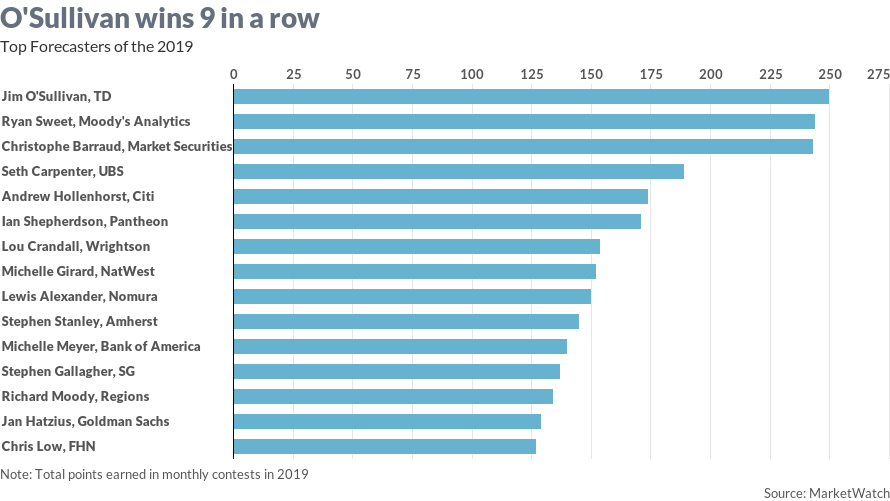

TD Securities chief U.S. macro strategist Jim O’Sullivan is a 12-time MarketWatch Forecaster of the Year, so when he makes a prediction, people listen.

And Sullivan, winner of nine straight Forecaster of the Year awards, says the best days of this decade-long economic expansion are behind us.

“The economy is slowing for sure,” said O’Sullivan, who is projecting just 1.5% gross domestic product growth for the U.S. in 2020.

The reason, O’Sullivan said, is slow job growth, weaker household income and spending growth, weak business investment and a tightening of the belt for corporate profits.

Current GDP is about 2%, but O’Sullivan said that will fall to 1.5% by the end of 2020 after ticking up to 3% by mid-2018.

Jim O’Sullivan of TD Securities

The markets have been happy about a phase one trade agreement between the U.S. and China, reached recently, but O’Sullivan doesn’t think exports to China are about to take off, and he’s cautious about “how will President (Donald) Trump respond” when the number is disappointing.

“We don’t expect anxiety about trade to suddenly disappear, while domestic political uncertainty looks poised to rise,” O’Sullivan wrote in a note to clients this week, according to MarketWatch. “More fundamentally, we believe the decade-long expansion is showing strains, with profits being squeezed by a tight labor market.”

And geopolitical tensions, such as between Iran and the U.S., aren’t about to ease by the sound of things coming from Tehran. Just this morning, Iran supreme leader Ayatollah Ali Khamenei called Trump a “clown” who was ready to stab the Iranian people in the back with a “poisonous dagger,” which is quite melodramatic.

“If business confidence has been subdued when the equity market has been surging, what will happen if equities SPX, +0.25% start falling?” O’Sullivan wrote.

He also said he expects job growth to take a dive from an average of 223,000 jobs created each month in 2018 to 176,000 in 2019, all the way down to 75,000 per month by the end of 2020.

While the dip sounds drastic, the actual pace of growth is roughly in line with natural growth in the overall workforce and as long as there isn’t a mass string of layoffs, there shouldn’t be a full-blown recession.

As far as the Federal Reserve’s next move, O’Sullivan is predicting one rate cut in the fourth quarter of 2020 and another in the first quarter of 2021.