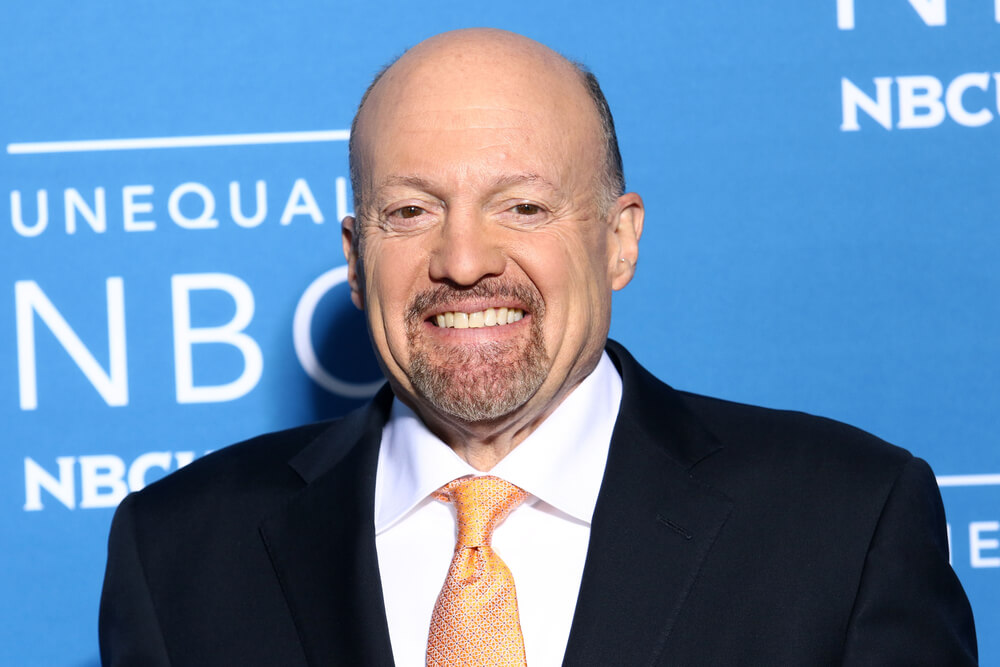

CNBC’s Jim Cramer isn’t shy about voicing his opinion when it comes to market moves, and he thinks investors everywhere are underestimating the true outcome of rising tensions between the U.S. and Iran.

The NYSE’s opening bell was met with Cramer’s call on CNBC’s “Squawk on the Street” for “Gold, gold, gold,” but he doesn’t think it’s a great sign for the future of the stock market despite the precious metal being up for the ninth straight session.

“When I see this endless buying for gold it makes me think for the first time people are just saying, ‘I’m really fearful,’” Cramer said while pointing out that the gold surge really started after Thursday night’s U.S. drone strike that killed Gen. Qasem Soleimani, a top Iranian military commander.

Gold, along with U.S. bonds, are known as defensive havens for investors to flee to amid uncertainties like growing international tensions or trade wars. The U.S. 10-year Treasury yield has tanked to 1.79% after being at 1.92% at the end of 2019.

“It’s not just Treasurys,” Cramer said. “The gold buying has been endless; over and over and over. It feels like gold wants to go to $1,700 to $1,800. Now that would be very negative for the (stock) market.”

Gold hit a seven-year high $1,590.90 briefly overnight Sunday before settling down to $1568.40 around 1:30 p.m. on the East Coast on Monday afternoon. It had surged 1.5% to $1,552 Friday after the death of Soleimani, which Iran has threatened retaliation for.

Dow futures Monday had dropped another 100 points after a hefty drop Friday that ended a two-session win streak, marking the end of 2019 and the beginning of 2020.

“Why aren’t the futures down more? They should be. I think they should be because we haven’t see what promises to be retaliation?” Cramer asked.

“I don’t think Iran is a paper tiger,” Cramer added. “Do they not have to do something after all the bluster?”

The Dow seems to be weathering the storm so far, though, as it’s only about 1% below Thursday’s record-high close at 28,868 points.