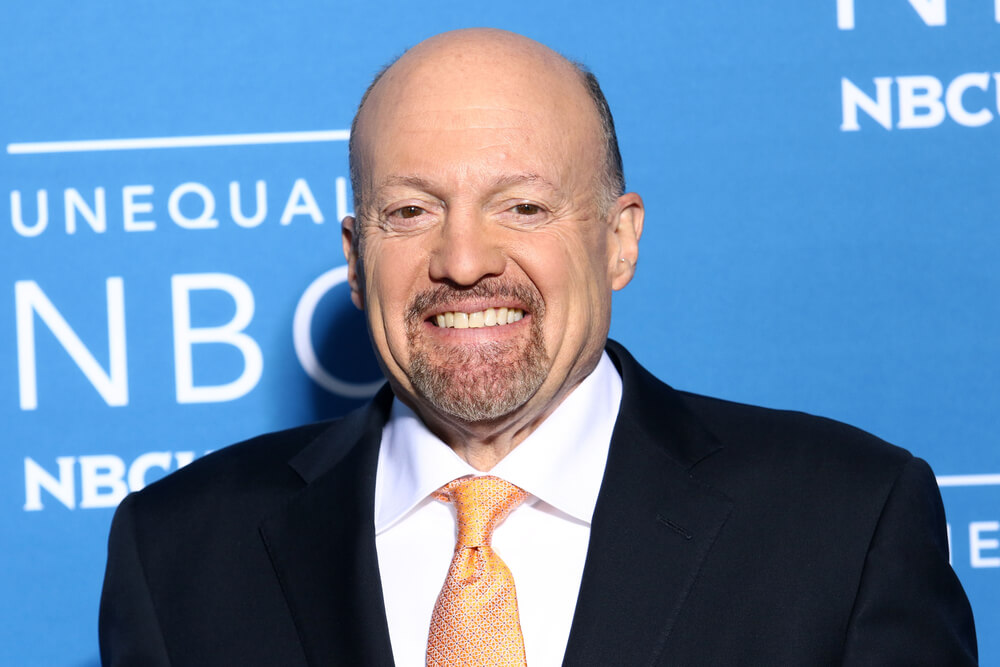

The Federal Reserve performed a rare emergency interest rate cut Tuesday morning amid the coronavirus outbreak, and CNBC’s Jim Cramer is now more worried than ever about the virus’ impact on the economy.

“The more important thing is that we need people to be able to stay at work.”

“It’s great that the Federal Reserve recognizes that there’s going to be weakness, but it makes me feel, wow, the weakness must be much more than I thought,” Cramer said during a Tuesday interview on CNBC’s “Squawk on the Street.”

“I’m now nervous. I’m more nervous than I was before,” he added.

Cramer thinks the emergency rate cut — which was the first the Fed had executed since December 2008 — will be a boost for investors Wall Street, but that doesn’t mean people are going to be itching to get out of their homes and spend money if they are worried about contracting a potentially fatal virus.

The Fed cut rates by 50 basis points to a target range of 1%-1.25%, and that was after cutting rates three times in 2019. The announcement sparked a big gain for the major stock indexes, with the Dow Jones Industrial Average jumping up 350 points after being down by around the same amount earlier in the morning Tuesday.

Those gains were short-lived, though, as the Dow had lost more than 600 points again by 1:30 p.m. on the East Coast.

And Cramer repeated his recent sentiment that the rate cuts are misguided because this is a “biological crisis,” not a financial one.

“If you got something that allowed you to get out of the hospital, if we had a vaccine, anything, then you won’t need this rate cut,” he said. “The more important thing is that we need people to be able to stay at work.”

Former Morgan Stanley Chief Economist Stephen Roach echoed Cramer’s sentiment on the Fed’s action Tuesday, calling the central bank a “fish out of the water.”

“Central banks are pulling out a playbook that was designed to deal with financial problems and not to deal with public health problems,” Roach told CNBC. “So I really think they’re like a fish out of the water here. They have no idea how to contain or even to understand what may be about to happen in the public health area or the U.S. economy’s response to that.”

Cramer warned that the coronavirus will hammer small businesses, which rely on week-to-week income to stay afloat. He called on the government to be ready to step in.

“Powell cannot feed your family. You’re not going to do better on that interest rate cut,” Cramer said to small business owners. “What you need is a pledge from the government that we will help tide you over until this thing passes because the small and medium size businesses cannot go through this.”

“It’s incumbent on the Treasury to say … ‘We’re going to work with small business. If you have a problem, you can come to us.’ Because that’s where the real pain is going to be,” Cramer added.