Federal Reserve Chairman Jerome Powell testified before Congress this week. Like all Fed chairs, the words he uses can be difficult to interpret. That’s because he doesn’t want to say when interest rates will change specifically.

He did mention that Fed policy will be biased toward low rates for some time. He also focused on why the Fed’s policy is no longer predictable.

Over the past few months, the Fed has backed off a rigid inflation target. Instead of committing to maintaining 2% inflation, the Fed is targeting inflation that averages 2%. The meaning of this is unclear.

In addition to being responsible for maintaining low inflation, the Fed is also tasked with ensuring maximum employment.

Here, Powell’s words are even more difficult to understand. He told Congress:

[Fed officials] emphasize that maximum employment is a broad and inclusive goal. This change reflects our appreciation for the benefits of a strong labor market, particularly for low- and moderate-income communities.

In addition, we state that our policy decisions will be informed by our “assessments of shortfalls of employment from its maximum level” rather than by “deviations from its maximum level.” This change means that we will not tighten monetary policy solely in response to a strong labor market.

Even without the nonquantifiable goals, the Fed has largely ignored employment factors in recent years.

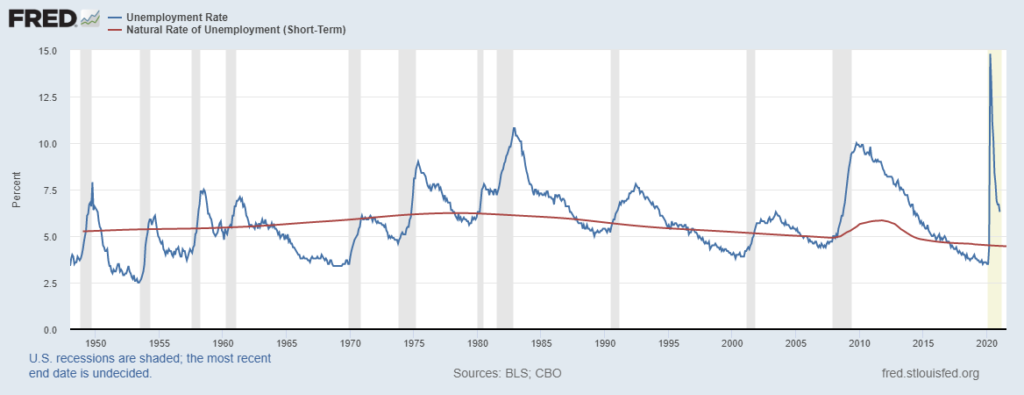

The chart below shows the unemployment rate (the blue line) and the Fed’s model of how low unemployment should be (the red line).

Targeted vs. Actual Unemployment

Source: Federal Reserve.

The Fed Doesn’t Influence Unemployment

The natural rate of unemployment, the Fed’s estimate of what the unemployment rate should be, is about 4.5%. With unemployment at 6.3%, there is significant room for economic growth before the Fed needs to worry about employment creating inflation.

But as the chart shows, the unemployment rate has often been below the Fed’s target. It’s also often been above the Fed’s target. There’s actually no consistent relationship between the Fed’s target for unemployment and the actual unemployment rate.

Investors need to remember this when Fed officials discuss unemployment. The truth is the Fed really doesn’t seem to influence the unemployment rate.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.