Some financial news seems to come off as a joke.

Elon Musk’s bid for Twitter appeared to be a joke at first. He may have even thought it was and spent millions on lawyer fees trying to get out of the deal. Twitter’s management team rebuffed by spending $90 million on lawyers to make it happen. If it started as a joke, it ended up turning into a multibillion-dollar tragedy for Musk.

Another joke is the Northern Lights Fund Trust IV — Inverse Cramer Tracker ETF (SJIM).

This is an exchange-traded fund (ETF) that’s designed to profit from the idea that Jim Cramer (the guy you see screaming and mashing his red buy and sell buttons on CNBC) is always wrong.

I’ve been tracking ETFs for almost 30 years. And I have seen a lot of dumb ETFs emerge and pass on.

I’m talking about funds that bought shares in companies that advertised at sporting events … funds promising to find stocks that would benefit from Democratic or Republican policies. Even triple-leveraged bets on Chinese real estate.

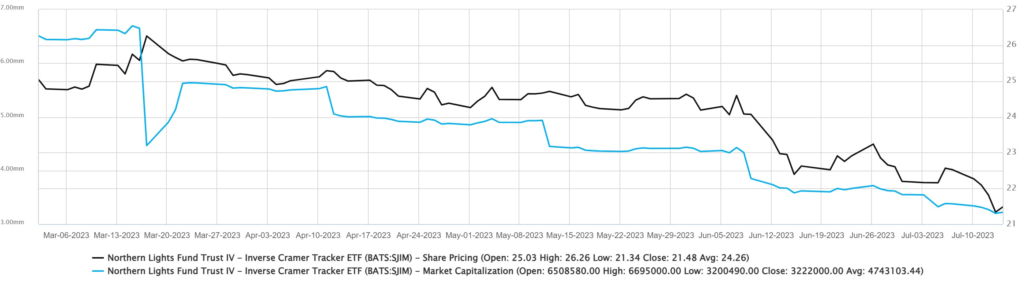

Most dumb ETFs die quickly — and SJIM will as well. The chart below shows that this ETF is already on life support. It has about $3.3 million in assets four months after launching. Funds generally need tens of millions in assets to pay the bills.

SJIM Drops 18% From March 2023

The black line is the price of SJIM. It gained about 6% in its first 10 days.

Many analysts said it couldn’t fail. The reasoning was that Cramer never does well.

However, SJIM dropped more than 18% since then. Investors have lost millions of dollars as shown by the blue line tracking the fund’s market cap (aka the money investors have added to SJIM).

ETFs need seed capital to launch. This fund launched with about $6.5 million. Two weeks after launch, someone withdrew more than $2 million, which you can see with the sharp drop on the left.

SJIM might be a dumb idea, but there seem to be smart people associated with it.

That big sale could be the fund sponsor taking their money out after the fund attracted publicity, but the chart shows other big withdrawals every month. That’s smart investors losing faith in the fund rather than losing money to laugh at Cramer.

A Better ETF That’s Not a Joke

It turns out Cramer is a smart guy who spends a lot of time on the air. He’s a co-anchor tracking the market open on CNBC’s Squawk on the Street. He’s back for another hour after the close with Mad Money.

That first hour of Squawk is unscripted. He proves he does his homework every day. Cramer and the other hosts are familiar with breaking news, trends and individual companies.

Mad Money is partly scripted as Cramer addresses questions about certain companies from viewers. These aren’t his picks. They’re stocks individuals are interested in. He makes a lot of recommendations in a week, and the poor performance of SJIM proves he knows his stuff.

As further proof of that, the strong performance of Northern Lights Fund Trust IV — Long Cramer Tracker ETF (LJIM), a fund that follows Cramer’s recommendations, confirms that. It’s up about 18% from the March lows. The S&P 500 gained about 12% over that same time.

Betting on Cramer has been the better play.

Yet investors still can’t get over their desire to bet against the Mad Money man. Losers have added more than $3 million to SJIM. Meanwhile, LJIM only has about $1 million in assets and those investors are making money.

Before Cramer brought a long-term record of success to CNBC, he managed a hedge fund. Reported returns of the fund beat the market. He also managed a charitable trust. Those returns also beat the market.

The truth here is that Cramer is smart. To benefit from that lesson, investors should avoid putting their money into jokes.

In our live Trade Room each morning, we take that approach. We put our hard-earned money into serious investments that help us grow our wealth.

At exactly 9:46 a.m. ET each trading day, we look for trade signals on two reliable ETFs. I’ve been building some of my most successful trading strategies around these ETFs for years, so they have stood the test of time. To learn more about how they’ve been delivering rapid winners for us in the room this year, click here.