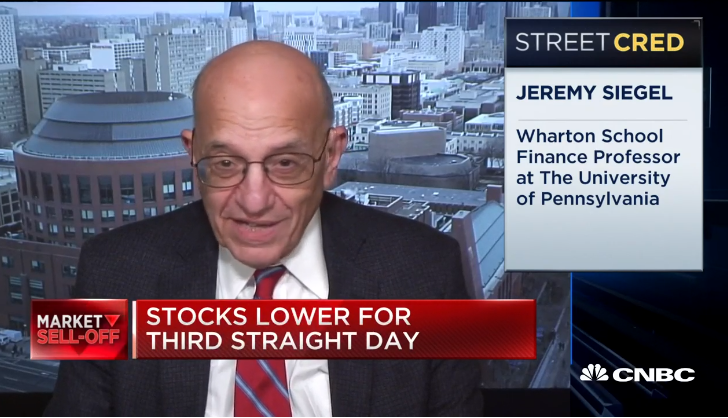

Wharton School professor of finance Jeremy Siegel said as long as a new trade deal between the U.S. and China is off the table, investors — who literally hang on every word uttered about the trade war — would be wise to stay away from stocks.

“That’s why financial is under pressure — obviously, lower interest rates aren’t good for financials. But that’s why utilities, defensive stocks, anything that gets you yield, I think, is going to do pretty well in 2020.”

The interview came as the market sank Tuesday on the latest on again, off again trade war news when U.S. President Donald Trump said he likes the idea of waiting until after the 2020 election to get a new China trade deal.

The markets didn’t take kindly to those words as the S&P 500 and Nasdaq both fell 0.6%, and the Dow dipped a full 1%.

“It’s trade, trade and trade. That is by far the dominant issue I think that’s affecting the market,” he said. “Before Thanksgiving everyone thought a deal was going to be imminent, brought up to all-time highs by 2, 3%. Now Trump is saying maybe not, and you see the sell-off. Honestly, my personal opinion is this is just a negotiating tactic — be really tough right before you make a deal. I still think he’s going to make a deal by the end of the year.

“If he doesn’t and tariffs get put on Dec. 15, whew, I don’t know if I want to be around equities then.”

If we get a “phase one” deal that’s been in the news for months now, along with no new tariffs on Dec. 15, which are planned, Siegel said things could get ugly.

“I think that’s a muddle through. I mean, if it’s just a standstill from where we are now, deferring anymore tariffs but taking any off, then people will say, ‘We are where we are, now let’s look at earnings and see how well they’re going to do.’ You know, this market is not cheap, 19 1/2 times this year’s earnings, I look at around 18 1/2 times next year’s earnings. I don’t think we’re going to get as high as 10, 12%, so you can’t have a lot of bad developments come on that sort of valuation.

“It’s not a disaster, but it’s much more modest and much more choppy, I think, if we get a standstill.”

The market rebounded on Wednesday with the S&P 500, Dow and Nasdaq all up between 0.7% and 0.8% by 2:10 p.m. EST, the first positive day in four sessions on … you guessed it, positive trade war news! (If only we had a nickel for every time the market bounced or sank on a trade war news tidbit …)

Sigel, who said you can blame 2018’s late-year crash entirely on the Federal Reserve, pointed to utilities and defensive as hot in the new year as long as there is no trade deal.

“What we saw (Tuesday) really just emphasizes that Treasury bonds have become the hedge asset against equities. Look at how they rose so strongly (Tuesday) when the equities market (Dow) sold down 700 to 800 points. That’s what it’s being bought at, yields are going to stay low with Treasurys being the hedge asset like this,” Siegel explained. “People are going to begin to think, ‘Where am I going to go for income?’ And I think this reinforces the fact that isn’t going to be bonds.

“That’s why financial is under pressure — obviously, lower interest rates aren’t good for financials. But that’s why utilities, defensive stocks, anything that gets you yield, I think, is going to do pretty well in 2020.”