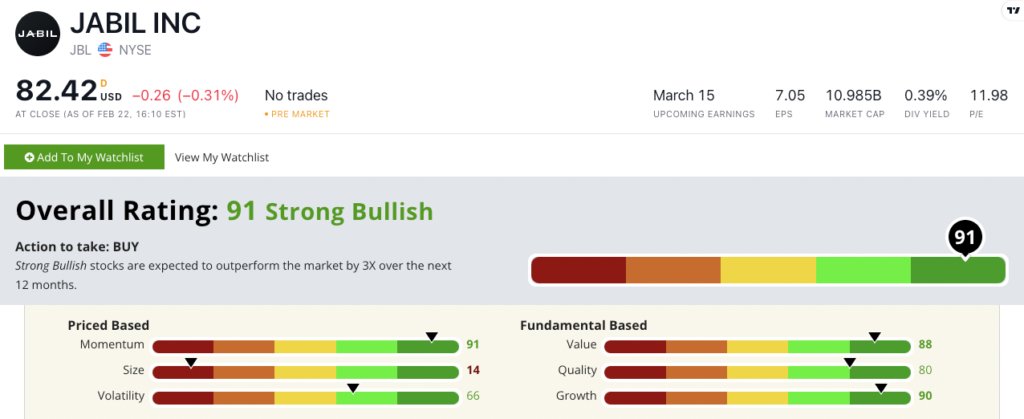

Jabil stock scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system, as outlined below.

We expect this stock to beat the broader market by 3X in the next 12 months.

JBL Stock: Outstanding Growth and Excellent Momentum

Jabil Inc. recently closed out a strong first quarter of fiscal 2023:

- Its total revenue reached $9.6 billion — a 12.5% increase from the same period a year ago … and the highest quarterly revenue since 2019!

- Gross profit was $743 million — up 10.1% from the same quarter last year … also a quarterly record.

Those numbers show why JBL stock earns a 90 on our growth factor.

The company is also strong on our value factor, where it scores 88.

JBL’s price-to-sales ratio is almost half its industry peers, while its price-to-earnings ratio is two points lower than the manufacturing equipment industry average.

These numbers all tell us JBL is a terrific growth and value stock compared to the rest of its industry peers.

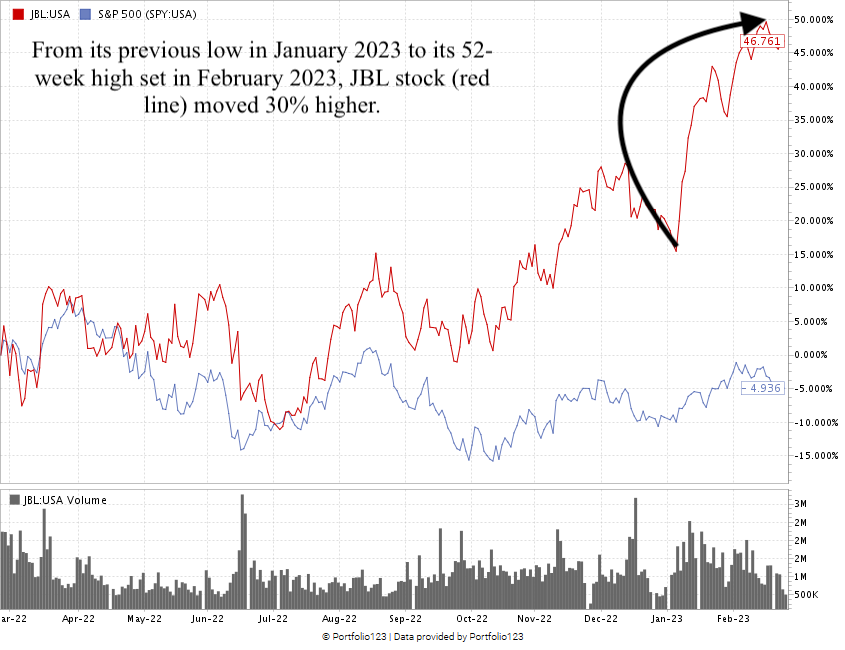

The following chart shows that JBL stock is up 46.8% over the last 12 months. It currently trades just 2.2% off its 52-week high.

Created in February 2023.

The S&P 500 (shown by the blue line in the chart above) is down 5% over the same time.

From its recent low in January 2023 to its new high set earlier this month, the stock climbed 30% … showing the “maximum momentum” we love to see in stocks.

Jabil stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish.” We expect it to beat the broader market by at least 3X in the next 12 months.

Bonus: The company’s 0.39% forward dividend yield nets investors $0.32 per year for every share they own.

Bottom line: The demand for connecting things like lights, thermostats and home security to our smartphones is growing in popularity.

While it started making low-cost, quality headphones, Jabil has grown into a major player in the smart home space.

Couple that with strong growth and great value, and you can see why JBL is a great addition for your portfolio.

Stay Tuned: What’s Next for the EU Energy Market

Russia’s invasion of Ukraine forced the EU to scramble as the antagonist cut off critical supply to its natural resources.

I’ll show you how Europe is using this as an opportunity to fast-track green energy efforts.

Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets